- United States

- /

- Insurance

- /

- NYSE:KNSL

Kinsale Capital Group: Assessing Valuation as Analyst Confidence and Earnings Optimism Drive Investor Interest

Reviewed by Kshitija Bhandaru

Shares of Kinsale Capital Group are attracting attention after new analyst commentary from Truist Securities and Zacks highlighted the company’s disciplined underwriting, favorable earnings outlook, and steady record of outperforming Wall Street estimates.

See our latest analysis for Kinsale Capital Group.

Kinsale’s share price is showing renewed momentum, climbing over 7% in both the last week and the past month. Fresh earnings optimism and analyst confidence have energized the stock. While the one-year total shareholder return sits at a modest 2%, the longer-term track record remains exceptional with a 69% total return over three years and more than 129% over five. This signals that investors who looked past short-term swings have been well rewarded.

If you want to see what other dynamic companies are attracting attention right now, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With shares now trading just below analyst price targets and fresh earnings optimism in the air, investors are left to consider whether Kinsale’s recent surge still leaves room for upside, or if the market has already factored in its future growth potential.

Most Popular Narrative: 4.6% Undervalued

With Kinsale’s most-followed narrative placing fair value at $499.11, the stock’s last close of $476.37 is coming in just below this consensus target, hinting at a modest gap between current pricing and projected potential.

Kinsale's advanced technology platform and strict expense discipline yield an industry-low expense ratio (about 20.7%), positioning the company to preserve and expand net margins as automation and data analytics further scale underwriting, quoting, and policy servicing over time.

Craving the details that fuel this valuation? A future profit multiple well above the industry average forms the backbone of these expectations. Can Kinsale’s unique margin and growth strategies really justify this ambitious price? The full story sits just out of sight. Dive in to see the numbers and logic that set this narrative apart.

Result: Fair Value of $499.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition and rising claims costs could pressure Kinsale’s margins. These factors could challenge the optimistic outlook if these risks persist.

Find out about the key risks to this Kinsale Capital Group narrative.

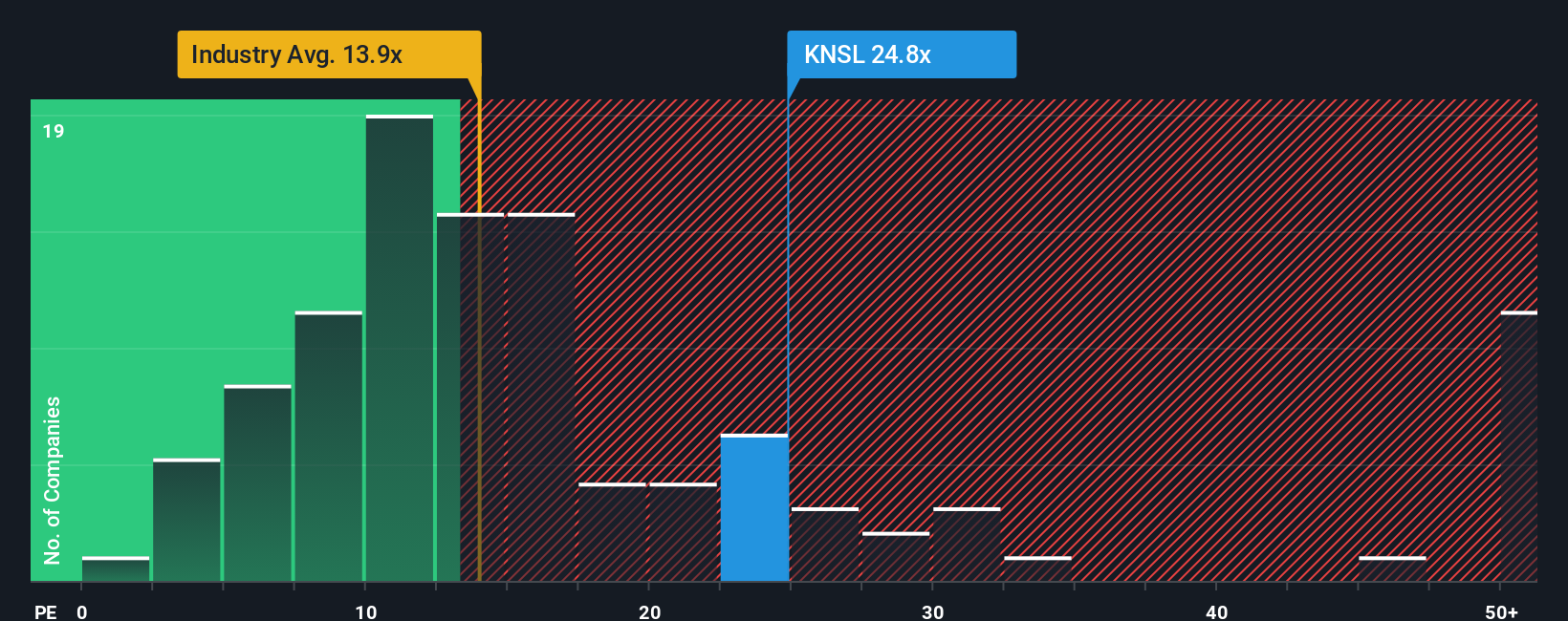

Another View: High Multiple Signals Premium Pricing

Looking through the lens of price-to-earnings, Kinsale trades at 24.8x, well above both the industry average of 14.2x and a peer average of 14.2x. The market is demanding a clear premium, even though the fair ratio is estimated at just 13.3x. Does this premium price reflect justified optimism or hidden valuation risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinsale Capital Group Narrative

If you want to challenge these insights or prefer to examine the numbers your own way, it only takes a few minutes to craft your personalized view. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Kinsale Capital Group.

Looking for More Smart Investment Ideas?

Great investors never stop searching for opportunities. Give yourself the edge, tap into distinctive market trends, and spot tomorrow’s winners before the crowd.

- Uncover untapped growth with these 26 quantum computing stocks by finding companies pushing the limits of quantum computing innovation.

- Supercharge your returns by targeting steady income with these 18 dividend stocks with yields > 3%, featuring stocks offering robust yields above 3%.

- Ride the next big wave in tech by tracking these 25 AI penny stocks as they lead the artificial intelligence transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinsale Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNSL

Kinsale Capital Group

Engages in the provision of property and casualty insurance products in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives