- United States

- /

- Insurance

- /

- NYSE:CB

Will Chubb's (CB) AI Investment Sharpen Its Edge in Digital Insurance and Stakeholder Engagement?

Reviewed by Sasha Jovanovic

- Earlier this month, Chubb introduced an AI-powered optimization engine in its Chubb Studio platform at the Singapore Fintech Festival, announced executive appointments including Bill Hazelton as COO for North America Field Operations and Susan Spivak as Senior Vice President of Investor Relations, and declared a quarterly dividend of US$0.97 per share payable on January 2, 2026.

- The launch of Chubb Studio's AI optimization engine signals a move toward greater personalization and digital integration in embedded insurance, while the leadership changes reflect an emphasis on operational expertise and stakeholder engagement across the company’s North American operations and investor relations functions.

- Next, we’ll explore how Chubb’s AI technology launch could shape its already robust investment outlook and digital expansion strategy.

Find companies with promising cash flow potential yet trading below their fair value.

Chubb Investment Narrative Recap

To be a Chubb shareholder today, you need confidence in its ability to balance international expansion, strong underwriting, and digital transformation, especially with the insurance sector facing pressures from rising claims costs and softening property pricing. The latest dividend declaration and executive appointments provide stability cues, but don’t materially alter the main catalysts, digital channel growth and premium expansion, or change the biggest risk right now: persistent loss cost inflation outpacing nationwide trends.

Chubb’s new AI-powered optimization engine in Chubb Studio stands out as particularly relevant, offering digital distribution partners real-time data insights and tailored insurance options at the point of sale. This digital innovation is closely tied to growth catalysts like expanding revenue in Asia and Latin America and improving underwriting through technology, key factors for investors evaluating how Chubb can offset margin pressure in a competitive market.

Yet, in contrast to this digital momentum, investors should also be aware of the ongoing impact of claims inflation and...

Read the full narrative on Chubb (it's free!)

Chubb's outlook forecasts $49.6 billion in revenue and $9.8 billion in earnings by 2028. This is based on an expected annual revenue decline of 4.8% and a $0.6 billion increase in earnings from the current $9.2 billion.

Uncover how Chubb's forecasts yield a $307.73 fair value, a 3% upside to its current price.

Exploring Other Perspectives

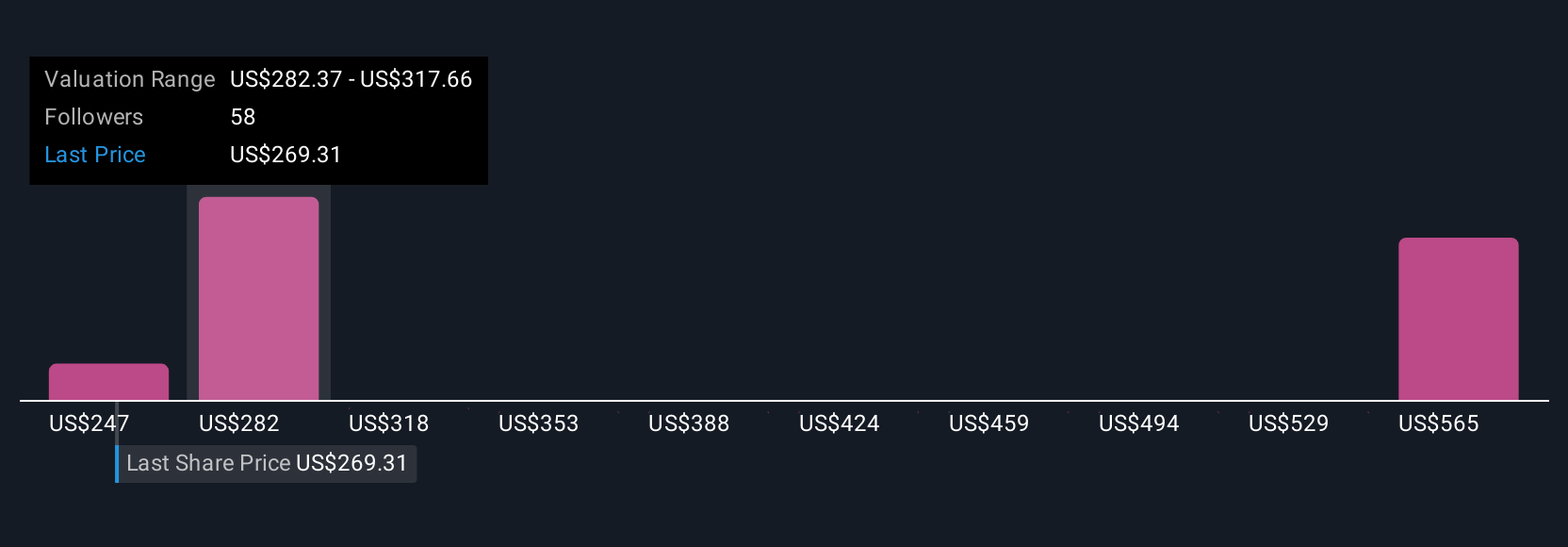

Eight Simply Wall St Community members have fair value estimates for Chubb that range from US$247.08 to US$643.51 per share. While some anticipate continued margin pressure from high claims inflation, others see digital expansion as a potential offset, explore the full spectrum of opinions to inform your own view.

Explore 8 other fair value estimates on Chubb - why the stock might be worth 17% less than the current price!

Build Your Own Chubb Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chubb research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chubb research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chubb's overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CB

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives