- United States

- /

- Insurance

- /

- NYSE:HMN

Are Horace Mann Educators Corporation's (NYSE:HMN) Fundamentals Good Enough to Warrant Buying Given The Stock's Recent Weakness?

Horace Mann Educators (NYSE:HMN) has had a rough three months with its share price down 8.9%. But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Particularly, we will be paying attention to Horace Mann Educators' ROE today.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. Simply put, it is used to assess the profitability of a company in relation to its equity capital.

Check out our latest analysis for Horace Mann Educators

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Horace Mann Educators is:

6.6% = US$108m ÷ US$1.6b (Based on the trailing twelve months to June 2020).

The 'return' is the amount earned after tax over the last twelve months. That means that for every $1 worth of shareholders' equity, the company generated $0.07 in profit.

Why Is ROE Important For Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Horace Mann Educators' Earnings Growth And 6.6% ROE

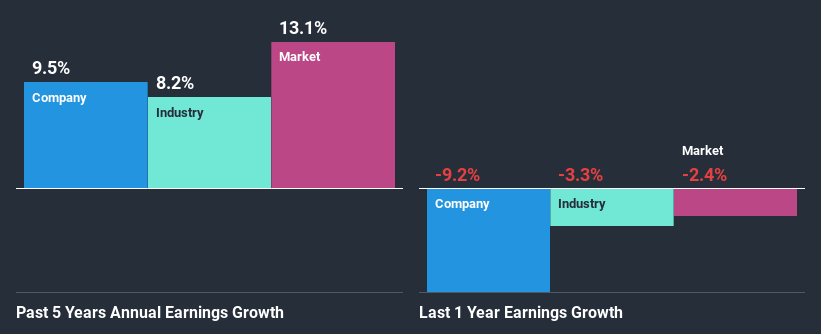

When you first look at it, Horace Mann Educators' ROE doesn't look that attractive. Yet, a closer study shows that the company's ROE is similar to the industry average of 8.1%. On the other hand, Horace Mann Educators reported a moderate 9.5% net income growth over the past five years. Considering the moderately low ROE, it is quite possible that there might be some other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

Next, on comparing Horace Mann Educators' net income growth with the industry, we found that the company's reported growth is similar to the industry average growth rate of 8.2% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. Doing so will help them establish if the stock's future looks promising or ominous. What is HMN worth today? The intrinsic value infographic in our free research report helps visualize whether HMN is currently mispriced by the market.

Is Horace Mann Educators Using Its Retained Earnings Effectively?

With a three-year median payout ratio of 36% (implying that the company retains 64% of its profits), it seems that Horace Mann Educators is reinvesting efficiently in a way that it sees respectable amount growth in its earnings and pays a dividend that's well covered.

Besides, Horace Mann Educators has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Upon studying the latest analysts' consensus data, we found that the company's future payout ratio is expected to rise to 45% over the next three years. However, the company's ROE is not expected to change by much despite the higher expected payout ratio.

Conclusion

In total, it does look like Horace Mann Educators has some positive aspects to its business. Even in spite of the low rate of return, the company has posted impressive earnings growth as a result of reinvesting heavily into its business. That being so, a study of the latest analyst forecasts show that the company is expected to see a slowdown in its future earnings growth. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you decide to trade Horace Mann Educators, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Horace Mann Educators might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:HMN

Horace Mann Educators

Operates as an insurance holding company in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives