- United States

- /

- Insurance

- /

- NYSE:BRO

Will BRO’s Leadership Shuffle Strengthen Its Retail Growth Strategy or Signal Deeper Integration Challenges?

Reviewed by Sasha Jovanovic

- Brown & Brown, Inc. recently appointed Steve Hearn as president of its Retail segment, while he continues as chief operating officer, following previous executive changes after the August acquisition of Accession Risk Management.

- This move aims to support ongoing growth, ensure business continuity, and focus on advancing Brown & Brown’s global Retail operations amid integration efforts.

- We'll examine how Steve Hearn's expanded leadership for the Retail segment could influence Brown & Brown's investment narrative and growth outlook.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Brown & Brown Investment Narrative Recap

To be a Brown & Brown shareholder, you need to believe in the company's ability to drive long-term revenue growth through acquisitions and platform expansion, even as near-term headwinds from insurance pricing shifts and legal changes persist. Steve Hearn’s expanded leadership of the Retail segment is intended to maintain momentum through the integration of recent acquisitions, supporting business continuity and scale. This leadership update is a positive signal, but it does not appear to materially affect the short-term catalyst, revenue growth from acquisitions, nor does it diminish the biggest risk, which remains external pressures on insurance margins, especially in CAT property lines.

Among the latest announcements, the $4.2 billion in senior note financing stands out for its relevance to ongoing integration and expansion efforts. This capital raise provides Brown & Brown with funding flexibility at a time when the company is steering through both structural and operational changes, reinforcing its position to pursue further acquisitions and support global growth as Hearn steps into his dual leadership roles.

In contrast, potential margin compression from declining CAT property rates remains a factor investors should closely watch for...

Read the full narrative on Brown & Brown (it's free!)

Brown & Brown's narrative projects $9.0 billion revenue and $1.6 billion earnings by 2028. This requires 21.9% yearly revenue growth and a $606 million earnings increase from $994.0 million.

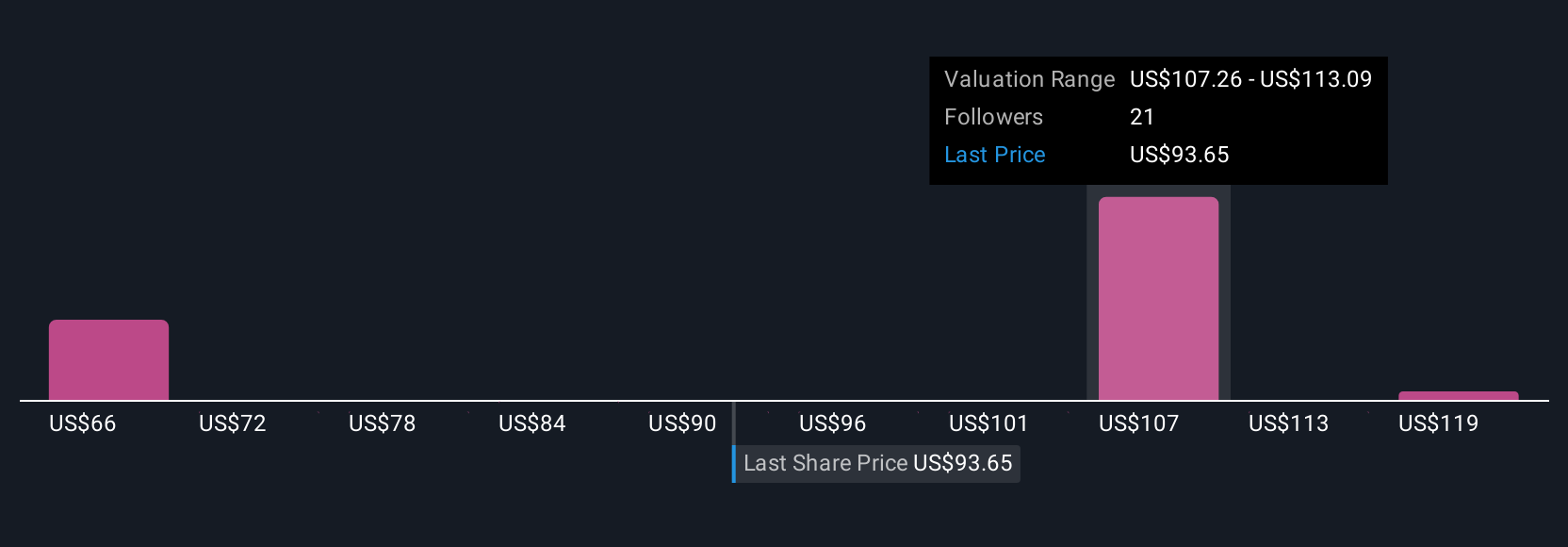

Uncover how Brown & Brown's forecasts yield a $108.33 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community for Brown & Brown span US$58 to US$124 per share, capturing broad divergence in outlook. With acquisition-driven revenue as a key catalyst, opinions among market participants are far from aligned, underscoring the complexity in assessing future performance.

Explore 6 other fair value estimates on Brown & Brown - why the stock might be worth as much as 43% more than the current price!

Build Your Own Brown & Brown Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brown & Brown research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Brown & Brown research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brown & Brown's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown & Brown might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRO

Brown & Brown

Brown & Brown, Inc. markets and sells insurance products and services in the United States, Canada, Ireland, the United Kingdom, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives