- United States

- /

- Insurance

- /

- NYSE:ASIC

Discovering US Undiscovered Gems November 2025

Reviewed by Simply Wall St

As the U.S. stock market rebounds with major indices like the Dow and S&P 500 snapping recent losing streaks, investors are keenly watching developments in AI and tech sectors, which continue to influence broader market sentiment. In this dynamic environment, identifying potential "undiscovered gems" requires a focus on companies with strong fundamentals that can navigate economic uncertainties while capitalizing on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Nutex Health (NUTX)

Simply Wall St Value Rating: ★★★★★★

Overview: Nutex Health Inc. operates as a healthcare services and operations company in the United States with a market cap of $701.53 million.

Operations: Nutex Health generates revenue primarily through its healthcare services and operations. The company has a market capitalization of approximately $701.53 million.

Nutex Health, a rising player in the healthcare sector, has shown significant growth with its revenue jumping to US$723.58 million for the first nine months of 2025 from US$222.33 million a year earlier. The company has become profitable this year, boasting high-quality earnings and reducing its debt-to-equity ratio from 78.2% to 14% over five years. However, it faces challenges such as volatile share prices and substantial shareholder dilution recently. Despite these hurdles, Nutex's EBIT covers interest payments well at 10.7 times coverage, indicating sound financial management amidst rapid expansion efforts in micro-hospitals and ambulatory care facilities.

Ategrity Specialty Insurance Company Holdings (ASIC)

Simply Wall St Value Rating: ★★★★★★

Overview: Ategrity Specialty Insurance Company Holdings operates through its subsidiaries to offer excess and surplus lines insurance and reinsurance products to small and medium-sized businesses in the United States, with a market capitalization of approximately $921.44 million.

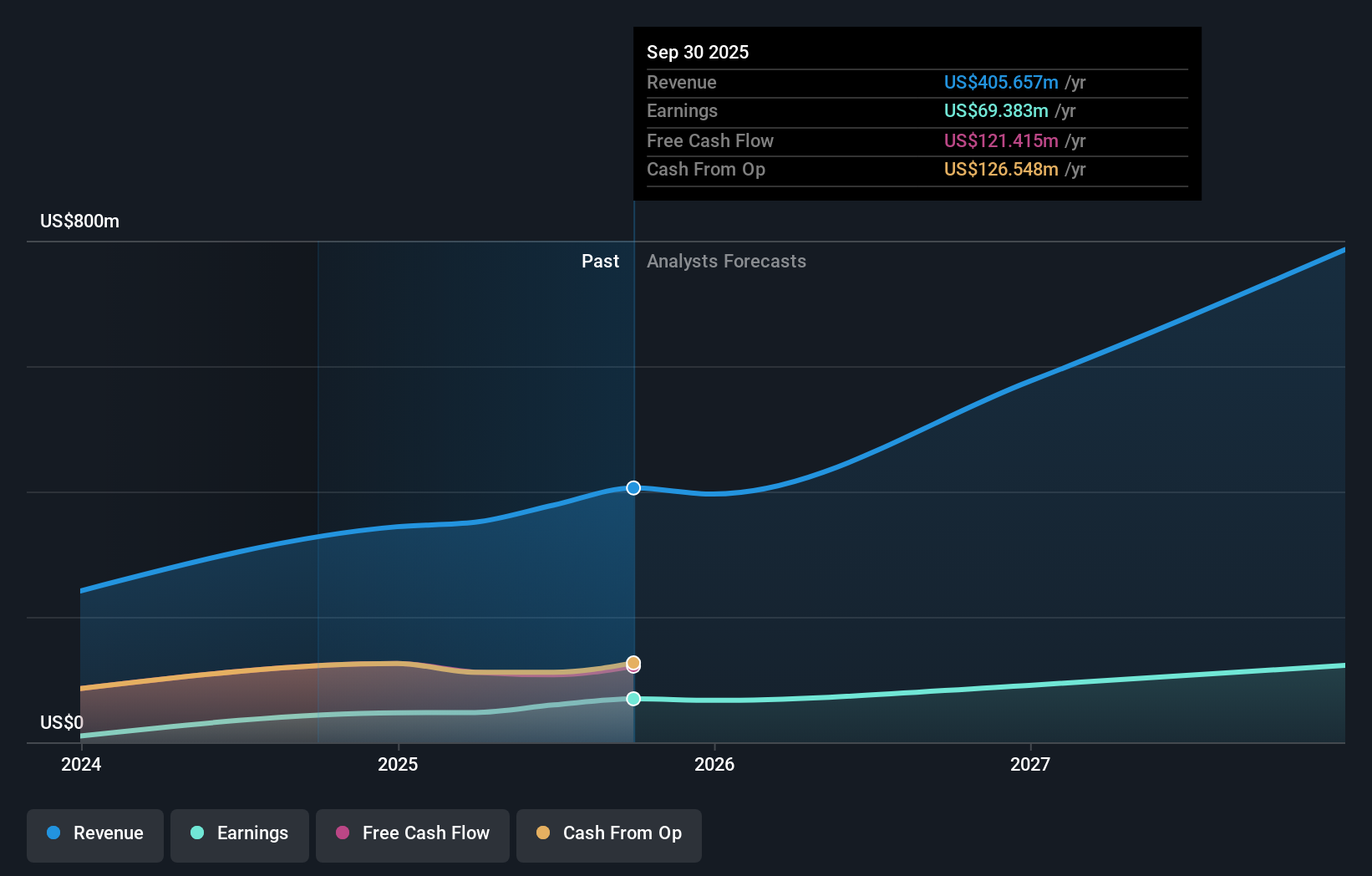

Operations: ASIC generates revenue primarily from its insurance business, amounting to $405.66 million. The company has a market capitalization of approximately $921.44 million.

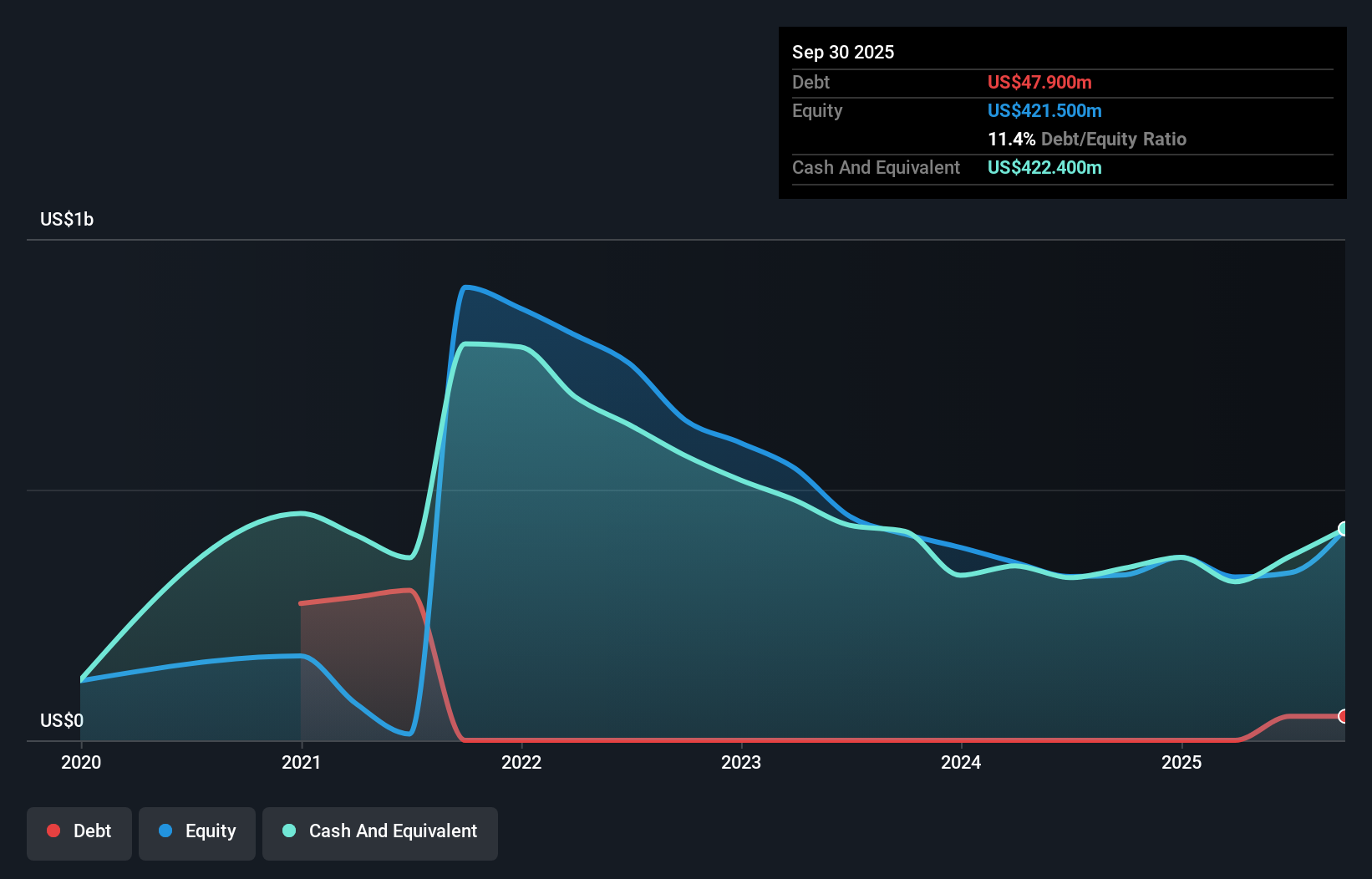

Ategrity Specialty Insurance Company Holdings, a nimble player in the insurance sector, has shown impressive growth with earnings surging 83.7% over the past year, outpacing the industry average of 10.3%. The company's revenue for Q3 2025 reached US$116.1 million, up from US$88.75 million last year, while net income increased to US$22.66 million from US$12.86 million a year ago. Recently added to multiple indices including Russell 2000 and S&P TMI Index, Ategrity's innovative platform like Ategrity Select enhances underwriting efficiency and supports its profitability goals without any debt burden weighing it down.

Hippo Holdings (HIPO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hippo Holdings Inc. offers property and casualty insurance products to individuals and businesses mainly in the United States, with a market capitalization of $813.77 million.

Operations: Hippo Holdings generates revenue primarily through premiums from property and casualty insurance products. The company's cost structure includes claims expenses, which significantly impact its profitability. Net profit margin trends can be observed over multiple periods to assess financial performance.

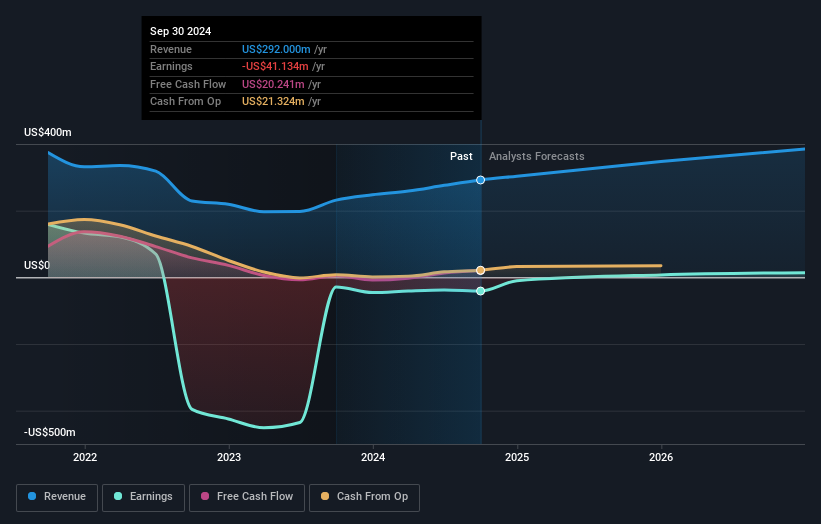

Hippo Holdings, a tech-driven insurance player, has shown notable financial improvements recently. The company reported a net income of US$98 million in Q3 2025, compared to a net loss of US$8.5 million the previous year. Its debt-to-equity ratio improved significantly from 131% to 11% over five years, highlighting effective debt management. A strategic partnership with Baldwin Group is expected to expand market access through Westwood Insurance Agency, potentially increasing policy volume among digitally savvy buyers. Despite these positive strides and an attractive P/E ratio of 8.9x, Hippo faces challenges like climate change impacts and rising competition within the sector.

Turning Ideas Into Actions

- Take a closer look at our US Undiscovered Gems With Strong Fundamentals list of 293 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASIC

Ategrity Specialty Insurance Company Holdings

Through its subsidiaries, provides excess and surplus lines insurance and reinsurance products to small and medium-sized businesses in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives