- United States

- /

- Insurance

- /

- NYSE:AON

What Does the NFP Wealth Business Sale Mean for Aon's Share Price in 2025?

Reviewed by Bailey Pemberton

If you are holding Aon stock, or even just watching from the sidelines, you have every reason to feel intrigued right now. The company’s share price has shown a mixed bag of performance lately, dipping 1.0% over the last week and sliding 0.6% in the past month. However, taking a longer view presents a much rosier picture, with a 1.5% gain year-to-date, 36.2% growth over three years, and 76.0% across five years. That blend of near-term bumps and long-term strength keeps the debate going on whether Aon is a buy, hold, or sell.

There is no shortage of headlines swirling around the stock. The latest news is that Aon is reported to be close to selling its NFP wealth business for $3 billion, a move that suggests leadership is targeting a leaner, more focused business model. Meanwhile, a lawsuit over its role in credit insurance deals has added a layer of risk, clearly affecting how some investors feel about the near term. Each of these developments has the potential to influence price swings, as seen in recent weeks.

Beyond the news cycle, what matters most is whether the stock is undervalued or overvalued at its current price. On a typical valuation checklist, Aon scores 3 out of 6 for undervaluation. This indicates some opportunity but also room for skepticism. Next, I will walk you through the various ways analysts and investors judge a company’s true worth, and share one approach that could provide an even clearer answer.

Approach 1: Aon Excess Returns Analysis

The Excess Returns model is designed to measure how much value a company like Aon can create beyond the expected return for its shareholders. Instead of relying solely on future cash flows, this method looks at the company’s return on invested capital, the cost of equity, and projections for growth in book value. Essentially, it asks whether Aon’s investments generate returns significantly above what investors could expect from similar risks elsewhere.

Based on recent data, Aon boasts an average return on equity of an extraordinary 1633.33%. Its book value per share stands at $36.36, while the stable book value projected by analysts is $44.74 per share. Aon’s stable earnings per share reach $730.72, with a modest cost of equity at $3.21. This means Aon's excess return is a remarkable $727.51 per share, using the median return on equity averaged over the last five years. These strong excess returns point to highly efficient capital allocation and sustainable profitability as measured by industry norms.

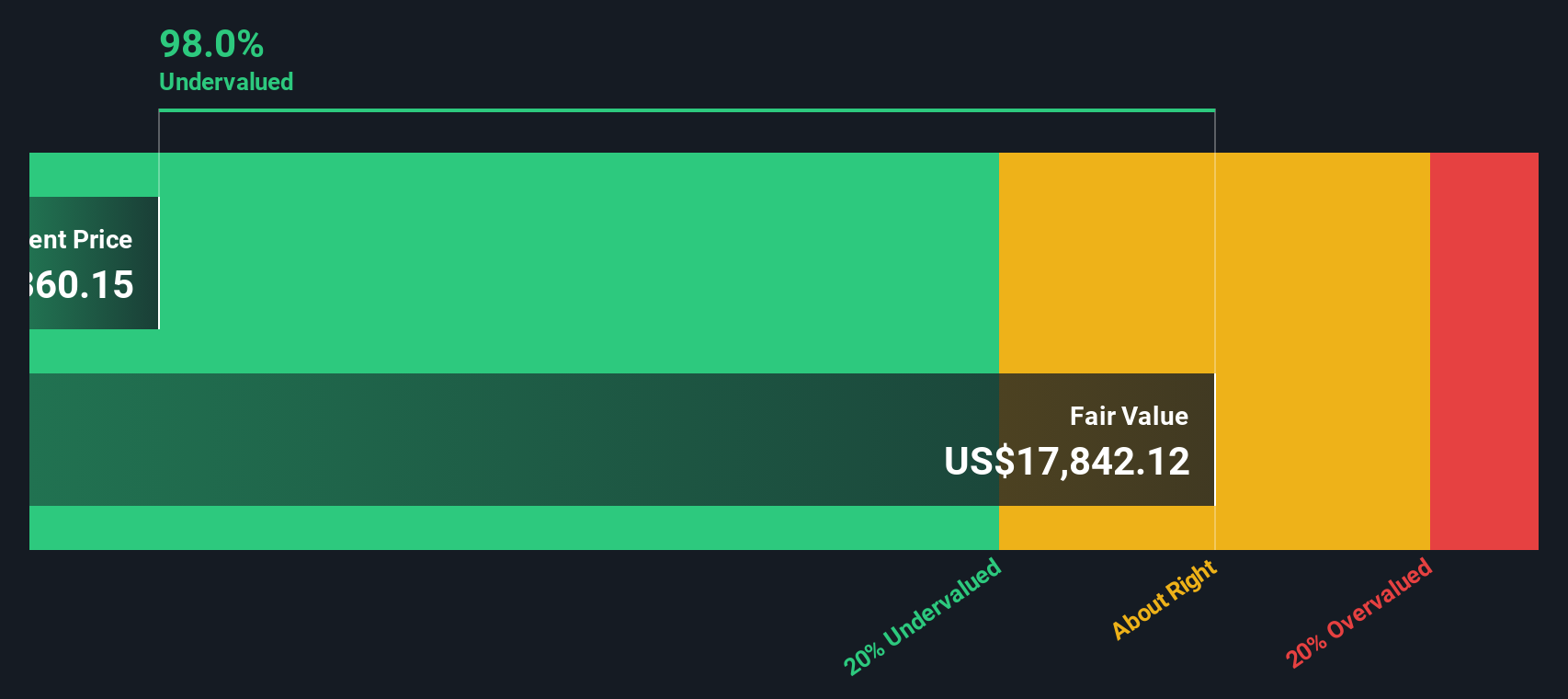

According to this analysis, Aon's intrinsic value appears significantly above its current share price, with the Excess Returns model indicating that the stock is 98.0% undervalued at present.

Result: UNDERVALUED

Our Excess Returns analysis suggests Aon is undervalued by 98.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Aon Price vs Earnings

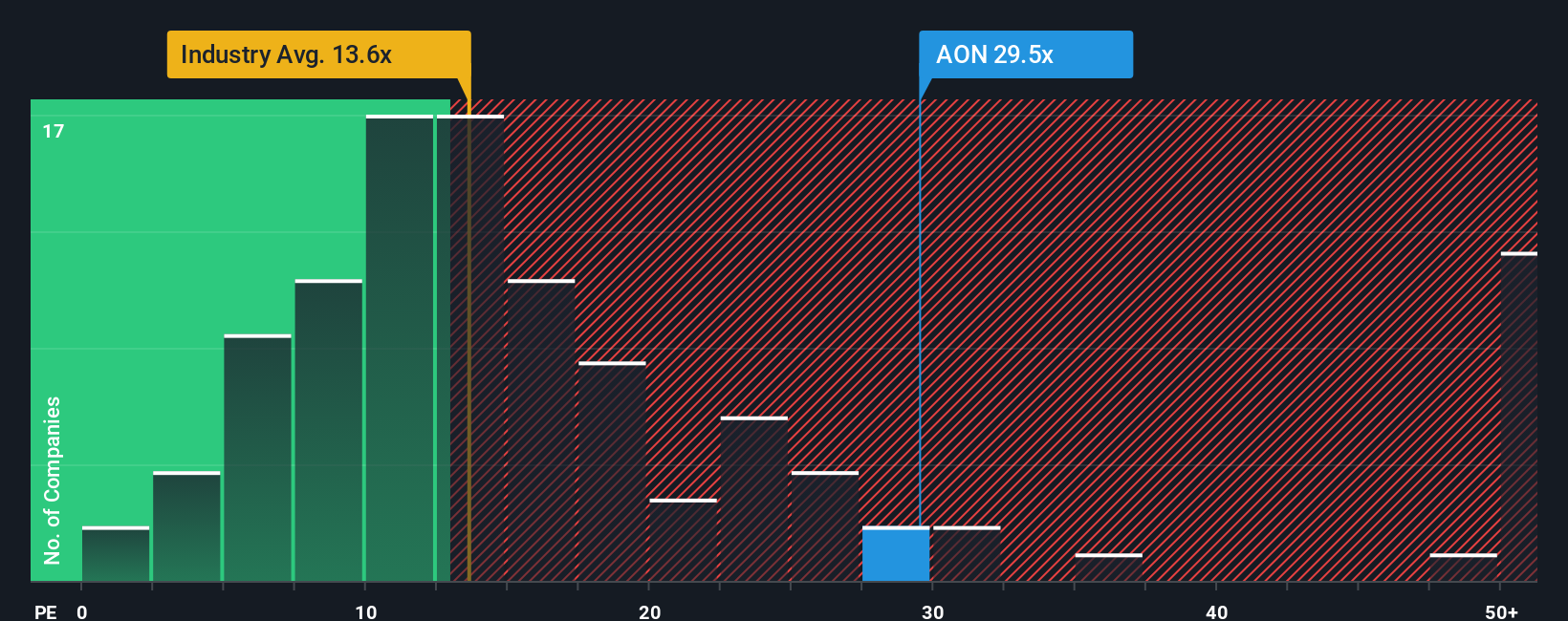

The price-to-earnings (PE) ratio is a widely used valuation tool for profitable companies like Aon because it directly relates the market price of the stock to its earnings per share. This makes it easy for investors to see how much they are paying for each dollar of profit, compared to both competitors and the broader industry.

What counts as a "normal" or "fair" PE ratio depends on several factors. Companies with higher expected growth rates or lower risks tend to trade at higher PE multiples, while those with lower growth or higher uncertainties see lower ratios. Understanding these benchmarks helps put Aon's valuation into context.

Currently, Aon's PE ratio stands at 29.83x, which is well above the Insurance industry average of 13.82x and also higher than the peer average of 56.48x. However, to avoid the pitfalls of simple comparisons, we look to Simply Wall St’s proprietary “Fair Ratio.” This ratio, calculated at 17.59x for Aon, goes deeper by factoring in key drivers such as expected earnings growth, profit margins, industry backdrop, company size, and risk profile. This means it gives a more tailored and realistic view of value than just comparing to broad industry or peer numbers.

When comparing the Fair Ratio of 17.59x with Aon's actual PE of 29.83x, the stock appears to be trading above what would typically be justified by its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Aon Narrative

Earlier, we mentioned there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your story about a company like Aon; it is how you connect its recent performance, current outlook, and future potential to your own assumptions about fair value and what drives the business.

With Narratives, you can blend your perspective on Aon’s management, industry moves, and risks directly into a financial forecast that leads to a personalized estimate of fair value. This approach goes beyond static ratios and headlines, letting you update your views instantly as new earnings reports, news, or investor insights come in.

Simply Wall St’s Community page makes building or exploring Narratives easy. Millions of investors already use this feature to clarify what matters and to keep pace as the facts change. By matching your own Narrative’s fair value to the current share price, you get a clear decision point for when to buy or sell, anchored in your research rather than market noise.

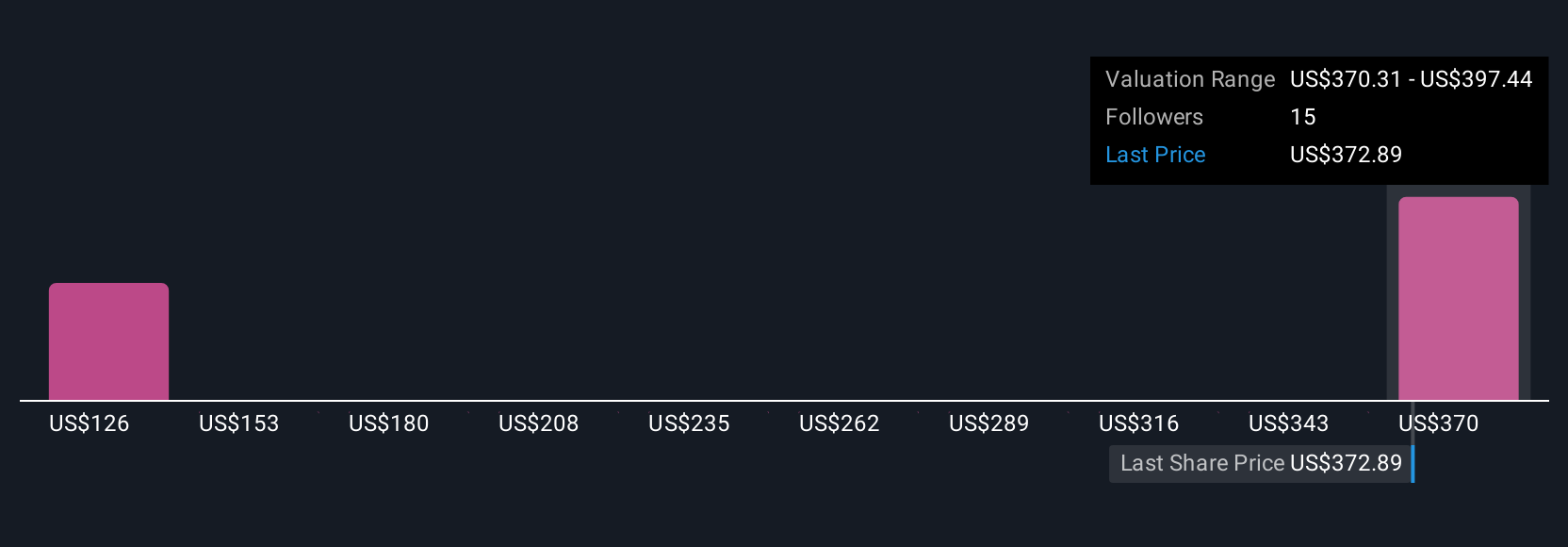

For example, one investor’s Narrative might value Aon as high as $451 per share due to their belief in sustained margin expansion and operational efficiency. A more cautious investor, concerned about macro risks and industry headwinds, might set fair value closer to $349. This illustrates how diverse perspectives can lead to different conclusions with the same facts.

Do you think there's more to the story for Aon? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026