- United States

- /

- Insurance

- /

- NYSE:GNW

Is It Too Late to Consider Genworth After Its 99% Five Year Share Price Surge?

Reviewed by Bailey Pemberton

- Wondering if Genworth Financial is still good value after its long climb, or if the easy money has already been made? This breakdown will walk through what the numbers are really saying about the stock today.

- The share price has cooled slightly in the last week, down 0.3%, but it is still up 1.8% over the last month, 24.4% year to date, 15.0% over the past year, and 99.1% over five years.

- Part of this move reflects shifting sentiment as investors reassess insurers with legacy long term care exposure and take note of Genworth's ongoing efforts to simplify its business and manage run off liabilities. Recent headlines have focused on capital management decisions, regulatory developments affecting long term care insurance, and the progress of its strategic repositioning, all of which shape how the market is pricing future risks and opportunities.

- Despite that backdrop, Genworth currently scores just 0 out of 6 on our valuation checks. This might surprise investors given the strong long term returns. Next we will unpack how different valuation approaches view the stock today and finish by looking at a more insightful way to think about its true value.

Genworth Financial scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Genworth Financial Excess Returns Analysis

The Excess Returns model looks at how much profit a company can generate above the return that investors demand on its equity, then converts that into an intrinsic value per share.

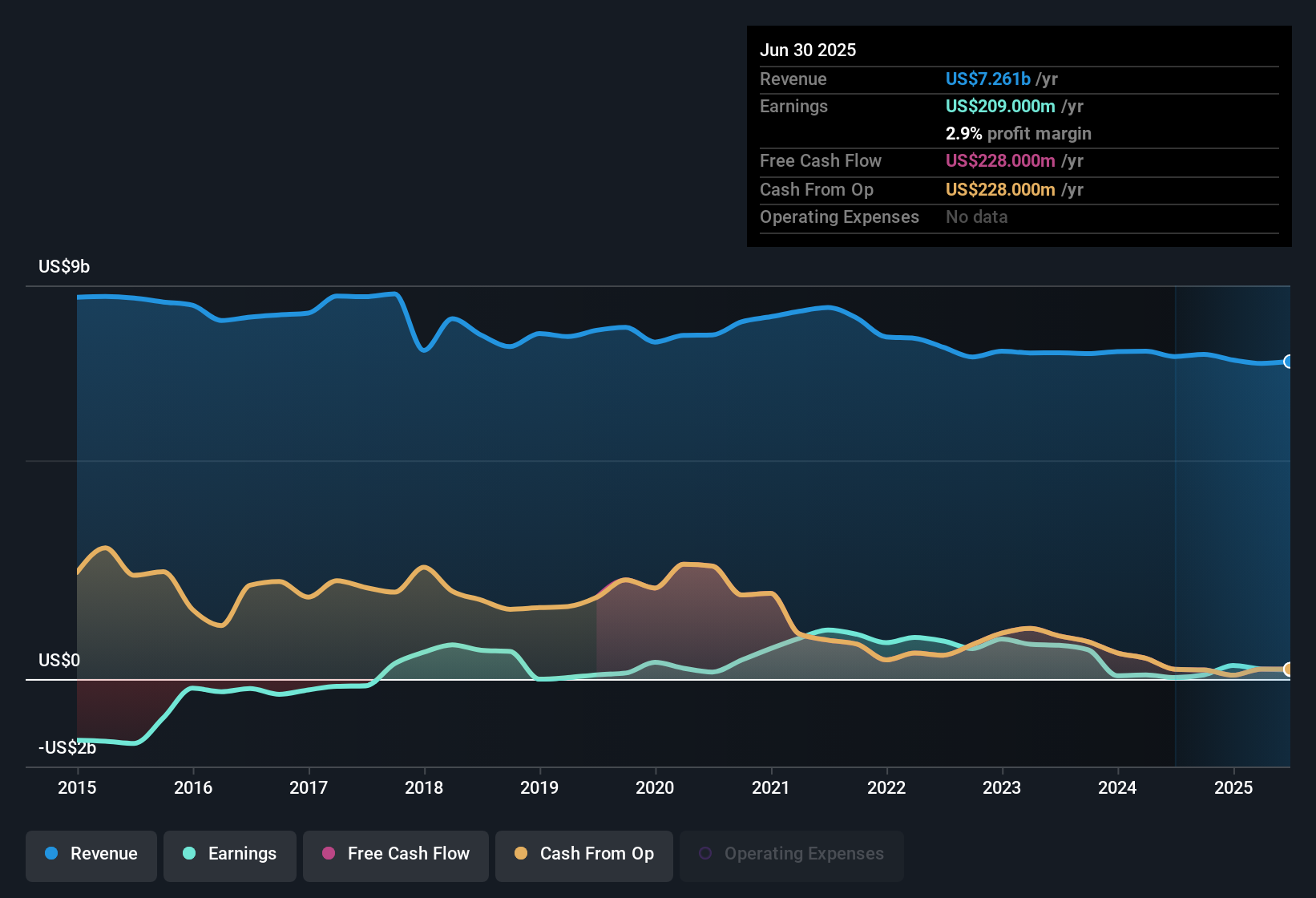

For Genworth Financial, the key inputs are not especially encouraging. Book Value is $21.88 per share, while Stable EPS is just $0.74 per share, based on the median return on equity from the past 5 years. That translates into an Average Return on Equity of only 4.00%, which is low for a financial company trying to create value from its capital base.

The model assumes a Cost of Equity of $1.36 per share, implying an Excess Return of negative $0.62 per share. In other words, Genworth is not expected to earn enough on its equity to cover investors' required return. The Stable Book Value used in the model is $18.47 per share, again based on historical medians.

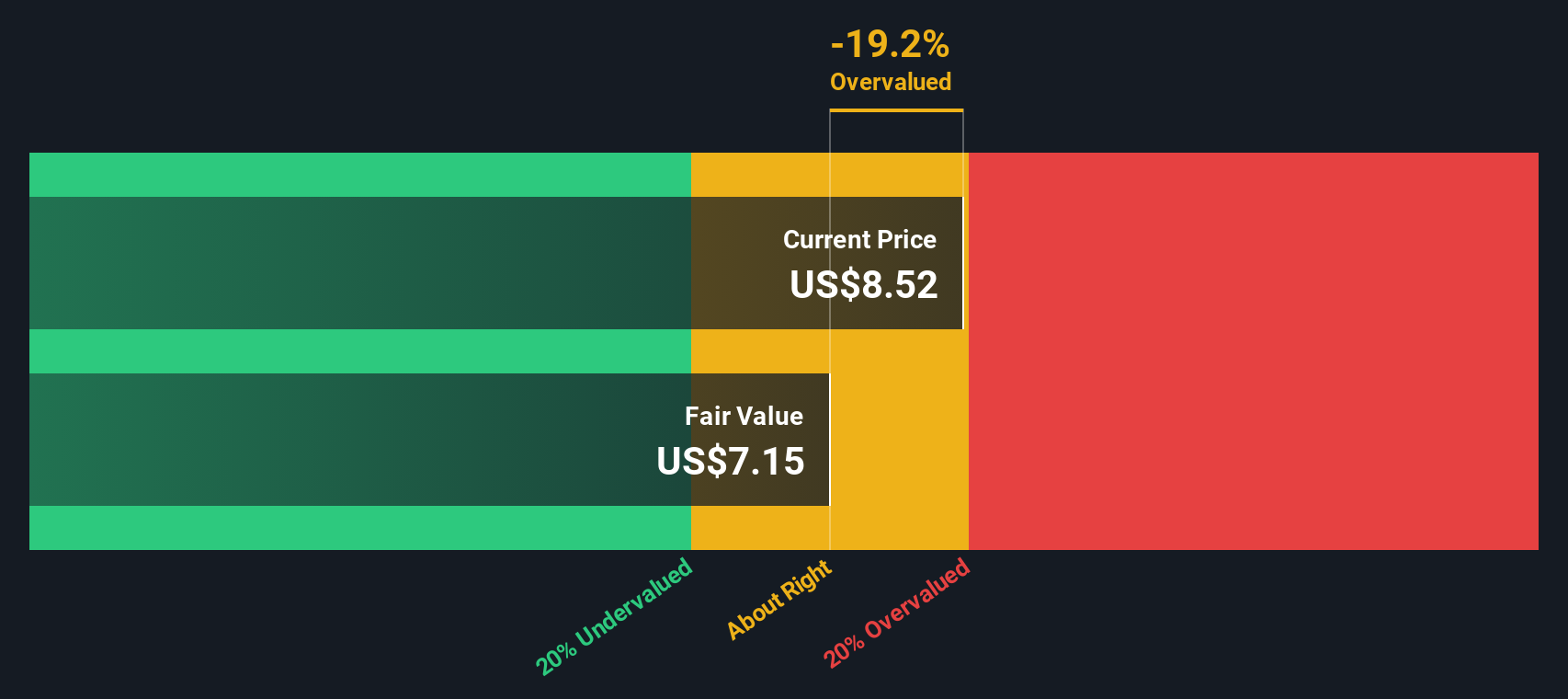

Together, these inputs produce an intrinsic value of roughly $3.32 per share, implying Genworth is about 161.5% overvalued relative to its current share price.

Result: OVERVALUED

Our Excess Returns analysis suggests Genworth Financial may be overvalued by 161.5%. Discover 913 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Genworth Financial Price vs Earnings

For consistently profitable companies, the price to earnings, or PE, ratio is often the most intuitive valuation tool because it directly links what investors are paying to the profits the business is generating today. In general, faster earnings growth and lower perceived risk can justify a higher, normal PE multiple, while slower growth or elevated risks tend to pull a fair PE lower.

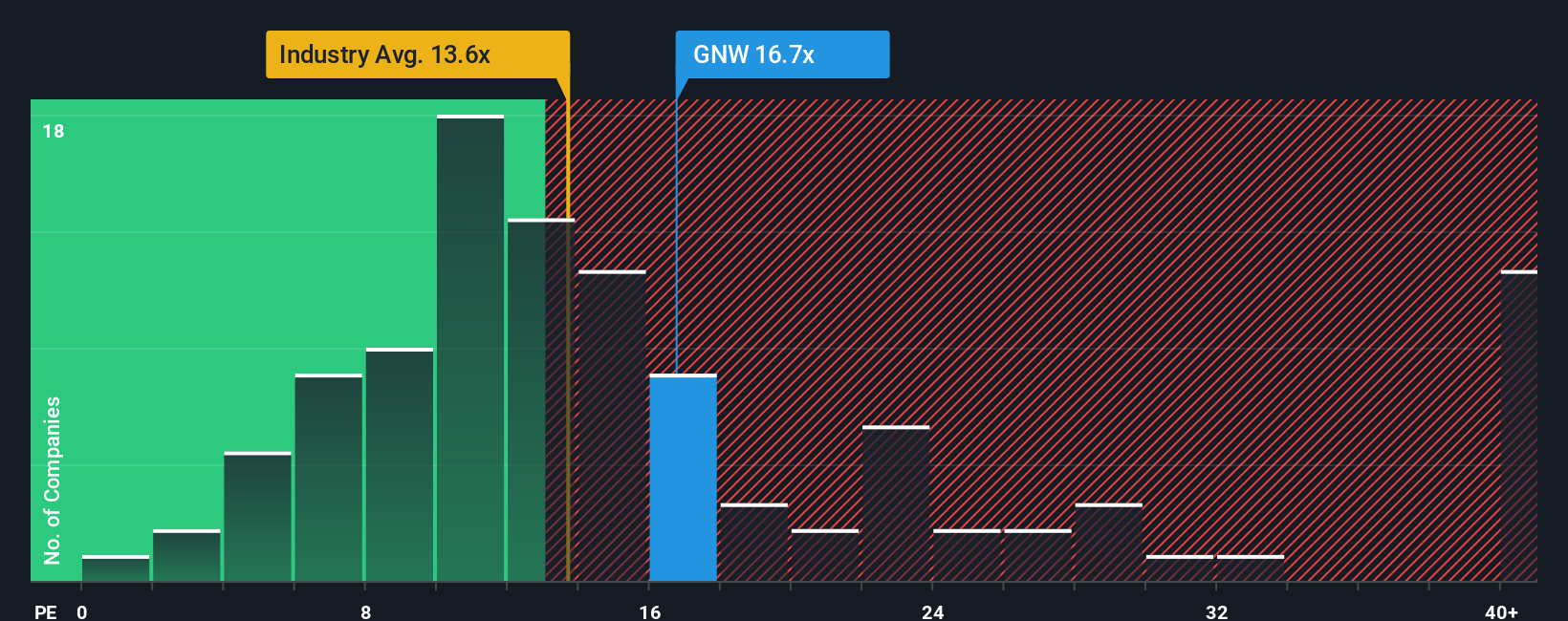

Genworth Financial currently trades on a PE of about 14.1x. That is modestly above the Insurance industry average of roughly 12.8x and also above the peer group average of about 7.8x, suggesting the market is already assigning a premium for its specific characteristics and outlook. However, simple comparisons to peers or the sector can be misleading because they ignore differences in earnings quality, growth prospects, balance sheet strength, and company size.

This is where Simply Wall St's Fair Ratio comes in. It is a proprietary estimate of what Genworth's PE should be once factors like its earnings growth profile, risk, profit margins, industry, and market cap are all taken into account. Since the Fair Ratio for Genworth is not meaningfully above the current 14.1x, this multiple-based view lines up with the DCF work and points to the shares being on the expensive side rather than a clear bargain.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Genworth Financial Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you connect your view of a company’s story with the numbers behind it, such as fair value, future revenue, earnings, and profit margin assumptions. A Narrative takes what you believe about Genworth’s strategy, risks, and opportunities, turns that into a forward looking financial forecast, and then converts that forecast into a fair value you can compare to today’s share price. On Simply Wall St, millions of investors do this on the Community page, where Narratives are easy to explore, create, and refine, helping you decide when to buy or sell by seeing whether your Fair Value sits above or below the current market Price. Because Narratives are updated dynamically as new information like news, filings, or earnings arrives, your fair value view can evolve with Genworth’s actual progress. For example, one Genworth Narrative might assume very cautious growth and assign a low fair value, while another factors in stronger premium growth and better long term care outcomes, which could lead to a much higher fair value estimate.

Do you think there's more to the story for Genworth Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNW

Genworth Financial

Provides mortgage and long-term care insurance products in the United States and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026