- United States

- /

- Insurance

- /

- NYSE:FNF

Fidelity National Financial (FNF): Examining Valuation Following Record Q3 Results, Dividend Hike, and Special F&G Distribution

Reviewed by Simply Wall St

Fidelity National Financial (FNF) is making waves, reporting a record-setting third quarter that featured sharp growth in title insurance and F&G annuities, along with a 4% quarterly dividend increase for shareholders.

The company also revealed a special distribution of roughly 12% of F&G's outstanding shares to FNF shareholders, adding a fresh layer to its value strategy and broadening access to F&G’s business.

See our latest analysis for Fidelity National Financial.

Momentum seems to be picking up for Fidelity National Financial, especially after its record third quarter and freshly announced shareholder-friendly moves. The share price has gained 1.9% year-to-date and delivered a 57% total shareholder return over three years, though its 12-month total return is slightly negative, which hints at some recent volatility. With the latest results and capital returns, investors are watching to see if this operational strength can turn recent price momentum into lasting gains.

If strategic moves like special distributions inspire you to see what else is possible, now’s an ideal moment to discover fast growing stocks with high insider ownership

With the stock now trading below analyst price targets and recent results outperforming expectations, the question is whether Fidelity National Financial remains undervalued or if the market has fully priced in the next stage of growth.

Most Popular Narrative: 18.8% Undervalued

With Fidelity National Financial closing at $57.05, the most widely followed narrative assigns a fair value of $70.25, suggesting substantial upside from here.

Ongoing digital investment including enhanced security, technology, and recruitment in tech-focused roles is expected to streamline transaction processes and drive operational efficiencies. This may result in lower long-term costs and eventual net margin expansion once these up-front expenses normalize.

Want to know what transformation powers this bullish price target? One core assumption changes the outlook for earnings and margins, projecting Fidelity as a future leader in efficiency. Wondering how aggressive these digital-driven numbers get? Click through to find out what’s fueling this fair value forecast.

Result: Fair Value of $70.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent market volatility or prolonged real estate slowdowns could challenge Fidelity's core growth narrative and put recent optimism to the test.

Find out about the key risks to this Fidelity National Financial narrative.

Another View: Testing the Multiples

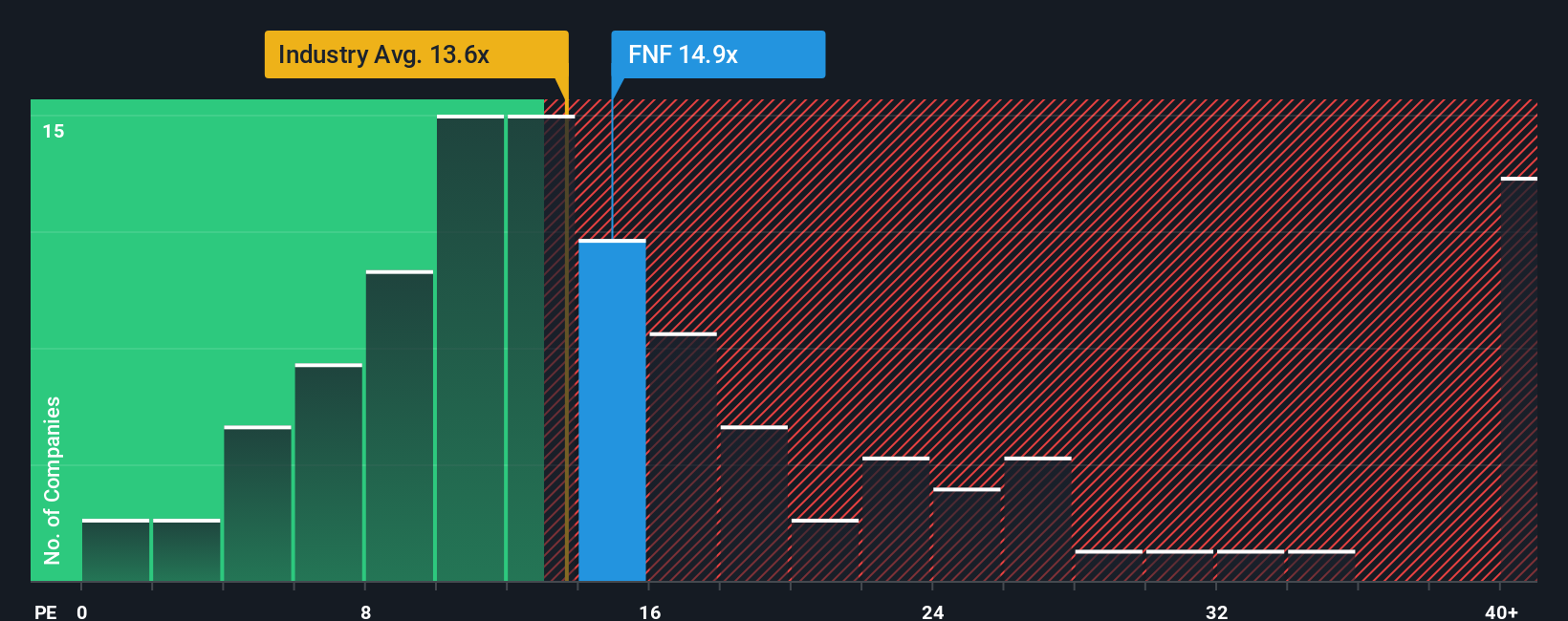

While analyst consensus highlights upside based on expected earnings, comparing Fidelity National Financial’s price-to-earnings ratio of 13.2x reveals a different story. This matches the industry average but is below the peer average of 15.9x, and still sits well under the market’s fair ratio of 19.9x. On paper, this gap hints at opportunity, yet also means the rerating relies on future earnings holding up. Will the market recognize Fidelity’s value as its story unfolds?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fidelity National Financial Narrative

If you see things differently or want to dig into the details for yourself, you can put together your own take in just minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Fidelity National Financial.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Give your portfolio an edge by tapping into unique lists of stocks curated through powerful research tools on Simply Wall Street.

- Tap into rapid market shifts and seize opportunities in artificial intelligence by checking out these 25 AI penny stocks, which are changing the way industries operate.

- Cement reliable income for your future with these 16 dividend stocks with yields > 3%, which offers attractive yields above 3% for steady returns.

- Position yourself for potential outsized growth with these 3588 penny stocks with strong financials, combining strong fundamentals with compelling upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FNF

Fidelity National Financial

Provides various insurance products in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives