- United States

- /

- Insurance

- /

- NYSE:HG

Should Hamilton Insurance Group’s (HG) Buyback Expansion After Strong Earnings Prompt Investor Action?

Reviewed by Sasha Jovanovic

- Earlier this month, Hamilton Insurance Group reported strong third quarter 2025 earnings with revenue of US$667.65 million and net income of US$136.2 million, alongside the completion of a 5.35% share repurchase totaling US$113.82 million since August 2024.

- The company's decision to expand its buyback authorization to US$300 million shortly after its earnings release highlights management's confidence and commitment to returning value to shareholders.

- We’ll explore how Hamilton’s increased buyback authorization, coming after robust quarterly earnings, could influence its investment narrative and outlook.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Hamilton Insurance Group Investment Narrative Recap

Hamilton Insurance Group’s investment thesis centers on confidence in specialty (re)insurance as demand rises for complex risk coverage, but shareholders must weigh volatility tied to catastrophic events and margin sensitivity in an intensely competitive sector. The recent move to expand its share buyback authorization following robust quarterly earnings signals conviction from management, but the most important short-term catalyst, resilient underwriting performance, relies less on capital actions than actual loss experience, so the fundamental risk landscape remains largely unchanged for now.

Among recent announcements, the third-quarter earnings update stands out given revenue rose to US$667.65 million and net income reached US$136.2 million, surpassing the prior year and supporting ongoing buybacks. This earnings momentum bolsters the narrative around capital strength, but any tailwinds from these results still meet the reality of sector pricing pressure and elevated loss cost uncertainty.

By contrast, investors should take note of how even with strong capital management, the unpredictability of catastrophe loss events still...

Read the full narrative on Hamilton Insurance Group (it's free!)

Hamilton Insurance Group's projections see revenues reaching $3.1 billion and earnings of $536.4 million by 2028. This outlook is based on an assumed 5.6% annual revenue growth rate and reflects a $155.9 million increase in earnings from the current level of $380.5 million.

Uncover how Hamilton Insurance Group's forecasts yield a $27.14 fair value, a 4% upside to its current price.

Exploring Other Perspectives

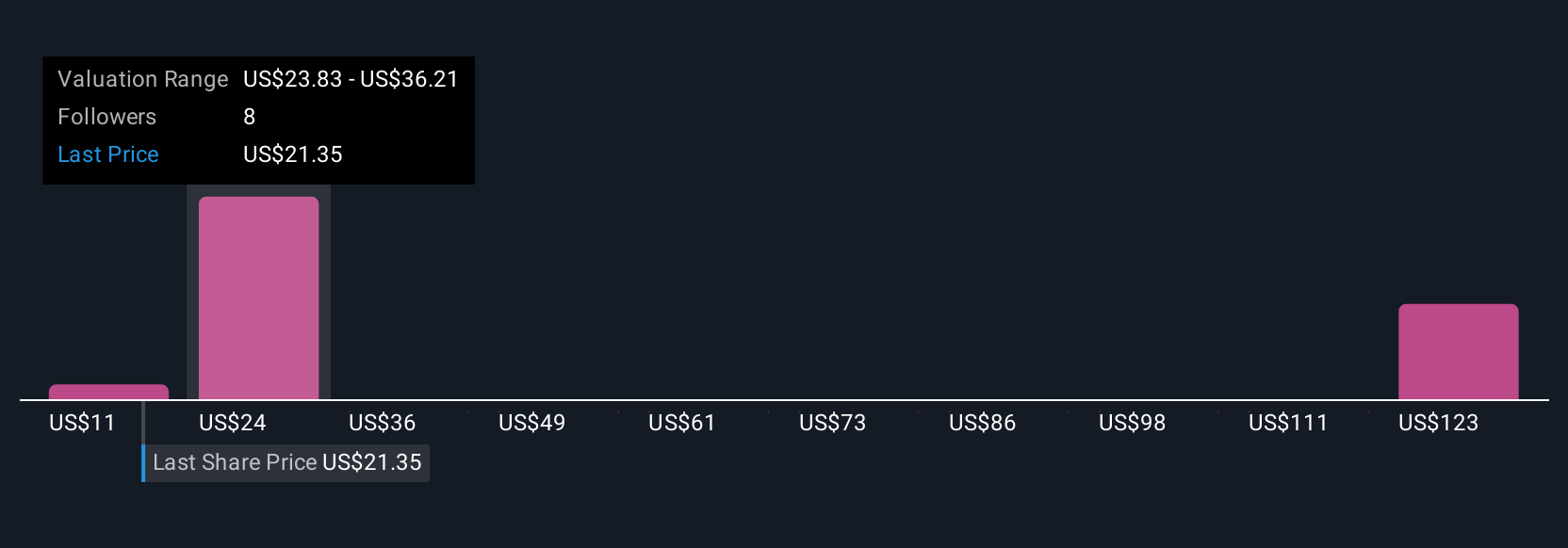

Simply Wall St Community members provided five fair value estimates for Hamilton Insurance Group, spanning US$11.44 to US$120.38. While opinions vary widely, keep in mind the company’s future profit growth is forecast to trail the broader market, so exploring different viewpoints is essential to making sense of performance expectations.

Explore 5 other fair value estimates on Hamilton Insurance Group - why the stock might be worth over 4x more than the current price!

Build Your Own Hamilton Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hamilton Insurance Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hamilton Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hamilton Insurance Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HG

Hamilton Insurance Group

Through its subsidiaries, operates as specialty insurance and reinsurance company in Bermuda and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives