- United States

- /

- Insurance

- /

- NYSE:HMN

A Look at Horace Mann Educators (HMN) Valuation Following Dividend Hike and Digital Expansion Momentum

Reviewed by Kshitija Bhandaru

Horace Mann Educators (HMN) is back in the spotlight after its decision to raise the quarterly dividend and ongoing digital platform upgrades. These moves are capturing attention among income-minded investors and those tracking the insurer’s growth trajectory.

See our latest analysis for Horace Mann Educators.

Recent momentum has been hard to miss. Horace Mann Educators’ share price has jumped over 18% year-to-date, while investors celebrating its steady profit growth and digital upgrades have enjoyed a 30.95% total shareholder return over the past 12 months. This sustained performance, paired with another dividend hike, underscores shifting sentiment and a sense that the insurer’s growth runway is starting to get noticed.

If news of Horace Mann’s dividend raise has you rethinking your strategy, why not broaden your horizons and discover fast growing stocks with high insider ownership

With the stock rallying and already nearing analyst price targets, investors are now left wondering: is Horace Mann Educators still trading at an attractive valuation, or have rising expectations already been priced in, leaving little room for further upside?

Most Popular Narrative: 6.8% Undervalued

With Horace Mann Educators trading at $45.67, the most popular narrative suggests the shares could be worth $49. This implies a modest opportunity beyond today's price. This sets the scene for a deeper look at the drivers behind this fair value call and what must happen for the upside to materialize.

Ongoing expansion of digital engagement platforms and proprietary technology solutions (such as the Catalyst lead management system) are improving agent productivity and making it easier for educators to engage. This is likely to drive increased policy sales, higher customer conversion rates, and improved customer retention, positively impacting both revenue growth and net margins.

Want to know which surprising future financial changes are packed into this price target? Analysts are betting on a sharp earnings rebound and higher margins. Think cash flows that could shift the narrative for years. Unlock the numbers powering this view and uncover what could tip the balance next.

Result: Fair Value of $49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including Horace Mann’s reliance on an aging educator customer base and the company’s lag behind competitors in digital technology adoption.

Find out about the key risks to this Horace Mann Educators narrative.

Another View: What Does the DCF Model Say?

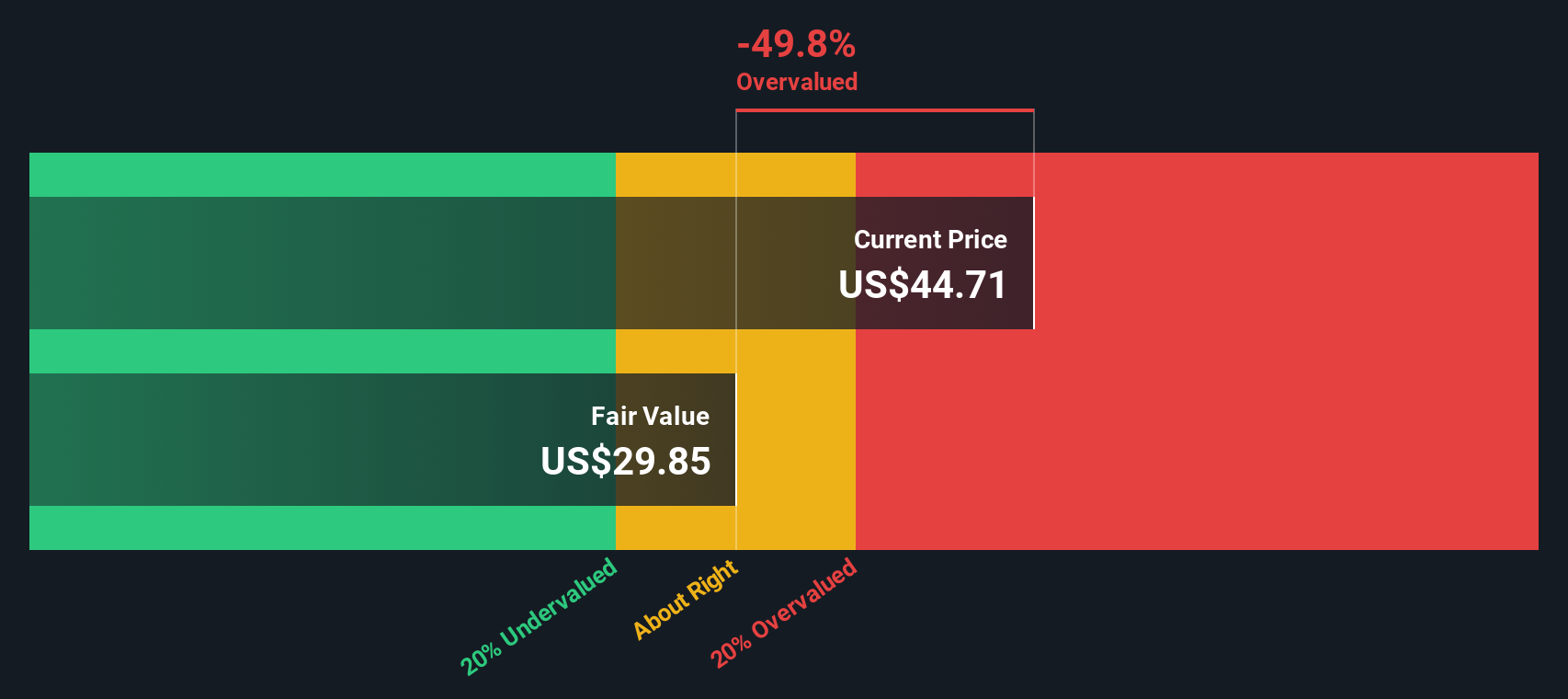

Looking at our DCF model, a different picture emerges. This approach places Horace Mann’s fair value at just $29.85 per share, which is below the current market price. It suggests that optimism in the market may be ahead of the company’s true cash flow potential. Which method would you trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Horace Mann Educators for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Horace Mann Educators Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Horace Mann Educators.

Looking for more investment ideas?

Don’t limit your strategy to just one stock. Unlock major growth potential by acting on the latest insights and handpicked opportunities waiting in our screeners below.

- Turbocharge your search for high-yield opportunities with these 18 dividend stocks with yields > 3%, offering yields over 3% and consistent income potential.

- Seize your chance in the booming world of artificial intelligence by tapping into these 25 AI penny stocks, transforming industries and redefining tech leadership.

- Catch hidden value with these 881 undervalued stocks based on cash flows, which could offer upside based on strong cash flow and solid fundamentals before the market takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Horace Mann Educators might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HMN

Horace Mann Educators

Operates as an insurance holding company in the United States.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives