- United States

- /

- Insurance

- /

- NYSE:HRTG

How Investors May Respond To Heritage Insurance Holdings (HRTG) Earnings-Revenue Divergence and Estimate Revisions

Reviewed by Sasha Jovanovic

- Heritage Insurance Holdings Inc will report its Q3 2025 earnings on November 5, 2025, following a quarter where its actual earnings per share significantly surpassed analyst expectations even as revenue came in below estimates.

- This divergence between stronger-than-expected earnings and softer revenue projections, alongside upward earnings estimate revisions and declining revenue forecasts for 2025 and 2026, has driven increased investor attention ahead of the upcoming results.

- We will explore how the market's anticipation around earnings revisions and recent estimate changes shapes Heritage's broader investment narrative.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Heritage Insurance Holdings Investment Narrative Recap

To be a shareholder in Heritage Insurance Holdings, you need to believe in the company's ability to grow its policy count and earnings despite exposure to extreme weather and reinsurance risks in catastrophe-prone markets. The recent pattern of earnings outperformance―even as revenue estimates fall―has sharpened focus on profit margins and expense controls as the likely short-term catalyst, while softening revenue forecasts and unpredictable storm activity remain the biggest risks. For now, this news does not materially change the balance between these key drivers.

Among the recent corporate announcements, the expansion and amendment of Heritage’s $200 million credit facilities in July 2025 stands out. While not directly linked to the latest earnings estimates, this move provides greater financial flexibility, supporting the company’s ability to manage volatile claims costs and potential revenue shortfalls as the company navigates upcoming quarters.

By contrast, investors should also be aware that the company’s concentration in high-risk coastal markets could amplify downside from...

Read the full narrative on Heritage Insurance Holdings (it's free!)

Heritage Insurance Holdings is projected to reach $955.9 million in revenue and $158.8 million in earnings by 2028. This outlook requires 4.3% annual revenue growth and a $51.9 million increase in earnings from the current $106.9 million level.

Uncover how Heritage Insurance Holdings' forecasts yield a $31.50 fair value, a 36% upside to its current price.

Exploring Other Perspectives

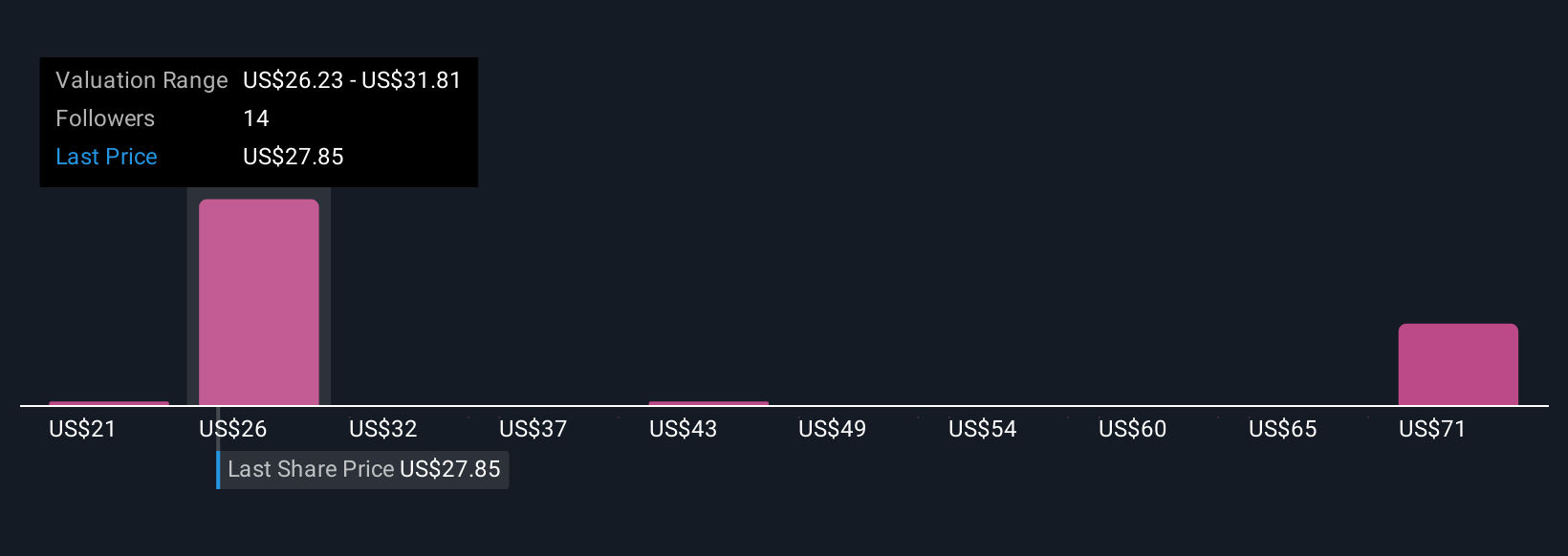

Five members of the Simply Wall St Community estimate fair values for Heritage between US$20.65 and US$75.01 per share. Despite this wide range, many are watching closely as revenue forecasts for the next two years trend lower, reflecting ongoing questions about longer-term premium growth and competitive pressures.

Explore 5 other fair value estimates on Heritage Insurance Holdings - why the stock might be worth 11% less than the current price!

Build Your Own Heritage Insurance Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Heritage Insurance Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Heritage Insurance Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Heritage Insurance Holdings' overall financial health at a glance.

No Opportunity In Heritage Insurance Holdings?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heritage Insurance Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HRTG

Heritage Insurance Holdings

Through its subsidiaries, provides personal and commercial residential insurance products.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives