- United States

- /

- Insurance

- /

- NYSE:AON

Should Rising US Storm Losses Shift the Risk Analytics Narrative for Aon (AON) Investors?

Reviewed by Sasha Jovanovic

- Aon has recently reported that a series of severe storms across the US in mid-October are expected to result in hundreds of millions of US dollars in insured losses, which could increase catastrophe loss ratios for both primary carriers and reinsurers ahead of the critical January 1 renewal period.

- This ongoing catastrophe activity highlights Aon's central role in providing insurers and reinsurers with critical insights and analytics on insured loss trends, as well as the narrowing global protection gap due to rising insurance coverage in key markets.

- We'll examine how Aon's catastrophe risk advisory and analytics capability shapes its investment narrative as insurers face higher storm-related losses.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Aon Investment Narrative Recap

To own Aon, you need to believe in its ability to drive resilient growth through advanced analytics and risk advisory services, even as macroeconomic uncertainty and intense storm activity test insurers. The recent US storms underscore short-term challenges to catastrophe loss ratios, but do not materially change Aon’s most important near-term catalyst: continued revenue contributions and margin support from the NFP acquisition. The main risk remains pressure on client spending amid economic or geopolitical instability.

Among recent announcements, the October dividend declaration of US$0.745 per share is particularly relevant, reaffirming Aon’s commitment to shareholder returns and financial consistency, even as catastrophe risk events could impact industry margins. Dividend stability may help cushion sentiment during periods of heightened loss activity, supporting Aon’s broader capital allocation strategy.

Yet, in contrast to the steady dividend, investors should be aware of how client discretionary spend, especially in uncertain markets, could quickly shift and ...

Read the full narrative on Aon (it's free!)

Aon's outlook anticipates $19.7 billion in revenue and $3.8 billion in earnings by 2028. This scenario is based on a projected 5.6% annual revenue growth and a $1.2 billion increase in earnings from the current $2.6 billion level.

Uncover how Aon's forecasts yield a $414.20 fair value, a 21% upside to its current price.

Exploring Other Perspectives

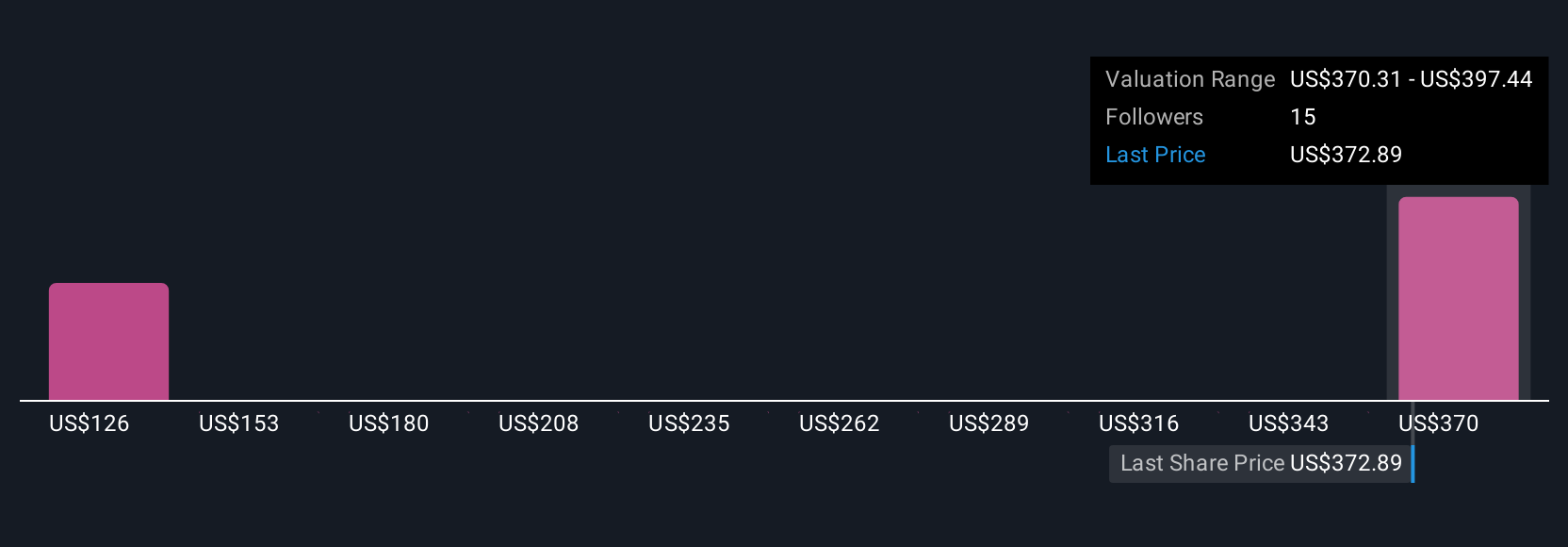

Five members of the Simply Wall St Community estimate Aon’s fair value between US$347 and US$17,773 per share, showing very wide valuation gaps. With current catalysts focused on integration of acquisitions and margin expansion, you may want to see how your expectations compare to others in the Community.

Explore 5 other fair value estimates on Aon - why the stock might be a potential multi-bagger!

Build Your Own Aon Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aon research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aon research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aon's overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives