- United States

- /

- Insurance

- /

- NYSE:KNSL

Should You Reconsider Kinsale After Its 12% Weekly Surge?

Reviewed by Bailey Pemberton

Thinking about what to do with your Kinsale Capital Group shares, or just curious if now’s the right moment to get in? Let’s talk about what’s been driving the headlines for this specialty insurer and, more importantly, what the current price actually means. The numbers catch your eye right away: up an impressive 11.9% in just the last week. Zoom out, and the five-year return is a staggering 120.8%. Even with some slower growth this year (just 2.7% year-to-date), that long-term chart shows a clear pattern. Kinsale inspires confidence, fueling both high hopes and high expectations.

Of course, markets don’t move in a vacuum. Investors have been reevaluating risk and return across financials, with specialty insurers like Kinsale benefiting from more attention lately. This recent surge could be a reaction to broader market optimism or shifting risk perceptions in the sector, as investors hunt for companies with resilient business models and strong underwriting performance. But are current prices justified or just a symptom of momentum?

That’s where valuation comes in. By the numbers, Kinsale checks only one box out of six on our undervaluation scorecard, giving it a value score of 1. On the surface, that points to a company priced for growth rather than a bargain. But sometimes the real picture is more complicated than a simple checklist can capture. Next, let’s unpack the common valuation methods analysts use to size up companies like Kinsale, and stick around as we wrap up with a better way to interpret those numbers before you make any moves.

Kinsale Capital Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Kinsale Capital Group Excess Returns Analysis

The Excess Returns valuation model focuses on how effectively a company reinvests its capital and generates returns above its cost of equity. For Kinsale Capital Group, the model weighs key inputs such as return on equity, projected earnings, and stable book value to estimate the stock's fair value from a shareholder return perspective.

- Book Value: $73.93 per share

- Stable EPS: $22.84 per share (Source: Weighted future Return on Equity estimates from 9 analysts.)

- Cost of Equity: $6.49 per share

- Excess Return: $16.35 per share

- Average Return on Equity: 23.84%

- Stable Book Value: $95.82 per share (Source: Weighted future Book Value estimates from 7 analysts.)

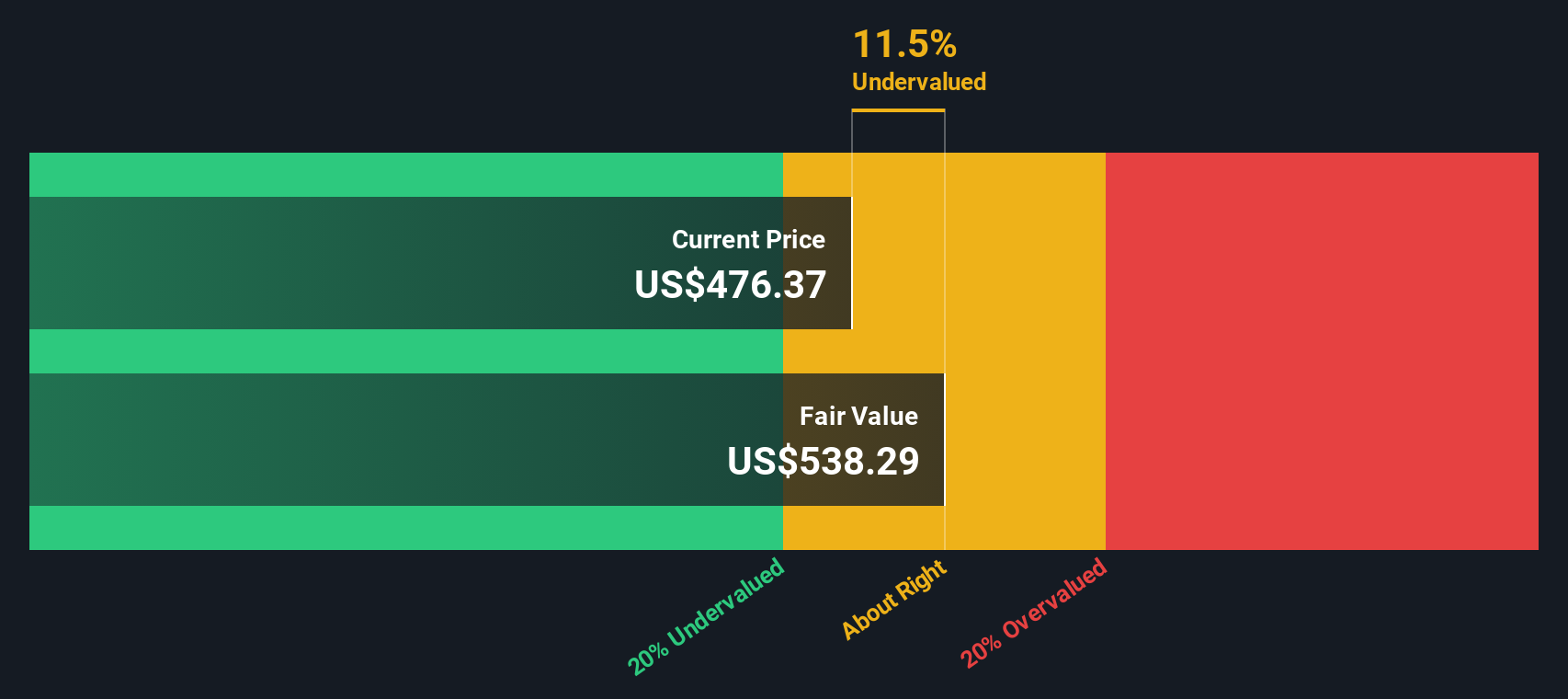

The model calculates that the company’s capacity to deliver excess returns, meaning returns above what shareholders could expect from similarly risky investments, implies an intrinsic value well above the current share price. Based on this approach, the intrinsic value per share is estimated to be $538.08, suggesting the stock is approximately 13.3% undervalued at current market prices.

Result: UNDERVALUED

Our Excess Returns analysis suggests Kinsale Capital Group is undervalued by 13.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Kinsale Capital Group Price vs Earnings

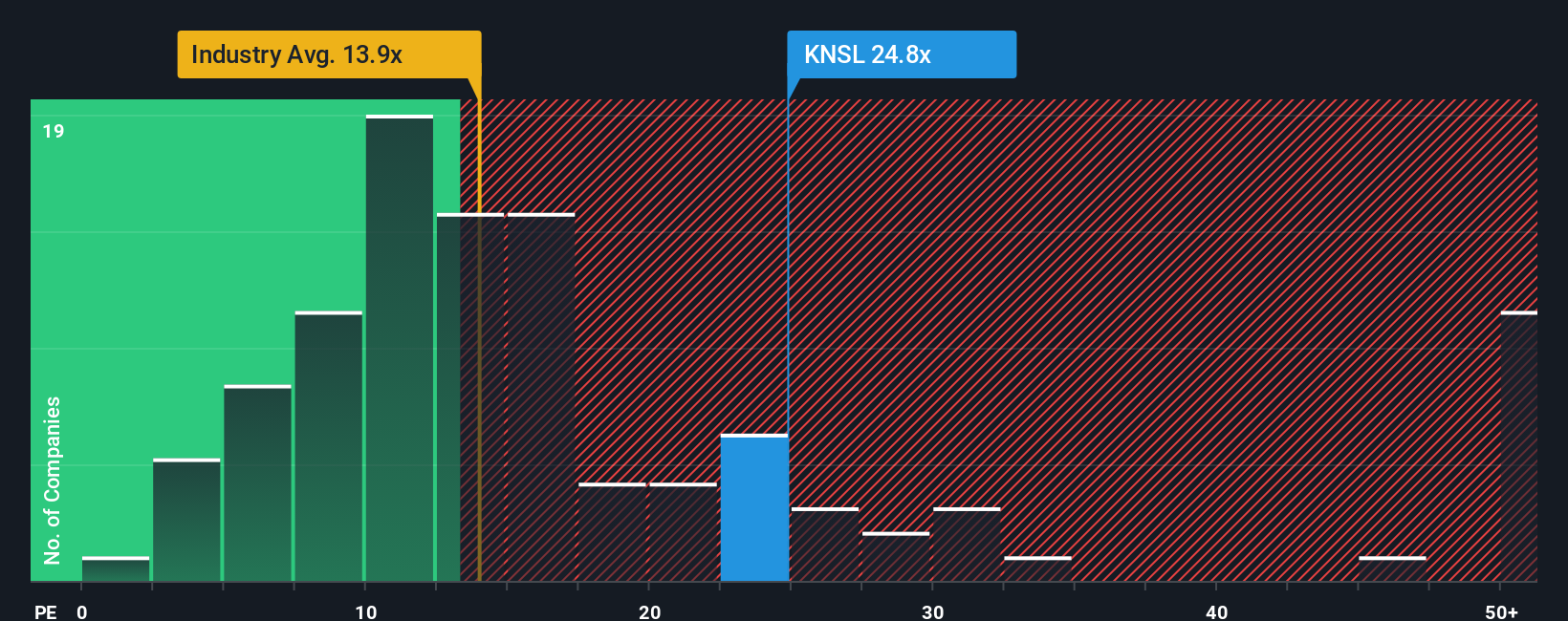

The price-to-earnings (PE) ratio is widely recognized as an effective valuation tool for profitable companies like Kinsale Capital Group because it directly compares a company’s share price to its per-share earnings. This makes it a practical gauge of whether the market is paying a reasonable price for current profitability. That said, a “normal” or fair PE ratio is shaped by expectations of future earnings growth and the degree of risk investors associate with the company or its industry. Higher growth prospects or lower risk typically justify a premium multiple.

Kinsale’s current PE ratio is 24.3x, which is notably higher than the average PE for insurance peers (14.5x) and the broader industry average (14.2x). This suggests the market is assigning Kinsale a premium, possibly reflecting its strong track record and anticipated growth. Still, comparing with just peers or the industry can miss key context. That is where Simply Wall St’s proprietary “Fair Ratio” comes in. This measure incorporates not only industry norms but also unique drivers like Kinsale’s earnings growth, risk profile, profit margins, and size to produce an adjusted benchmark. For Kinsale, the Fair Ratio is estimated at 13.3x.

Looking at these numbers side by side, Kinsale is currently trading well above its Fair Ratio. This suggests the stock is overvalued on a price-to-earnings basis, as the market is pricing in more growth or safety than what is justified by a comprehensive risk-adjusted assessment.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kinsale Capital Group Narrative

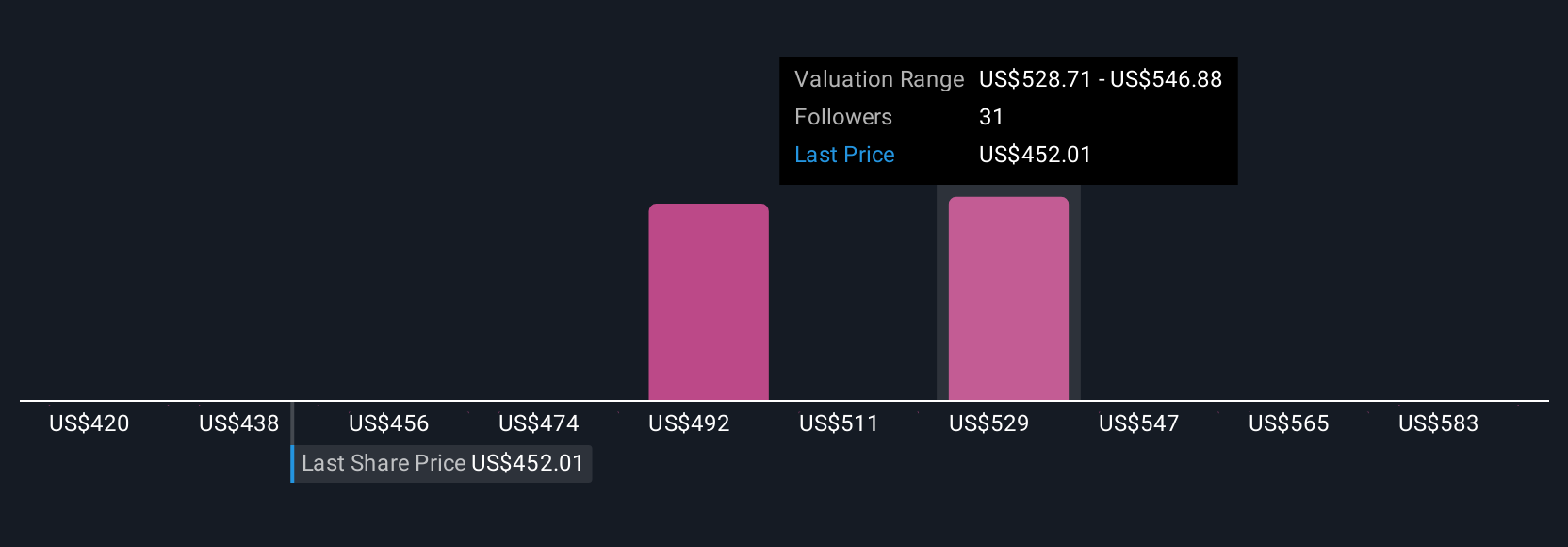

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply a story backed by numbers, letting you combine your perspective of Kinsale Capital Group—how you expect future revenues, profit margins or risks to play out—with a financial forecast and a calculated fair value. This approach makes investing more personal and practical, since it bridges what you believe about the business with its actual numbers, instead of just relying on generic ratios or analyst consensus.

Narratives are available right inside Simply Wall St’s Community page, where millions of investors clarify and share their outlooks. You can quickly see how your Narrative stacks up, compare your fair value with the current share price, and decide what action makes sense, whether it is time to buy, sell, or simply watch. Even better, Narratives get updated automatically whenever new company information, like earnings or headlines, comes in so your story and its numbers stay current and relevant.

For example, one investor might believe that strong growth in specialty insurance and advanced technology justifies a fair value near $560 per share, while another who is more cautious about increased competition and margin risks might set their fair value at $448. This highlights how Narratives turn your expectations into a clear, actionable guide for every investment decision.

Do you think there's more to the story for Kinsale Capital Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinsale Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNSL

Kinsale Capital Group

Engages in the provision of property and casualty insurance products in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives