- United States

- /

- Insurance

- /

- NYSE:FG

Assessing F&G Annuities & Life's Valuation Following Dividend Hike and Return to Profitability

Reviewed by Simply Wall St

F&G Annuities & Life (FG) announced a significant 14% increase to its quarterly cash dividend, along with a return to quarterly profitability and higher revenue. These developments are likely to catch investors' attention this quarter.

See our latest analysis for F&G Annuities & Life.

The combination of higher quarterly profits and a generous dividend hike has lifted sentiment around F&G Annuities & Life. The shares notched a robust 11.3% gain over the past week and a 15.1% share price return for the month. Still, momentum has been needed, as the stock’s year-to-date share price return remains down 19%, and total shareholder return over the past year is negative 25.6%, reflecting longer-term challenges even amid this recent rebound.

If you’re open to finding other stocks with accelerating performance or strong recent events, now’s a perfect moment to discover fast growing stocks with high insider ownership

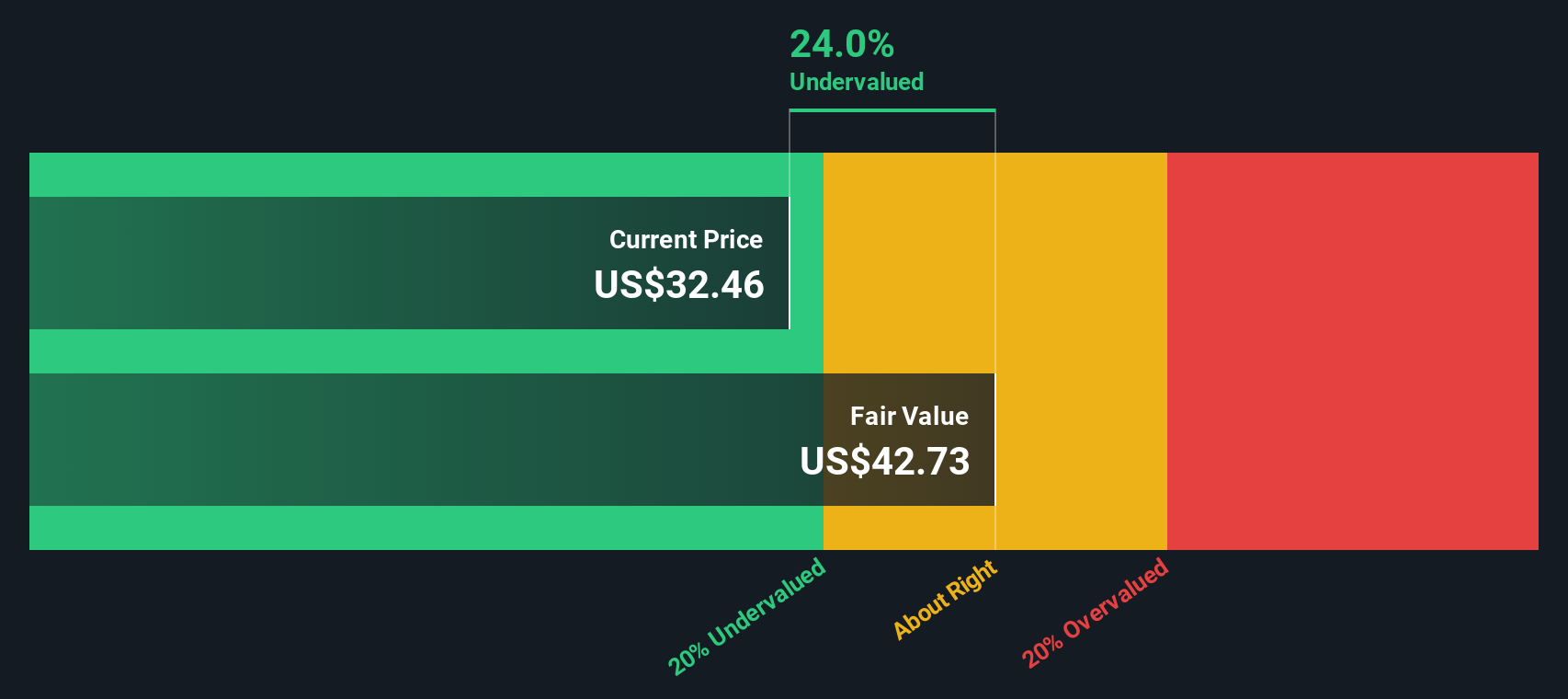

With the stock still trading below its estimated intrinsic value and rebounding after recent declines, investors may wonder whether F&G Annuities & Life offers a real buying opportunity or if the market is already factoring in future gains.

Price-to-Earnings of 10x: Is it justified?

F&G Annuities & Life is trading at a price-to-earnings (P/E) ratio of 10x, notably cheaper than both its industry and peers. At the last close of $33.28, this valuation points to compelling potential value versus the wider insurance market and may attract investors looking for underappreciated earnings power.

The price-to-earnings multiple is a vital measure for insurance businesses, as it reflects how much investors are willing to pay for each dollar of earnings. It benchmarks expectations of future profit growth, risk, and business model strength within the sector.

This 10x P/E marks a strong discount to both the US Insurance industry average of 13.2x and the peer average of 10.7x. The market appears to be assigning a conservative outlook for F&G Annuities & Life’s future profitability, despite recent improvements in net margins and growth. If sentiment shifts or performance continues trending upward, there could be mean reversion closer to those higher industry multiples.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 10x (UNDERVALUED)

However, the stock's negative year-to-date and one-year returns suggest that persistent investor doubts could weigh on sustained momentum, even though recent earnings trends have been positive.

Find out about the key risks to this F&G Annuities & Life narrative.

Another View: SWS DCF Model Offers More Upside

Looking at F&G Annuities & Life through the SWS DCF model offers a brighter story. The stock is trading at $33.28, which is 22.1% below our fair value estimate of $42.73. Could this deeper discount point toward overlooked upside for patient investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out F&G Annuities & Life for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own F&G Annuities & Life Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can easily craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding F&G Annuities & Life.

Ready for More Ideas You’ll Want on Your Radar?

Don’t leave smart investing to chance. See what you could be missing by checking out these powerful opportunities reshaping markets right now. Your next winner may be just a click away.

- Tap into income potential and secure your future by browsing these 14 dividend stocks with yields > 3%, offering yields higher than traditional savings accounts.

- Accelerate your portfolio with these 27 AI penny stocks, which are setting new standards in artificial intelligence innovation and market disruption.

- Capitalize on untapped value when you scan these 881 undervalued stocks based on cash flows, priced below what their cash flows truly justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FG

F&G Annuities & Life

Provides annuity and life insurance products in the United States.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives