- United States

- /

- Insurance

- /

- NYSE:HG

Assessing Hamilton Insurance Group After 34% Rally and Strategic Acquisition in 2025

Reviewed by Bailey Pemberton

- Wondering if Hamilton Insurance Group is a smart buy right now? If you are keen on unlocking value in the insurance sector, this one should definitely catch your eye.

- The stock has surged 34.3% over the last year and boasts a 26.9% gain so far in 2024, even after a slight dip of 2.8% last week. This reflects strong momentum with a touch of recent volatility.

- Analysts and investors are abuzz after Hamilton Insurance Group completed a notable strategic acquisition, and the company announced a push into new specialty insurance lines. These moves have helped drive the recent price action and are fueling expectations for further growth.

- On our valuation scorecard, Hamilton earns a 5 out of 6 for being undervalued. This is impressive, but how much should you rely on just the numbers? Let’s break down the most popular valuation methods first, and later on, I’ll show you a more complete way to judge if Hamilton’s stock is truly worth owning.

Approach 1: Hamilton Insurance Group Excess Returns Analysis

The Excess Returns valuation model focuses on how efficiently a company generates profit on the capital shareholders have invested, compared to the baseline cost of equity. In short, it measures whether a business adds value beyond what investors could earn elsewhere, which is a vital sign of long-term business quality and shareholder returns.

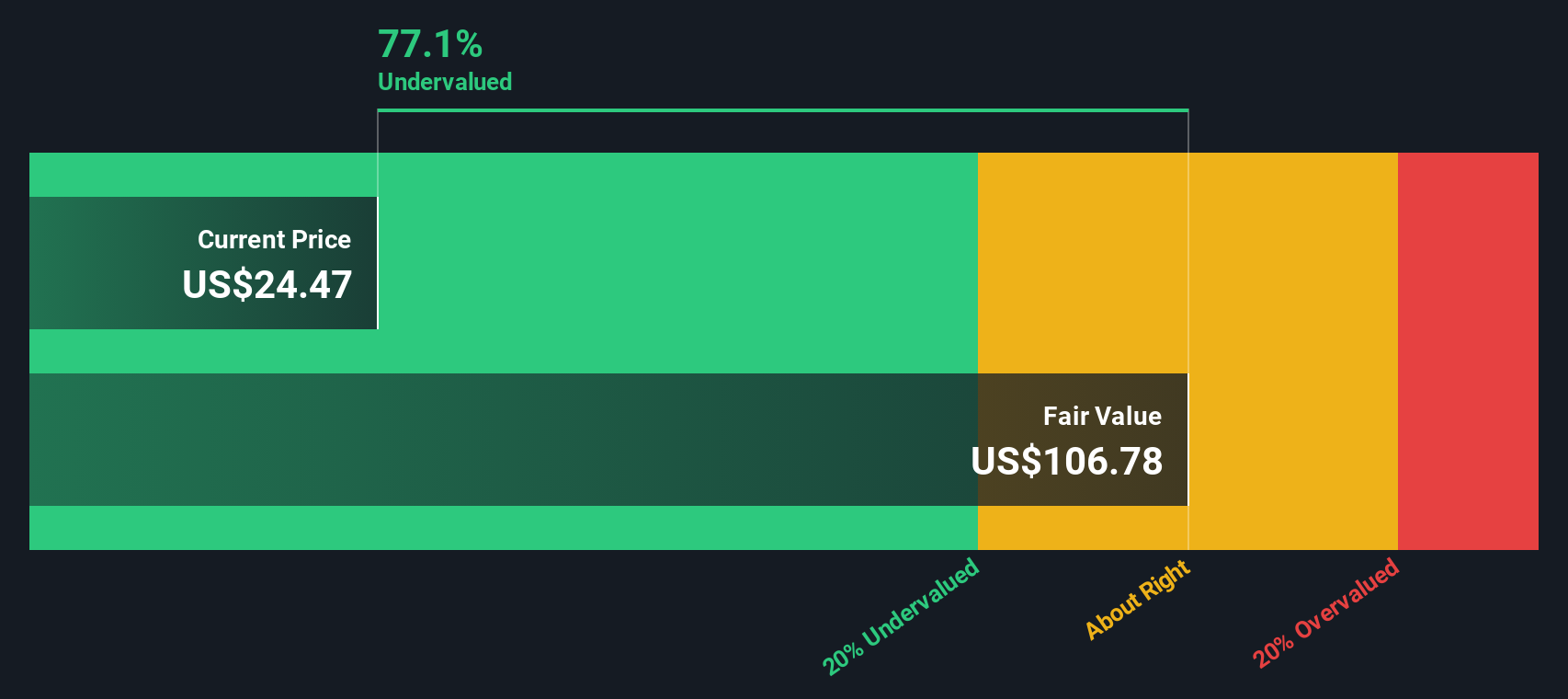

For Hamilton Insurance Group, the numbers are telling. The company’s Book Value stands at $25.55 per share, with a projected Stable EPS of $4.99 per share, based on weighted future Return on Equity estimates from four analysts. The cost of equity is $2.19 per share, and the resulting Excess Return, what Hamilton generates beyond that baseline, is $2.81 per share. Notably, the average Return on Equity is healthy at 15.49%. Looking forward, the Stable Book Value is estimated at $32.25 per share, with projections informed by three analysts.

This methodology produces an estimated intrinsic share value of $108.26, implying the stock is currently trading at a substantial 78.1% discount to its intrinsic value. That kind of margin suggests Hamilton Insurance Group is deeply undervalued, with significant upside if the company continues to deliver strong returns on equity.

Result: UNDERVALUED

Our Excess Returns analysis suggests Hamilton Insurance Group is undervalued by 78.1%. Track this in your watchlist or portfolio, or discover 853 more undervalued stocks based on cash flows.

Approach 2: Hamilton Insurance Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies, as it provides a snapshot of how much investors are willing to pay for each dollar of a company’s earnings. It is particularly relevant for companies like Hamilton Insurance Group, which have consistent and positive earnings.

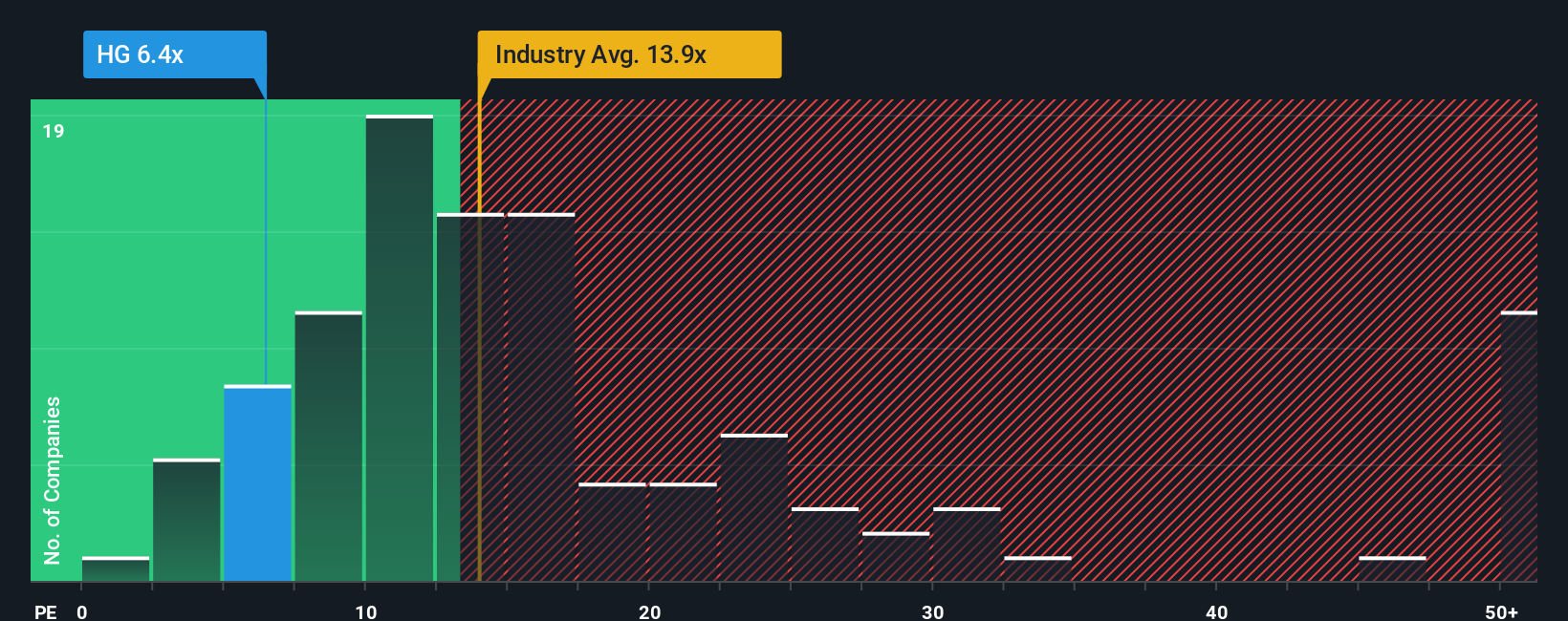

It is important to remember that the “right” PE ratio varies between companies and industries. Growth expectations play a big role, as faster-growing companies typically command higher PE multiples, while higher risk can push the appropriate PE lower. This means the context surrounding a company’s earnings matters as much as the raw number itself.

Currently, Hamilton Insurance Group trades at a PE ratio of just 6.24x. For comparison, the industry average for insurance stands at 13.28x, and the peer average is a much higher 16.48x. This positions Hamilton well below both its sector and direct competitors, suggesting the market is pricing it conservatively.

Now, let’s talk about the Fair Ratio, a proprietary metric from Simply Wall St. Unlike simple peer or industry comparisons, the Fair Ratio adjusts for key factors, including Hamilton’s earnings growth, profit margins, inherent business risks, industry norms, and its market cap. This leads to a more tailored view of what the stock’s multiple should be, in this case 13.33x.

With a Fair Ratio of 13.33x and an actual PE multiple of 6.24x, Hamilton Insurance Group is trading significantly below what would be expected given its fundamentals, pointing to potential undervaluation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Hamilton Insurance Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own story and perspective about a company’s future. Essentially, it is how you connect real-world business changes, like new markets or buybacks, to your forecasts for revenue, profit margins, and ultimately a fair share price. With Narratives, you link your view of Hamilton Insurance Group’s business outlook directly to the numbers, creating a forecast and a fair value, then easily compare that to the actual price to make informed decisions about buying or selling.

Narratives are an accessible, intuitive tool available to millions of investors right now on Simply Wall St’s Community page, making them easy to use whether you are new to investing or a seasoned analyst. Because Narratives get updated automatically whenever fresh news, earnings or market events emerge, your view stays relevant as the story unfolds.

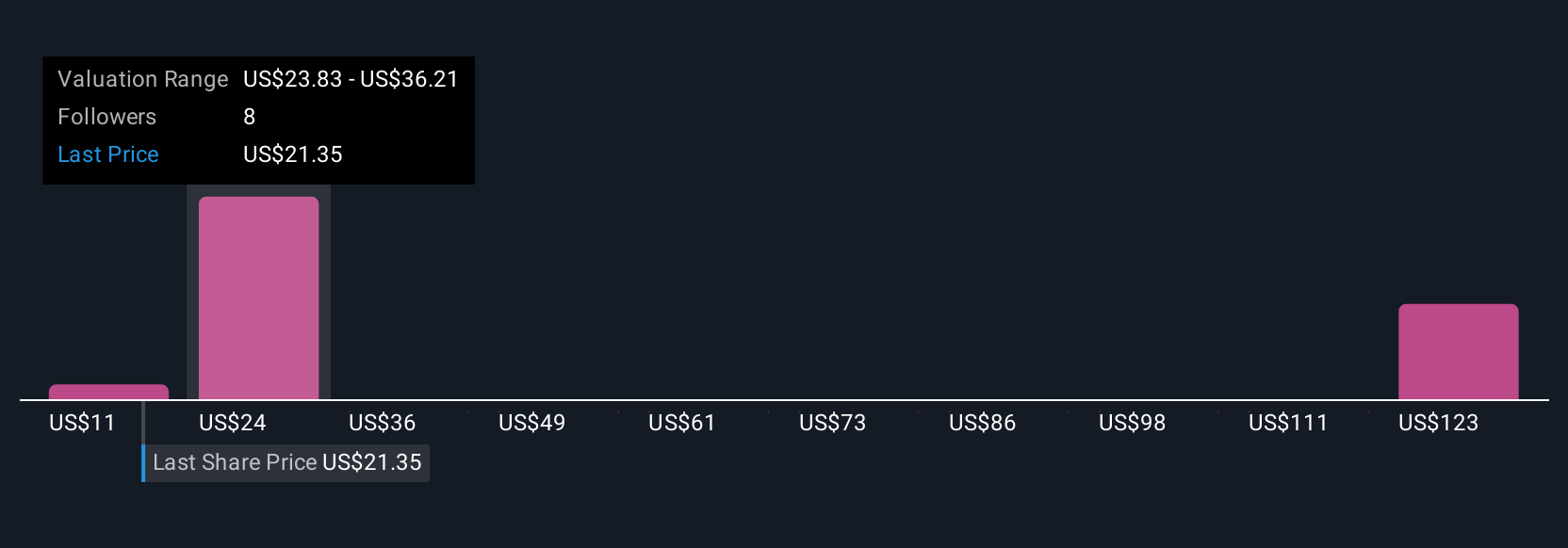

For example, some investors currently believe Hamilton Insurance Group could be worth up to $29 per share, based on optimistic forecasts of rapid digital growth and strong buybacks. Others see fair value closer to $23 per share, citing potential volatility and industry risks. Narratives help you see where you stand, so you can build your conviction and invest with confidence.

Do you think there's more to the story for Hamilton Insurance Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hamilton Insurance Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HG

Hamilton Insurance Group

Through its subsidiaries, operates as specialty insurance and reinsurance company in Bermuda and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives