- United States

- /

- Insurance

- /

- NYSE:HIPO

Hippo Holdings (HIPO): Premium Valuation Faces Test as Revenue Seen Growing 15.9% Annually

Reviewed by Simply Wall St

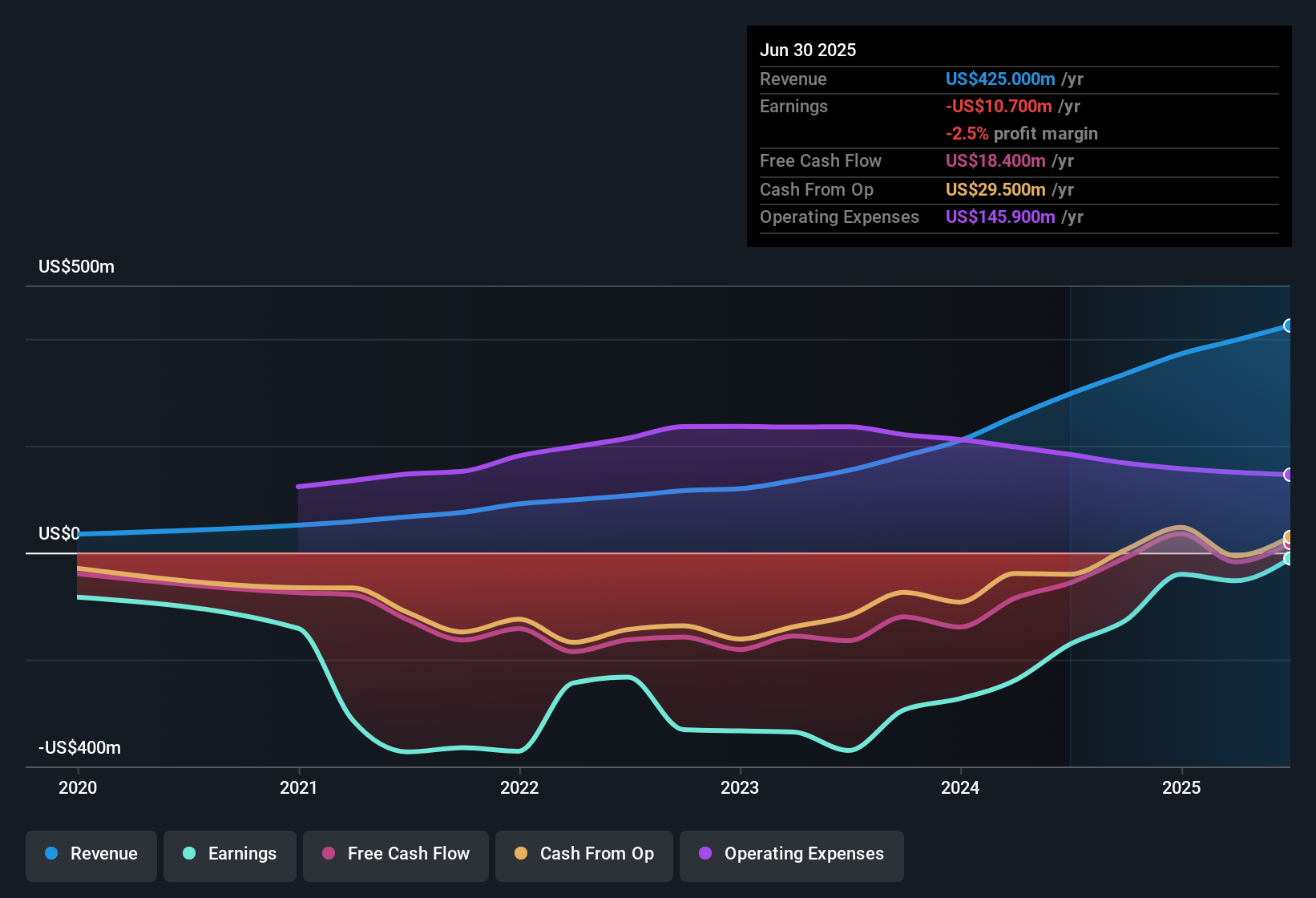

Hippo Holdings (HIPO) remains unprofitable, but the company has managed to reduce its losses by 23% per year over the past five years. Looking ahead, analysts forecast revenue to grow at 15.9% per year, which exceeds the broader US market growth rate of 10.5%. They also project a potential path to profitability within three years. Although profit is not in sight just yet, investors may be watching closely as revenue growth expectations drive sentiment, even as earnings and revenue are not both anticipated to rise together.

See our full analysis for Hippo Holdings.Next, we will see how these figures compare with the most widely followed narratives surrounding Hippo Holdings and whether the latest results challenge or reinforce the market’s expectations.

See what the community is saying about Hippo Holdings

Fixed Expenses Down as Revenue Grows 31%

- Hippo’s fixed expenses dropped by 16% year-over-year even as revenue increased by 31%, indicating the company is gaining operating leverage and finding ways to scale up efficiently.

- Analysts' consensus view sees scalable cost controls and higher premium volumes as the backbone for future margin expansion.

- Consensus narrative notes Hippo’s partnerships, such as with Baldwin Group, triple access to new home closings and support rapid growth without a matching rise in expenses.

- As core costs shrink relative to revenue, there is greater potential for incremental profit and improved margins, particularly if technology-driven underwriting keeps claim losses in check.

See how the latest cost discipline aligns with long-term goals and pivotal partnerships in the full analyst consensus for Hippo Holdings. 📊 Read the full Hippo Holdings Consensus Narrative.

Profit Margins Forecast to Flip Positive

- Analysts expect profit margins to climb from the current -2.5% to 4.6% within three years, signaling a clear pathway toward profitability if revenue momentum continues.

- Consensus narrative highlights that targeted use of technology, such as automating risk assessments and reducing claim losses, could accelerate this move into the black.

- Consensus believes investments in AI and IoT will enable Hippo to lower loss ratios, which can unlock more stable and predictable net margins over time.

- However, critics underscore that if climate-driven events intensify or underwriting models misfire, margin improvement could stall and test whether technology is enough to offset insurance risks.

Premium Valuation Raises the Bar

- Hippo trades at 2.2x price-to-sales, a premium versus both peer (1.7x) and industry (1.1x) averages. This creates high expectations for its forecasted growth and operational turnaround.

- Consensus narrative warns that this valuation demands a convincing leap in both revenue and profitability to justify paying above-average multiples.

- With a current share price of $37.85 and the only approved analyst target at $38.67, the implied upside is just over 2%, suggesting the market already prices in aggressive future gains.

- Consensus also reminds investors that climbing costs or slower-than-expected growth could erode these expectations, leaving little margin for error if the growth story wobbles.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Hippo Holdings on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data another way? Seize the chance to craft your own narrative in just a few minutes and share your unique take. Do it your way

A great starting point for your Hippo Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Hippo Holdings commands a premium valuation, its profitability and margin improvements remain uncertain and are heavily dependent on continued aggressive revenue growth and cost controls.

Seeking more reliable performance? Compare with stable growth stocks screener (2074 results) that consistently deliver steady revenue and earnings, allowing you to invest with greater confidence and fewer surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hippo Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HIPO

Hippo Holdings

Provides property and casualty insurance products to individuals and business customers primarily in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives