- United States

- /

- Insurance

- /

- NYSE:GNW

Genworth Financial (GNW): Assessing Valuation Following Recent Share Price Momentum

Reviewed by Kshitija Bhandaru

Genworth Financial (GNW) shares have seen some movement recently, inviting investors to check in on how the stock has been performing. With the latest price at $8.55, let’s take a closer look at its recent momentum.

See our latest analysis for Genworth Financial.

Genworth Financial’s share price has steadily carried the momentum from earlier this year, building on recent gains with a 14.9% move over the past quarter and an impressive 22.5% year-to-date share price return. Long-term investors have also benefited from a remarkable 125.6% five-year total shareholder return, which points to continued strength and renewed optimism about the company’s outlook.

If you’re in the mood to find your next outperformer, now is the perfect time to discover fast growing stocks with high insider ownership

But with shares still trading about 17% below the average analyst price target, investors are left weighing whether Genworth remains a bargain with upside potential or if the market has already factored in the company’s future gains.

Price-to-Earnings of 16.8x: Is it justified?

Genworth Financial currently trades at a price-to-earnings (P/E) ratio of 16.8x, notably higher than its peer group average of 9.2x and the US Insurance industry average of 13.2x. This premium indicates that investors are willing to pay more for GNW’s recent gains, but it also raises questions about whether this valuation is sustainable based on the company’s fundamentals.

The price-to-earnings ratio measures what the market is willing to pay for one dollar of Genworth’s earnings. For insurance companies, the P/E ratio often reflects expectations for earnings growth and profitability, as well as confidence in management’s ability to deliver steady results.

In GNW’s case, this relatively high P/E might be influenced by its recent rebound in earnings, with a remarkable jump over the past year. However, earnings have actually declined significantly over a five-year period. Despite the near-term performance, the stock looks expensive compared to both its immediate competitors and the broader US insurance sector, where averages are lower. The market’s optimism may hinge on a repeat of last year’s exceptional income growth. Time will tell if that expectation is realistic.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 16.8x (OVERVALUED)

However, uncertainty remains because a lack of consistent earnings growth or a failure to meet analyst targets could quickly reverse Genworth’s recent momentum.

Find out about the key risks to this Genworth Financial narrative.

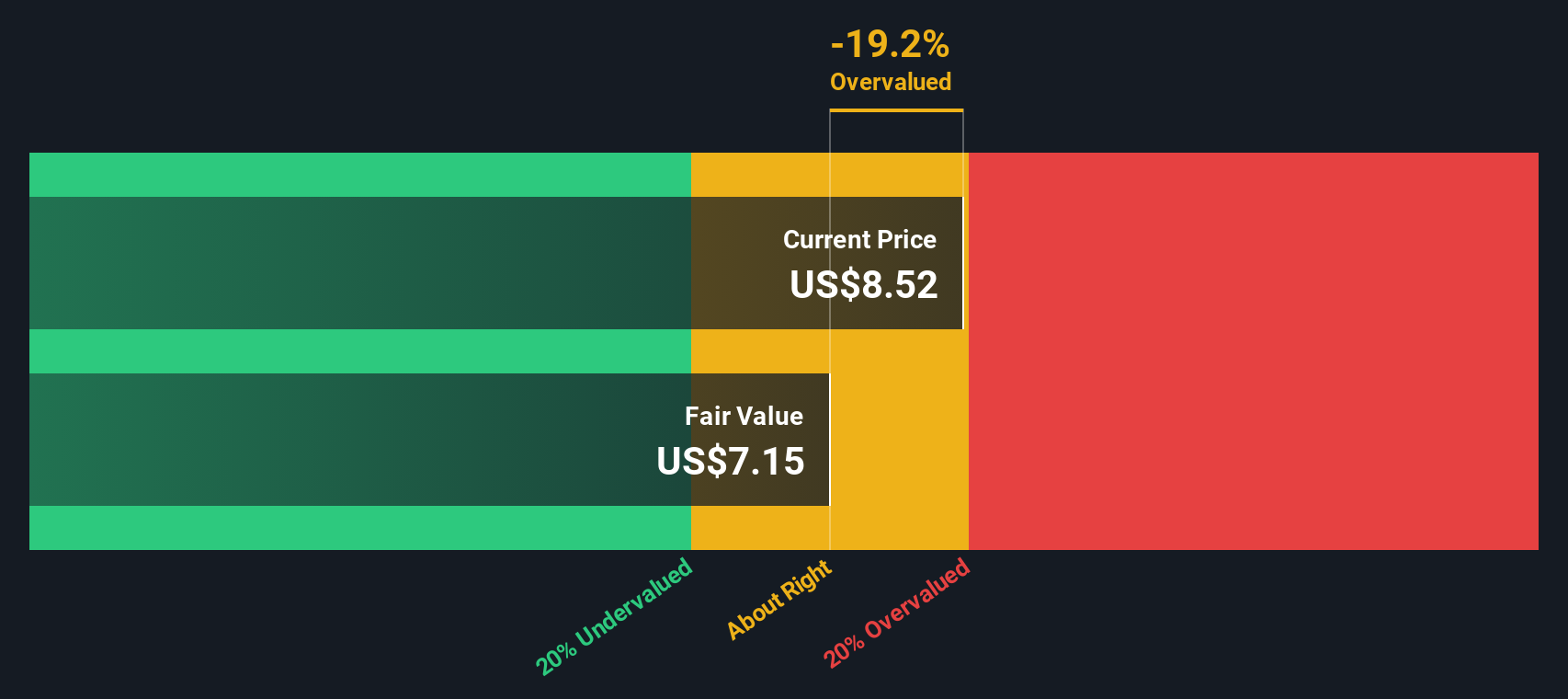

Another View: SWS DCF Model Signals Overvaluation

Looking at Genworth Financial through the lens of our SWS discounted cash flow (DCF) model offers a different perspective. The SWS DCF model estimates fair value to be $7.14 per share. As a result, the current price of $8.55 trades at a premium. This suggests investors may be paying more than what underlying cash flows justify. Could this hint at heightened long-term risk if expectations fall short?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Genworth Financial for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Genworth Financial Narrative

If you think there’s another angle or want a deeper dive into the numbers, you can easily shape your own story in just a few minutes with Do it your way.

A great starting point for your Genworth Financial research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Seize new opportunities before others catch on and expand your investing playbook with the most promising trends transforming today’s market landscape.

- Accelerate your search for stable, high-potential investments by analyzing market leaders with these 877 undervalued stocks based on cash flows. Uncover companies overlooked by most investors.

- Capitalize on breakthrough medicine by targeting future-focused innovators through these 33 healthcare AI stocks to keep ahead in the fast-changing healthcare field.

- Boost your income strategy with reliable payers by reviewing these 18 dividend stocks with yields > 3%, featuring stocks with strong yields positioned for lasting returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:GNW

Genworth Financial

Provides mortgage and long-term care insurance products in the United States and internationally.

Proven track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives