- United States

- /

- Insurance

- /

- NYSE:HMN

A Look at Horace Mann Educators’s Valuation After Strong Q3 Results and Upbeat 2025 Outlook

Reviewed by Simply Wall St

Horace Mann Educators (HMN) delivered strong third quarter results, surpassing Wall Street forecasts for both earnings and revenue. The company also raised its full-year guidance, signaling continued operational progress and positive momentum for investors.

See our latest analysis for Horace Mann Educators.

Momentum has picked up for Horace Mann Educators, as the latest strong quarterly results and upbeat guidance helped the stock climb to $46.07. This has driven a year-to-date share price return of 19.1%. Over the longer run, total shareholder returns remain healthy, with a 13.6% gain over the past year and a solid 35.5% total return for investors over three years. These figures reflect the company’s operational progress and resilience.

If you're interested in broadening your search beyond insurance, now is a perfect moment to discover fast growing stocks with high insider ownership.

With shares trading just below analyst price targets after a double-digit run this year, investors are now left to decide whether Horace Mann Educators remains attractively valued or if the recent gains already reflect future growth potential.

Most Popular Narrative: 8.5% Undervalued

Compared to the last close price of $46.07, the most widely watched narrative suggests Horace Mann Educators is trading below its calculated fair value of $50.33. Market watchers are now turning to the drivers behind this favorable pricing gap.

Ongoing expansion of digital engagement platforms and proprietary technology solutions (such as the Catalyst lead management system) are improving agent productivity and making it easier for educators to engage. These initiatives are likely to drive increased policy sales, higher customer conversion rates, and improved customer retention, positively impacting both revenue growth and net margins.

Curious what’s powering this valuation edge? There is a specific playbook behind the future fair value. It features upgraded technology, productivity boosts, and a surprising financial leap. Interested in the full story? The detailed narrative reveals the sharp assumptions and bold projections that could redefine the company’s next chapter.

Result: Fair Value of $50.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the company’s heavy concentration in the education sector and ongoing vulnerability to climate-related losses remain notable risks. These factors could reshape future expectations.

Find out about the key risks to this Horace Mann Educators narrative.

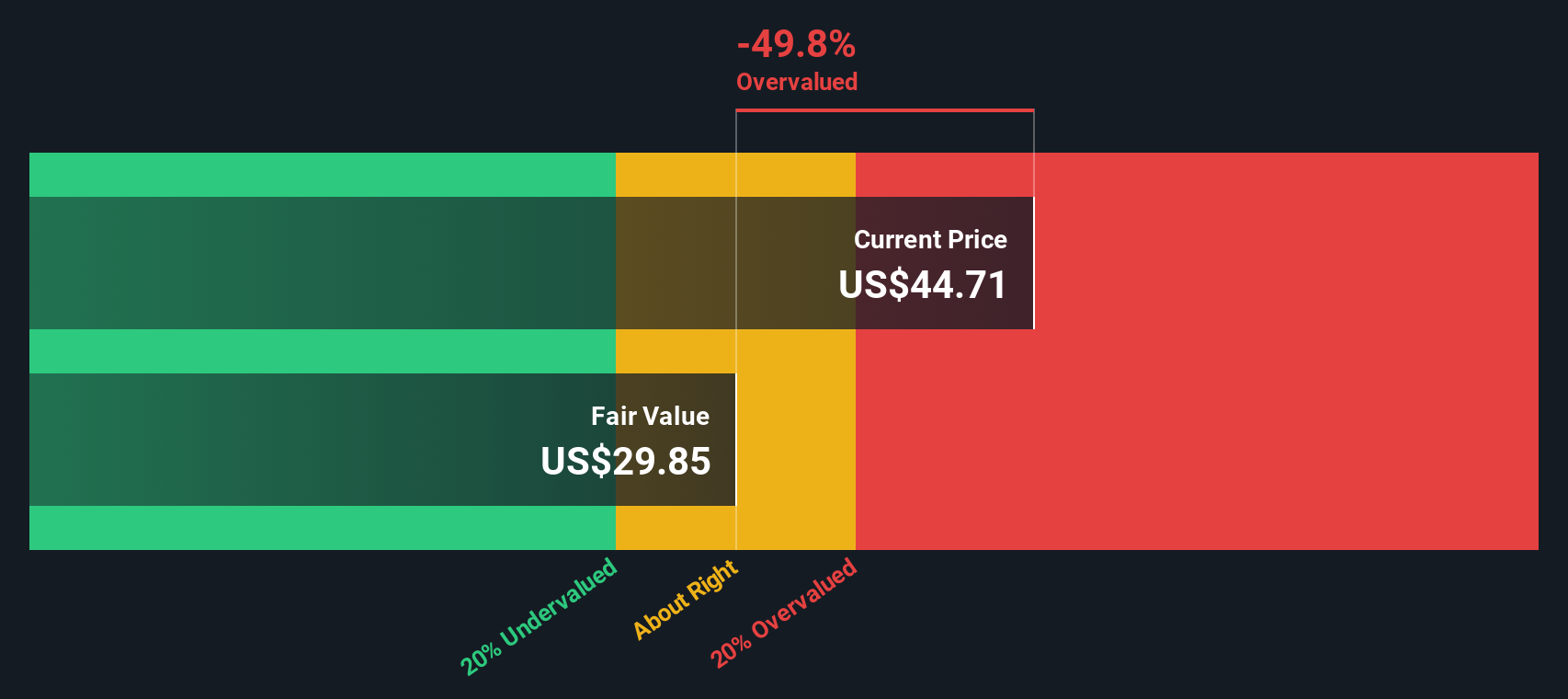

Another View: SWS DCF Model Offers a Different Perspective

While market watchers see Horace Mann Educators as undervalued by comparing its price to future expected earnings, our SWS DCF model tells a different story. This method calculates that shares might actually be trading above their true fair value right now, which suggests there may be less upside than it first appears. What could this mean if the future growth does not fully pan out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Horace Mann Educators for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Horace Mann Educators Narrative

If you see things differently or want to dig into the data yourself, you have everything you need to shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Horace Mann Educators research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. The Simply Wall Street Screener features smart ways to spot your next winning trade or hidden gem before the masses catch on.

- Capture passive income with these 15 dividend stocks with yields > 3% that deliver solid yields and reliable cash flow for your portfolio.

- Get ahead of the technology curve with these 25 AI penny stocks harnessing artificial intelligence in new and profitable ways.

- Grow your wealth by targeting these 923 undervalued stocks based on cash flows that the market has yet to recognize for their true value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Horace Mann Educators might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HMN

Horace Mann Educators

Operates as an insurance holding company in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026