- United States

- /

- Insurance

- /

- NYSE:CNO

Take Care Before Diving Into The Deep End On CNO Financial Group, Inc. (NYSE:CNO)

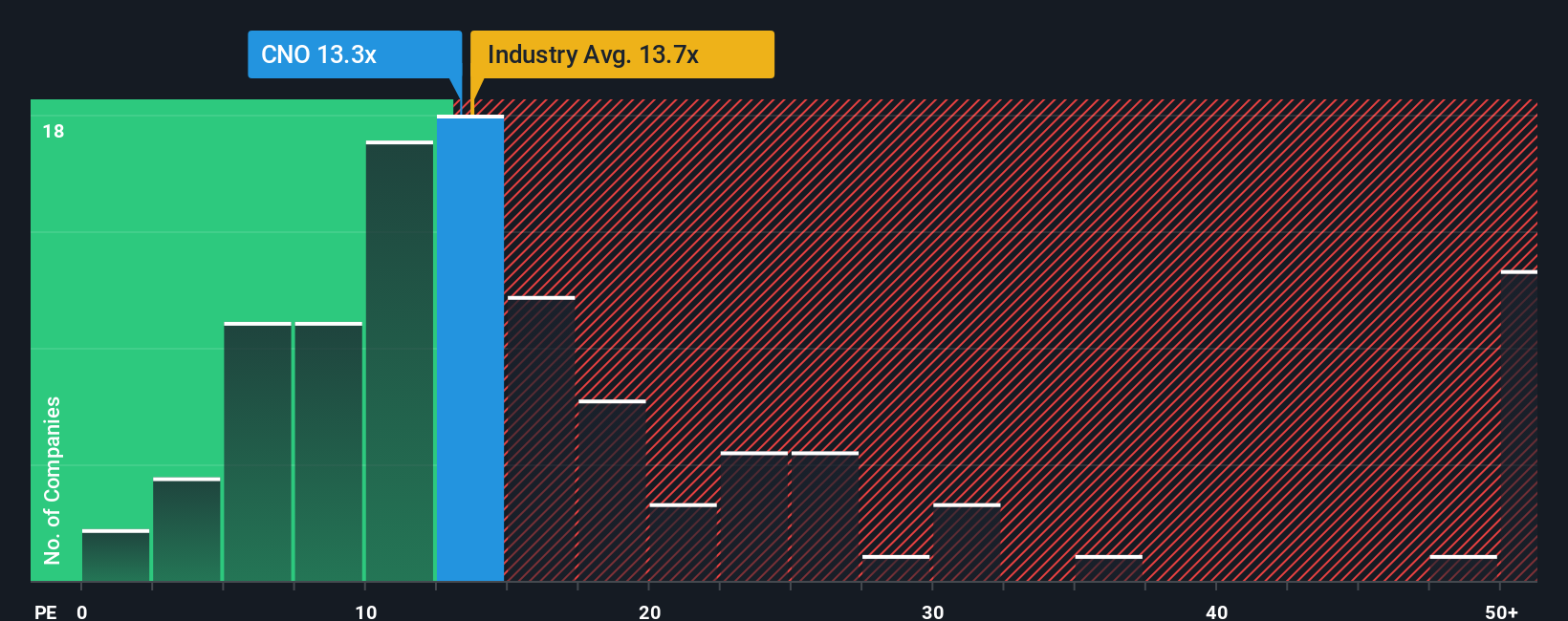

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may consider CNO Financial Group, Inc. (NYSE:CNO) as an attractive investment with its 13.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

CNO Financial Group hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for CNO Financial Group

How Is CNO Financial Group's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like CNO Financial Group's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 28% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 43% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings should grow by 20% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 11% each year, which is noticeably less attractive.

In light of this, it's peculiar that CNO Financial Group's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of CNO Financial Group's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You need to take note of risks, for example - CNO Financial Group has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If you're unsure about the strength of CNO Financial Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CNO

CNO Financial Group

Through its subsidiaries, develops, markets, and administers health insurance, annuity, individual life insurance, insurance products, and financial services for middle-income pre-retiree and retired Americans in the United States.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives