- United States

- /

- Insurance

- /

- NYSE:KNSL

What Does Davenport’s Share Sale Reveal About Kinsale’s (KNSL) Portfolio Strategy Ahead of Earnings?

Reviewed by Sasha Jovanovic

- Earlier this week, Davenport & Co LLC disclosed it had sold 15,100 shares of Kinsale Capital Group, valued at approximately US$6.84 million, reducing its total holdings to 519,906 shares.

- The transaction appears to align with general portfolio management practices rather than signal any change in outlook for Kinsale Capital Group.

- With Kinsale's next earnings report imminent, we'll explore how this upcoming disclosure and Davenport's activity may shape the investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Kinsale Capital Group Investment Narrative Recap

To be a shareholder in Kinsale Capital Group, one must believe in the continued expansion of the excess and surplus (E&S) insurance market, Kinsale’s disciplined expense ratios, and its ability to maintain underwriting profitability despite rising competition and macroeconomic headwinds. The recent disclosure by Davenport & Co LLC of its share sale does not appear to materially affect the company’s immediate outlook, with the upcoming October 23 earnings report still set to be the central short-term catalyst, while margin pressure from increased competition in commercial property lines remains the principal risk.

Among recent company updates, Kinsale’s announcement of Q3 earnings stands out as most relevant, with analysts expecting further insight into how new business growth and underwriting discipline are helping offset margin pressures. As Davenport’s move aligns with routine portfolio adjustments, all eyes remain on Kinsale’s financials for visible signs of resilience or vulnerability in a more crowded market.

In contrast, investors should also consider the effect of heightened competition in key segments, where premium declines signal an emerging challenge that ...

Read the full narrative on Kinsale Capital Group (it's free!)

Kinsale Capital Group's outlook anticipates $2.3 billion in revenue and $546.8 million in earnings by 2028. This scenario calls for 9.5% annual revenue growth and a $100 million increase in earnings from the current $446.7 million.

Uncover how Kinsale Capital Group's forecasts yield a $499.11 fair value, a 12% upside to its current price.

Exploring Other Perspectives

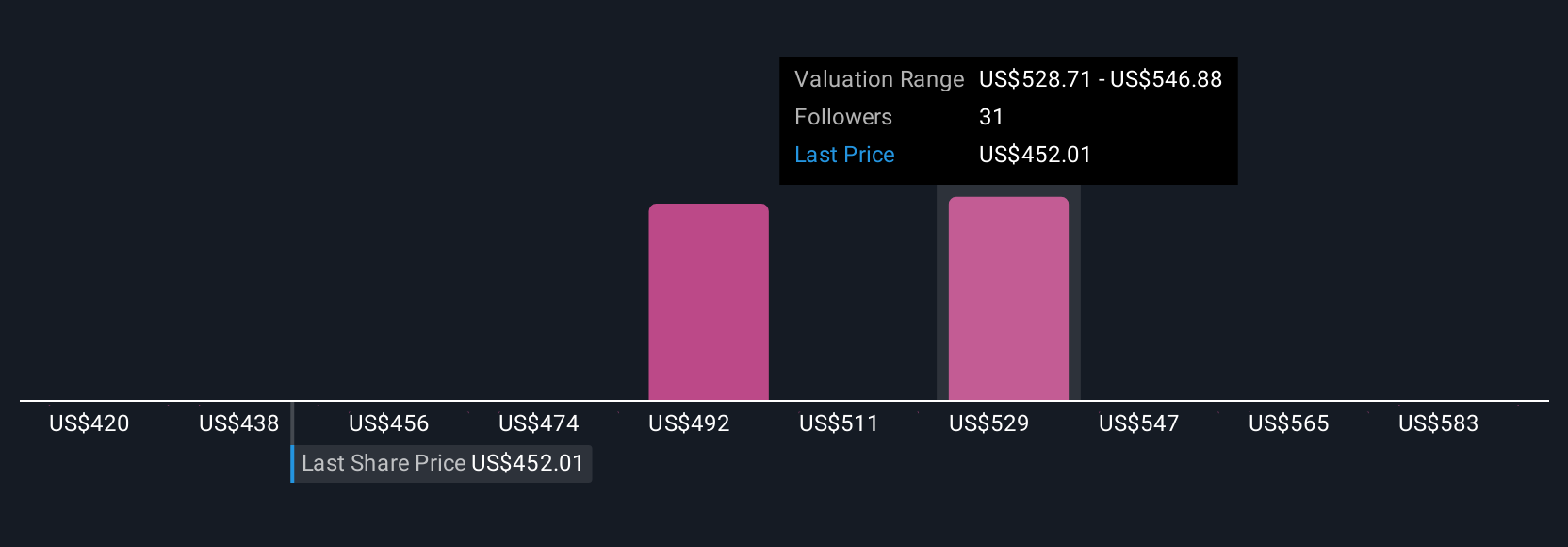

Six fair value estimates from the Simply Wall St Community range from US$419.65 to US$601.41 per share, showing a broad spread in individual assessments. While opinions differ widely, keep in mind that intensified competition in commercial property could pose ongoing risks to Kinsale’s future margins and growth; explore these alternative views to fully inform your outlook.

Explore 6 other fair value estimates on Kinsale Capital Group - why the stock might be worth as much as 34% more than the current price!

Build Your Own Kinsale Capital Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinsale Capital Group research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Kinsale Capital Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinsale Capital Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinsale Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNSL

Kinsale Capital Group

Engages in the provision of property and casualty insurance products in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives