- United States

- /

- Insurance

- /

- NYSE:BNT

A Look at Brookfield Wealth Solutions (NYSE:BNT) Valuation Following Its Debut in Japan’s Reinsurance Market

Reviewed by Kshitija Bhandaru

Brookfield Wealth Solutions (NYSE:BNT) has entered the Japanese reinsurance market for the first time, announcing a new agreement with Dai-ichi Frontier Life. The deal could help the company diversify and expand in Asia.

See our latest analysis for Brookfield Wealth Solutions.

Brookfield Wealth Solutions has been building momentum, with its latest push into Japan following steady progress throughout the year. The stock’s long-term total shareholder return has outpaced its share price performance, which suggests that investors are starting to recognize its growth potential rather than focusing only on short-term price swings.

If you’re exploring what other dynamic companies are catching the market’s eye, now is an opportune moment to discover fast growing stocks with high insider ownership

With Brookfield Wealth Solutions’ shares rallying nearly 20 percent this year and total returns far outpacing the market, investors are left to ask whether further upside is ahead or if future growth has already been accounted for.

Price-to-Earnings of 24.7x: Is it justified?

Brookfield Wealth Solutions is trading at a price-to-earnings ratio of 24.7x, which places its shares well above those of comparable companies in the insurance sector.

The price-to-earnings (P/E) ratio compares the company’s share price to its earnings per share, helping investors gauge how much they are paying for each dollar of profit. For the insurance industry, this ratio typically reflects expectations of stable growth and risk-adjusted returns.

At 24.7x, Brookfield Wealth Solutions’ P/E far exceeds the US Insurance industry average of 14.2x. This premium implies that the market prices in either aggressive earnings growth, a perceived competitive edge, or possibly both. While past performance points to strong average annual profit increases over five years, it is worth noting that the company experienced a sharp earnings decline of 30 percent over the last year alone.

This is a substantial divergence from peers and may be challenging to maintain if the underlying fundamentals do not catch up. Investors should be aware that although Brookfield Wealth Solutions has delivered above-industry total returns, its premium multiple leaves little room for disappointment in future earnings delivery.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 24.7x (OVERVALUED)

However, any unexpected downturn in profits or failure to deliver on growth expectations could quickly shift sentiment and put pressure on Brookfield Wealth Solutions’ elevated valuation.

Find out about the key risks to this Brookfield Wealth Solutions narrative.

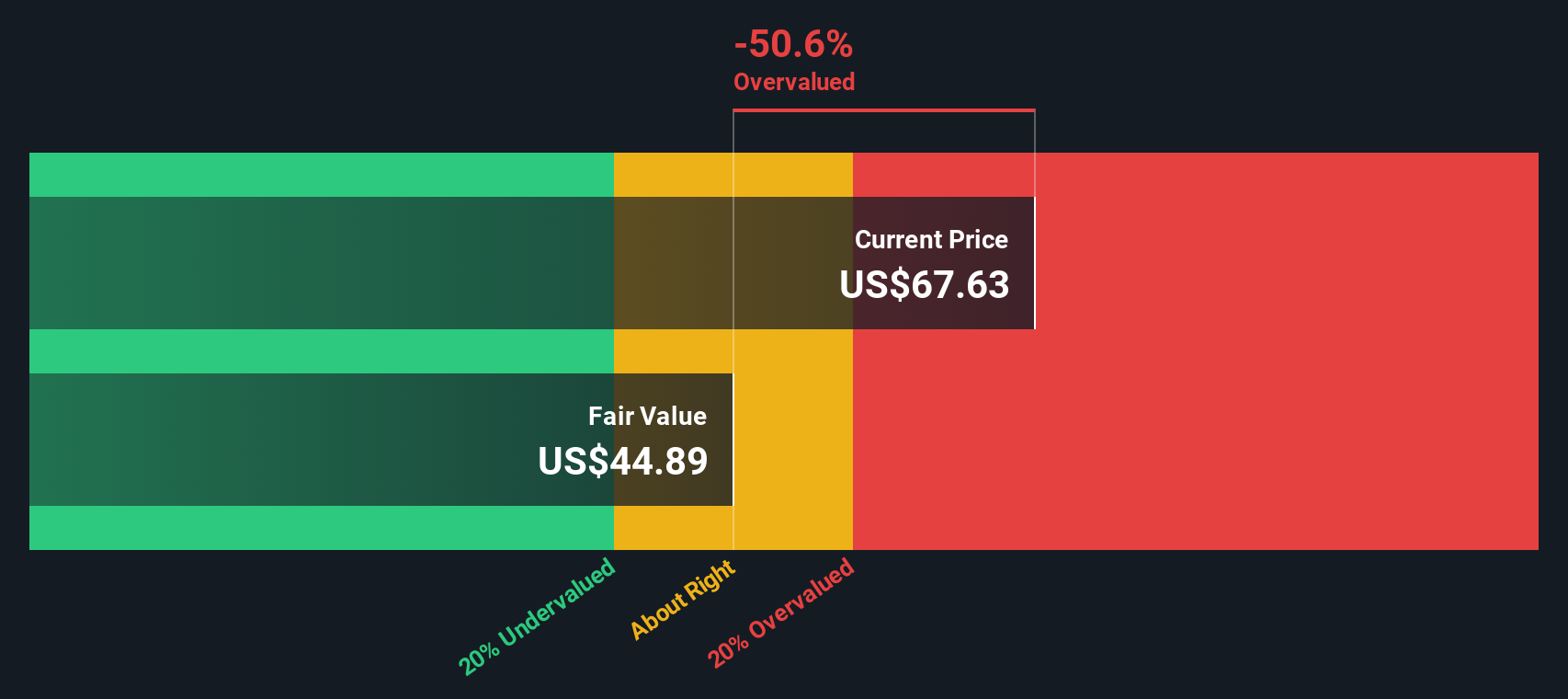

Another View: Discounted Cash Flow Model

While Brookfield Wealth Solutions commands a premium based on its price-to-earnings ratio, our SWS DCF model offers a more sobering view. According to this method, the company’s shares are trading above their estimated fair value, which suggests they may actually be overvalued when factoring in projected future cash flows. Could the current optimism be running ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Wealth Solutions for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Wealth Solutions Narrative

If you want to dig deeper into the numbers and share your perspective, it only takes a few minutes to craft your own view. Do it your way

A great starting point for your Brookfield Wealth Solutions research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Ready for More Investment Ideas?

The market always has more to offer. Don't miss your moment to get ahead and uncover companies with untapped potential using the Simply Wall Street Screener.

- Unlock steady returns and financial peace of mind with these 19 dividend stocks with yields > 3%, which offers strong yields above 3 percent.

- Ride the wave of technological innovation by targeting these 24 AI penny stocks, positioned to transform industries with real, AI-driven breakthroughs.

- Grow your wealth by seizing rare opportunities among these 893 undervalued stocks based on cash flows the market might be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Wealth Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BNT

Brookfield Wealth Solutions

Through its subsidiaries, provides retirement services, wealth protection products, and capital solutions to individuals and institutions.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives