- United States

- /

- Insurance

- /

- NYSE:HGTY

How Investors May Respond To Hagerty (HGTY) Expanding Services and Securing Analyst Optimism

Reviewed by Sasha Jovanovic

- Hagerty, a global provider of specialty insurance for classic vehicles, recently saw analysts express increased optimism following its partnership with Way to launch a Secure Storage Concierge service and the completion of a follow-on equity offering aimed at supporting future initiatives.

- This series of moves underscores Hagerty’s efforts to diversify its offerings and highlights analyst confidence in meaningful upcoming catalysts, particularly premium growth and expanded collaborations.

- We’ll now assess how expanded service offerings and new partnerships may influence Hagerty’s investment outlook and growth narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Hagerty Investment Narrative Recap

To be a Hagerty shareholder, an investor must believe the company can sustain premium growth and expand its revenue base by engaging more classic car enthusiasts, while navigating changing demographics and market volatility. The recent partnership with Way to launch Secure Storage Concierge further aligns with Hagerty’s drive to deepen member value, but does not materially shift the most important near-term catalyst, premium growth via key partnerships, nor does it reduce the risk tied to concentrated underwriting exposure as Hagerty transitions to retaining 100% of insurance risk. Among recent announcements, the follow-on equity offering stands out as most relevant, with fresh capital earmarked to support new business lines and service enhancements, including the launch with Way. This bolsters Hagerty's ability to invest in premium growth and new collaborations, both central to its medium-term growth story. However, investors should also consider that, despite these service expansions, Hagerty's concentrated insurance risk profile may affect...

Read the full narrative on Hagerty (it's free!)

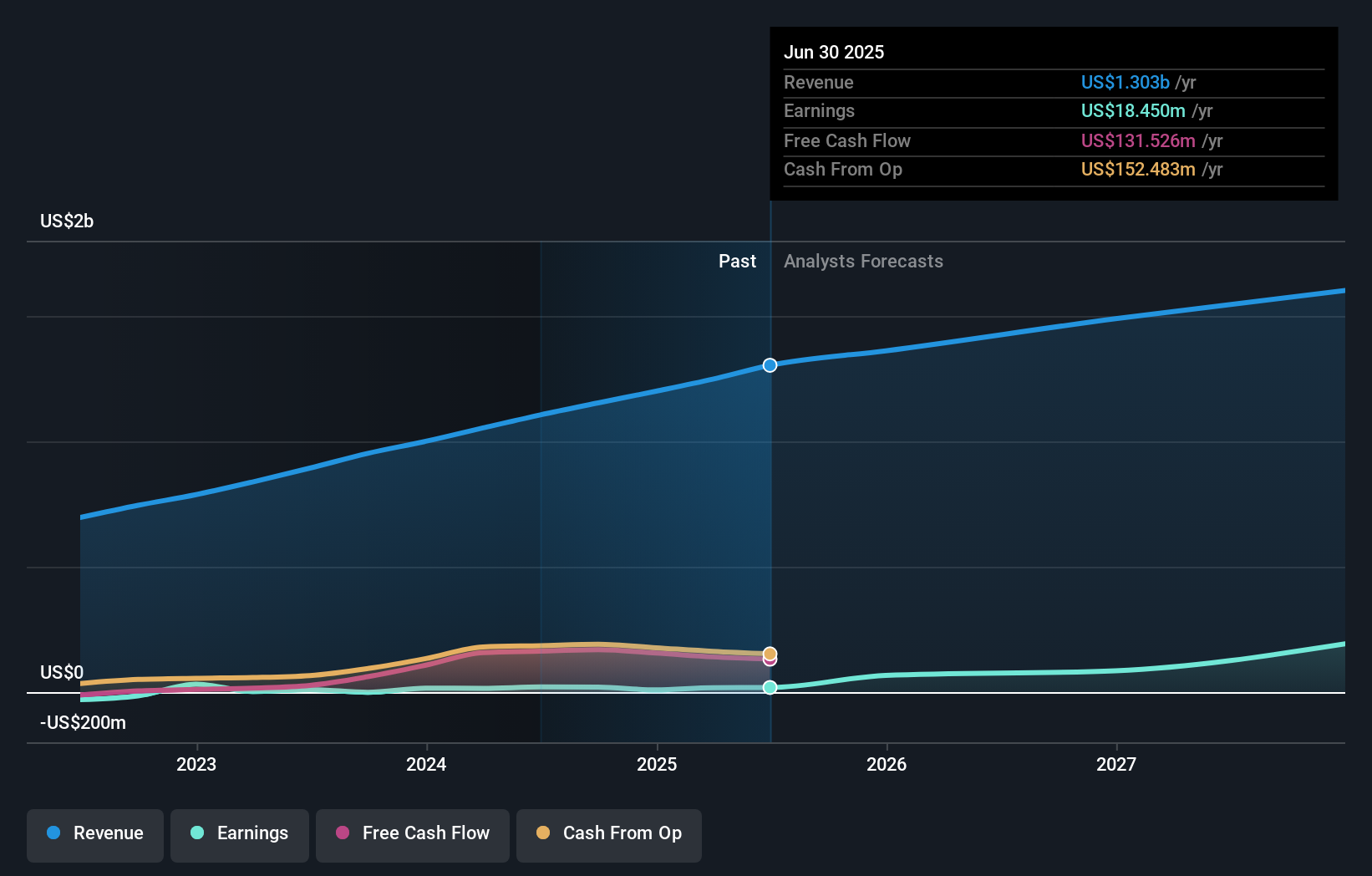

Hagerty's outlook anticipates $1.8 billion in revenue and $228.5 million in earnings by 2028. This projection relies on an 11.1% annual revenue growth rate and a $210.1 million increase in earnings from the current level of $18.4 million.

Uncover how Hagerty's forecasts yield a $13.17 fair value, a 10% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community fair value estimate stands at US$20.51 per share, with one perspective included. Although analysts highlight premium growth from partnerships as a catalyst, views on future value can differ significantly, and you should compare various approaches to see what aligns with your expectations.

Explore another fair value estimate on Hagerty - why the stock might be worth just $20.51!

Build Your Own Hagerty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hagerty research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hagerty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hagerty's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hagerty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HGTY

Hagerty

Provides insurance services for collector cars and enthusiast vehicles in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives