- United States

- /

- Insurance

- /

- NYSE:BNT

Brookfield Wealth Solutions (BNT) Reports Q2 Revenue Growth to US$3,037 Million

Reviewed by Simply Wall St

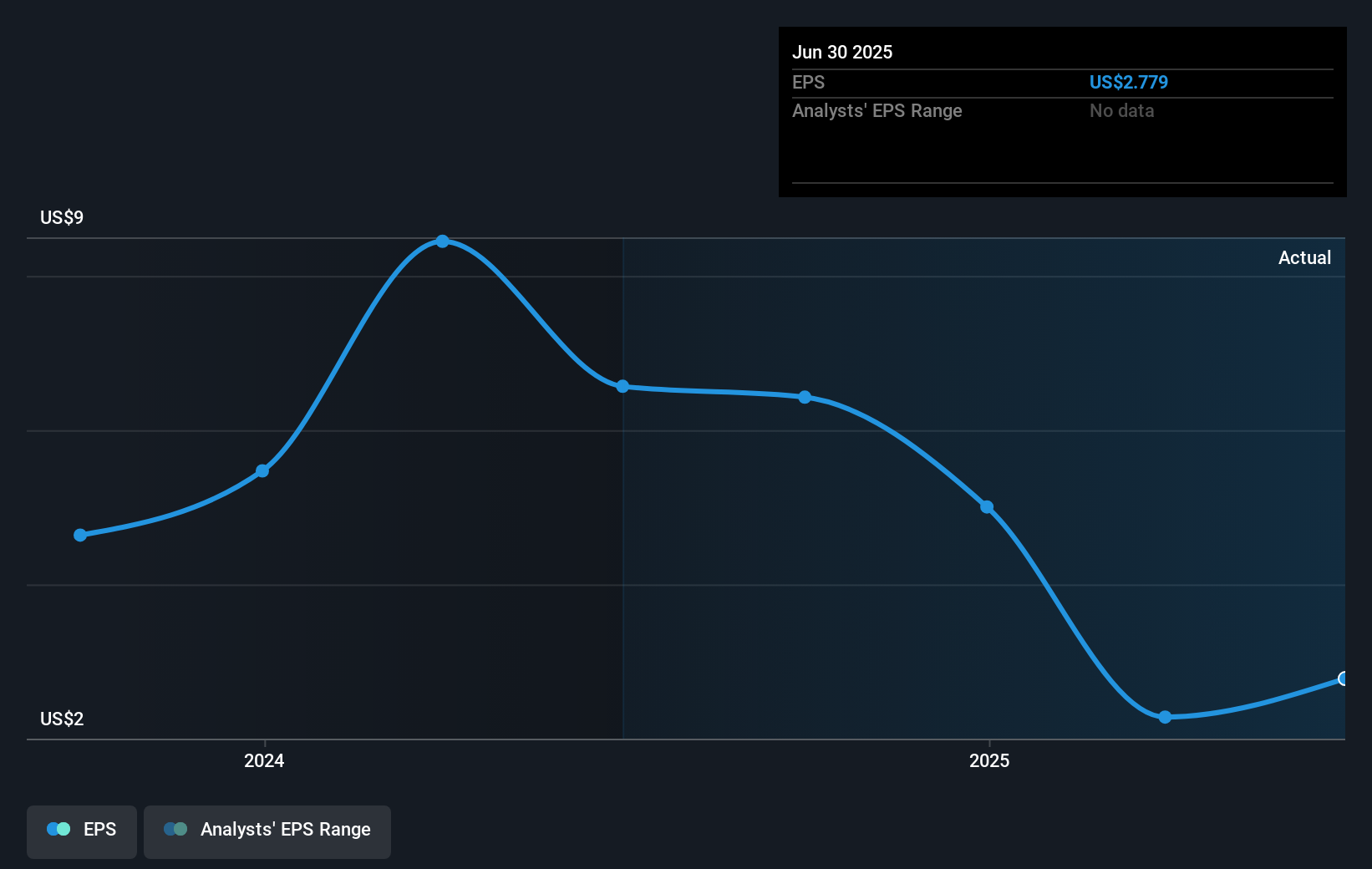

Brookfield Wealth Solutions (BNT) reported an impressive 14% increase in share price during the last quarter. This positive movement aligns with the company's strong second-quarter earnings, marked by revenue growth and a substantial rise in net income compared to the previous year. Despite concerns around a decline in first-half net income, Brookfield’s strategic communication during its annual meeting may have bolstered investor confidence. Meanwhile, market trends showed a solid rebound, with major indices posting significant weekly gains. Brookfield's performance seems to align with the broader market rally, potentially benefiting from improved economic stability and eased tariff-related concerns.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Brookfield Wealth Solutions has delivered a total return of 51.93% over the past three years, highlighting strong long-term performance. This contrasts with a lower, though still respectable, increase in one-year stock value, which outperformed both the US market and industry benchmarks. The company's robust performance is underpinned by increased quarterly revenues and net income, reflecting effective management actions and operational adjustments.

The recent 14% share price increase aligns with broader market movements and may be bolstered by improved investor sentiment following positive earnings reports. While recent strategic communications have enhanced investor confidence, it's worth noting that the current share price of $64.85 surpasses the calculated fair value of $49.43, indicating a potential overvaluation. The company's entry into the UK insurance market presents new revenue opportunities, although fluctuations in future earnings and revenues remain uncertain given current data limitations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Brookfield Wealth Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BNT

Brookfield Wealth Solutions

Through its subsidiaries, provides retirement services, wealth protection products, and capital solutions to individuals and institutions.

Excellent balance sheet and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion