- United States

- /

- Insurance

- /

- NYSE:BRO

A Fresh Look at Brown & Brown (BRO): Is the Market Overlooking Its True Value?

Reviewed by Simply Wall St

Brown & Brown (BRO) is showing interesting movement worth a closer look. While there is no single news event driving recent activity, the company's long-term performance has some investors reassessing its valuation and place in their portfolios.

See our latest analysis for Brown & Brown.

Brown & Brown’s share price has seen some pressure lately, with a recent 30-day return of -8.51% and year-to-date return of -19.92%. However, looking at the bigger picture, its total shareholder return over five years stands strong at 82.56%. This suggests long-term value remains robust despite short-term volatility and shifting market sentiment.

If this kind of price action has you exploring new ideas, consider broadening your search and discover fast growing stocks with high insider ownership.

With shares off their highs while the company continues to deliver consistent profit and revenue growth, investors are left to consider if Brown & Brown is now trading at a discount or if the market already reflects its future prospects.

Most Popular Narrative: 13.9% Undervalued

With Brown & Brown’s current share price of $80.51 sitting well below the narrative’s fair value estimate of $93.50, there is a clear disconnect between market sentiment and what analysts believe the company could be worth.

"Brown & Brown's strategic focus on acquisitions, having completed 13 acquisitions with projected annual revenues of $36 million, could significantly enhance future revenue streams and market presence. This aligns with their goal of sustained revenue growth through expansion."

Want to see what aggressive dealmaking and fresh revenue unlock for Brown & Brown’s next chapter? There is a bold growth plan and provocative profit targets that might shake up expectations. The financial groundwork supporting this fair value could surprise you. Dig deeper; only the full narrative tells how it all adds up.

Result: Fair Value of $93.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering economic and legislative uncertainties could put pressure on Brown & Brown’s earnings trajectory. This may potentially challenge the optimistic outlook analysts have outlined.

Find out about the key risks to this Brown & Brown narrative.

Another View: What Do Valuation Ratios Show?

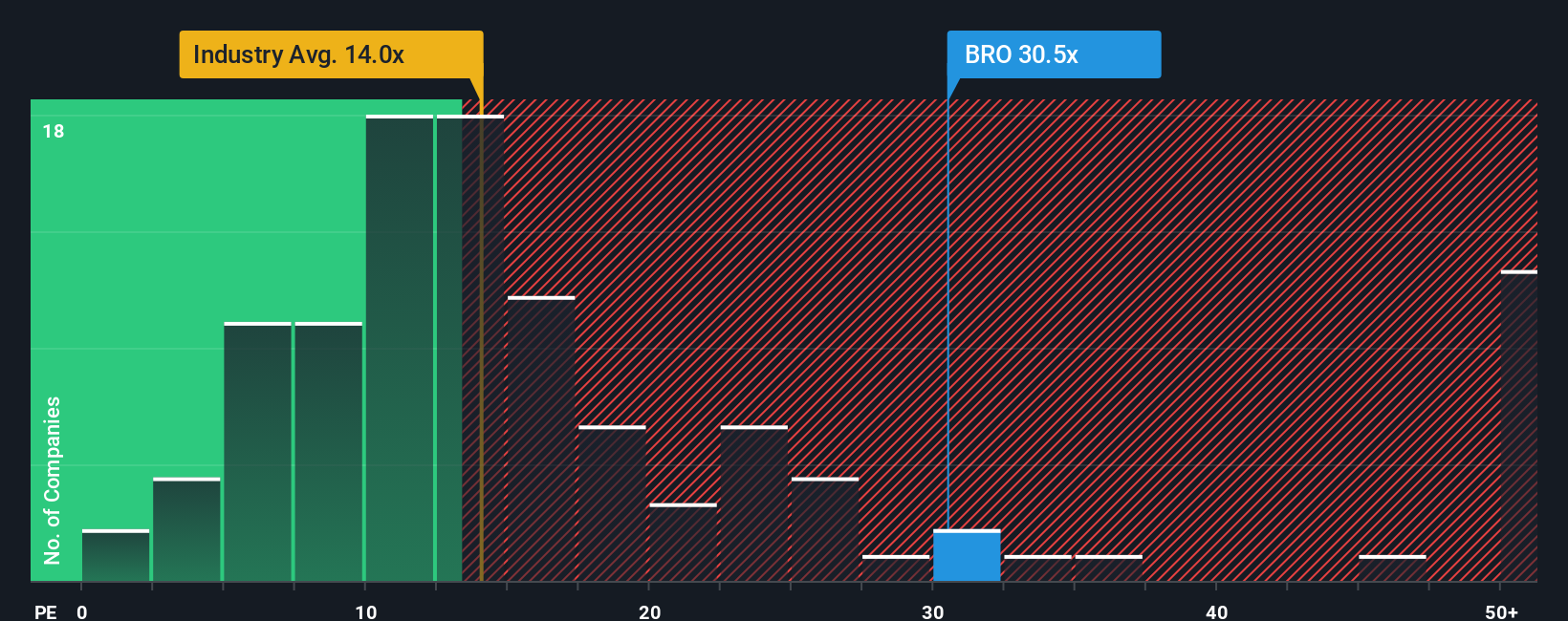

While the fair value model sees Brown & Brown as undervalued, looking at valuation ratios tells a different story. The company's price-to-earnings ratio stands at 27.8x, which is much higher than the US Insurance industry average of 13.2x and above its own fair ratio of 17.8x. This suggests investors may be paying a premium, raising questions about how much future growth is already priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Brown & Brown Narrative

If you see things differently or want to interpret the numbers for yourself, take a few minutes to build your own perspective. Do it your way

A great starting point for your Brown & Brown research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your investing edge by checking out stocks with unique potential beyond Brown & Brown. These screeners can help you spot the next opportunity before the crowd does.

- Uncover high-yield opportunities and shore up your income by checking the best performers among these 14 dividend stocks with yields > 3% with consistently strong yields.

- Tap into rapid growth and innovation by targeting businesses at the forefront of artificial intelligence, all highlighted in these 26 AI penny stocks.

- Seize undervalued gems that the market may be underestimating and get ahead of the curve with these 933 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brown & Brown might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BRO

Brown & Brown

Brown & Brown, Inc. markets and sells insurance products and services in the United States, Canada, Ireland, the United Kingdom, and internationally.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.