- United States

- /

- Insurance

- /

- NYSE:HG

The Bull Case For Hamilton Insurance Group (HG) Could Change Following $335 Million in Renewed Credit Facilities

Reviewed by Sasha Jovanovic

- In recent days, Hamilton Insurance Group announced amendments and renewals to two of its key credit facility agreements, including the establishment of a new US$260 million letter of credit supporting Lloyd’s Syndicate 4000 through to 2029 and the renewal of a separate UBS AG facility for up to US$75 million through 2026.

- These actions not only reinforce Hamilton’s access to liquidity for its syndicate operations but also underscore the group’s focus on maintaining financial flexibility amid evolving market needs.

- We'll explore how these renewed credit facilities may reinforce Hamilton Insurance Group’s capital position and overall investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Hamilton Insurance Group Investment Narrative Recap

To believe in Hamilton Insurance Group as a shareholder today, you need confidence in the company's ability to manage specialty and reinsurance risks while maintaining robust capital and liquidity. The recent amendments and renewals to its credit facilities help underline Hamilton’s access to funding, but they do not materially shift the most important short term catalyst: capturing continued premium growth from specialty (re)insurance demand. Similarly, the group's sector-specific risks, including exposure to catastrophic losses, remain unchanged by these financial actions.

The newly established US$260 million letter of credit supporting Lloyd's Syndicate 4000 stands out, both by extending Hamilton’s operational flexibility through 2029 and ensuring ongoing underwriting capacity at Lloyd’s. This is closely aligned with the near-term revenue growth catalyst, as solid funding is essential for expanding in high-demand specialty insurance segments while adapting to market volatility.

By contrast, investors should be aware of how persistent competitive pressures and margin compression could affect...

Read the full narrative on Hamilton Insurance Group (it's free!)

Hamilton Insurance Group's narrative projects $3.1 billion in revenue and $536.4 million in earnings by 2028. This requires 5.6% yearly revenue growth and a $155.9 million increase in earnings from the current $380.5 million.

Uncover how Hamilton Insurance Group's forecasts yield a $27.14 fair value, a 10% upside to its current price.

Exploring Other Perspectives

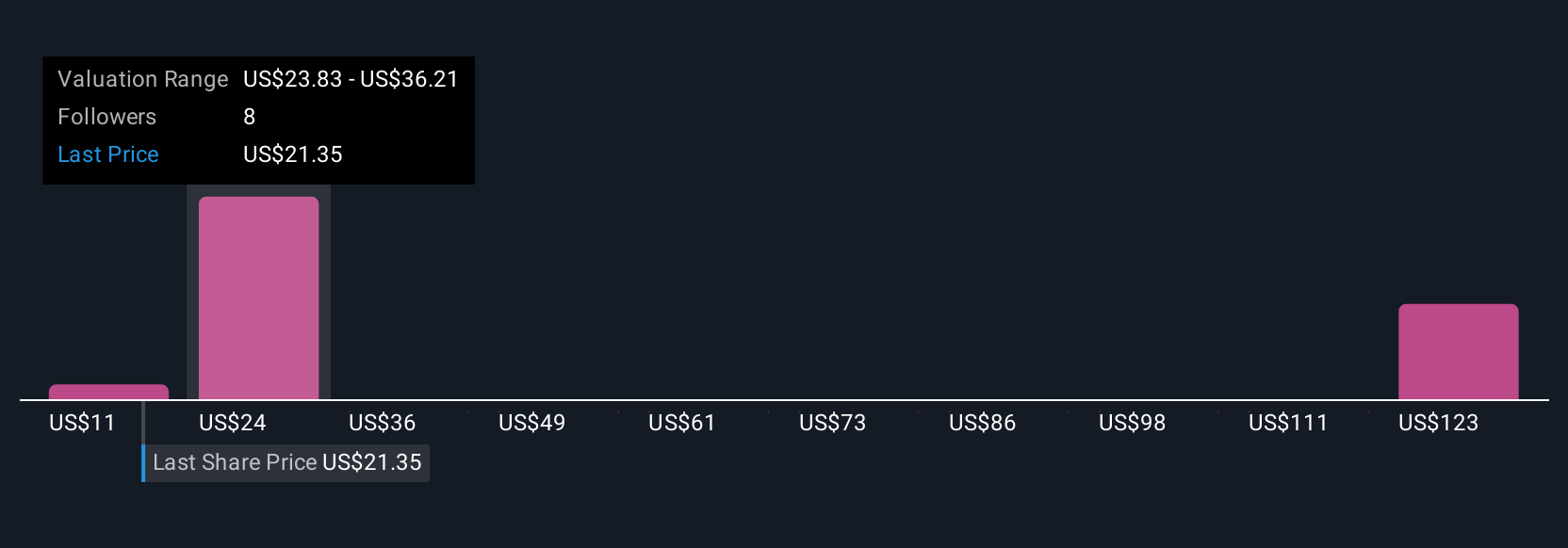

The Simply Wall St Community produced five fair value estimates for Hamilton Insurance Group, ranging from US$11.44 to US$120.38 per share. While opinions can differ widely, many are watching how ongoing shifts in market pricing and competition could shape future margins and overall group performance.

Explore 5 other fair value estimates on Hamilton Insurance Group - why the stock might be worth over 4x more than the current price!

Build Your Own Hamilton Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hamilton Insurance Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hamilton Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hamilton Insurance Group's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hamilton Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HG

Hamilton Insurance Group

Through its subsidiaries, operates as specialty insurance and reinsurance company in Bermuda and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)