- United States

- /

- Insurance

- /

- NYSE:AON

How Does Aon’s Digital Shift Influence Its Value After a 3.6% Share Drop?

Reviewed by Bailey Pemberton

If you are watching Aon’s stock and wondering whether now is the time to move, you are not alone. Over the past year, Aon’s share price has seen more dips than climbs, down 3.6% from this time last year and 3.8% year to date. The short-term story echoes this: Aon has slipped 3.3% over the past month and 0.5% in just the last week. However, before you dismiss this company entirely, it is important to notice the longer-term angle. Over three years, Aon shares have delivered a strong 23.8% return, with 90.2% gained over the last five years. That kind of track record does not happen by accident. It usually points to consistent performance and smart adaptation in a changing market.

Recently, the company has been in the news for stepping up its digital transformation, with several initiatives designed to make its insurance and risk advisory services more nimble and data driven. These strategic shifts could be shaping the way analysts and investors view Aon’s future prospects. Changes like these often take time to filter through to the stock price, which may help to explain the relatively muted movements in recent weeks compared to its historical trend.

On valuation, Aon currently scores a 4 out of 6 on key undervaluation checks, which is a solid signal that the shares could still offer value, even if the recent returns seem underwhelming. So, how do the different valuation methods really measure up, and is there an even more insightful way to gauge what Aon is truly worth? Let’s dig in.

Approach 1: Aon Excess Returns Analysis

The Excess Returns Model evaluates a company’s ability to generate returns greater than its cost of equity, focusing on whether the capital invested in the business produces more profit than shareholders could expect elsewhere. For Aon, this model highlights a remarkably strong financial position.

Let’s break down the key numbers. Aon’s Book Value stands at $36.36 per share, with a Stable Book Value projected to rise to $44.74 per share according to a weighted estimate from two analysts. The company’s average Return on Equity is an eye-popping 1633.33%, far exceeding the cost of equity at just $3.21 per share. This results in an Excess Return of $727.50 per share, with stable earnings per share estimated at $730.72 based on median returns over the last five years.

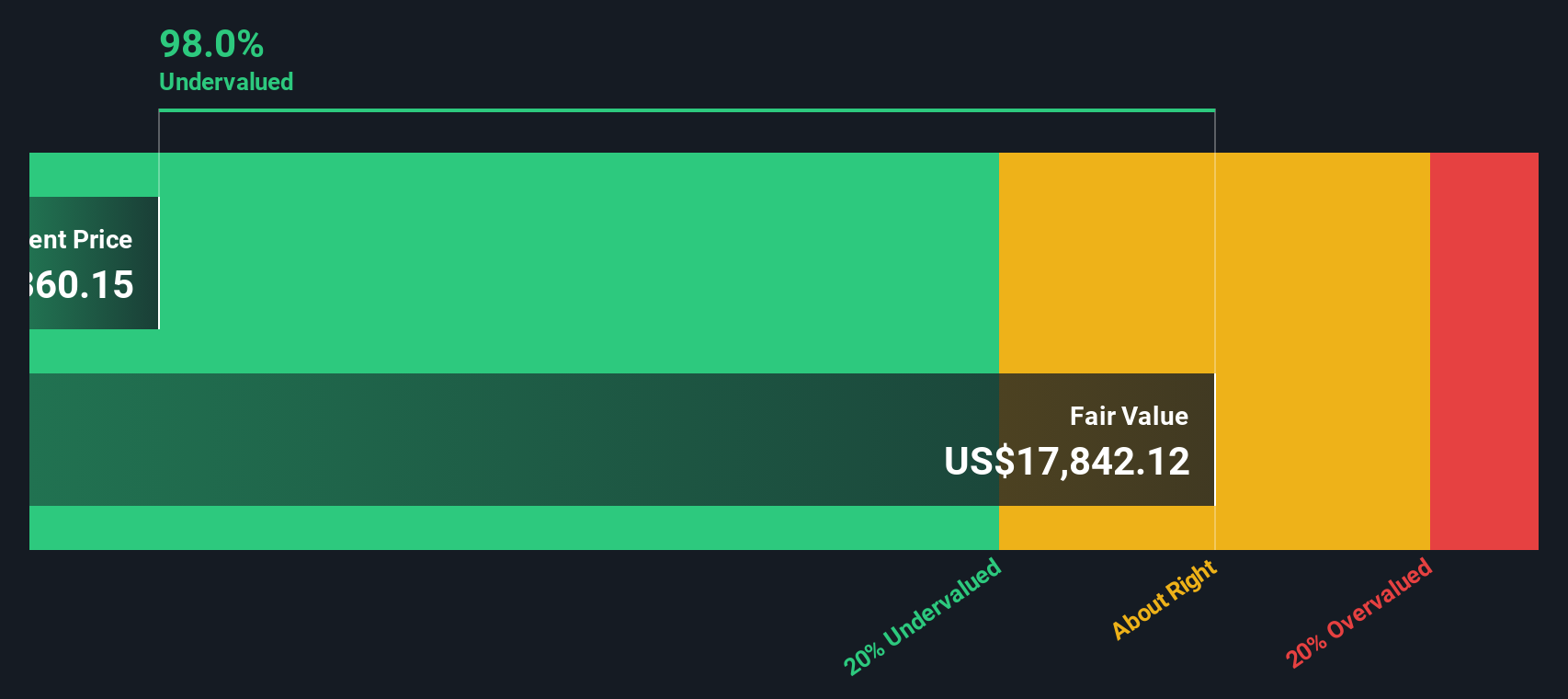

Because the model finds Aon’s return on invested capital so far above its expected cost, it calculates an intrinsic value of $17,777.69 per share. Compared to current price levels, this implies the stock is 98.1% undervalued, which is considered a very strong signal from this methodology.

Result: UNDERVALUED

Our Excess Returns analysis suggests Aon is undervalued by 98.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Aon Price vs Earnings

For profitable companies like Aon, the Price-to-Earnings (PE) ratio is commonly used because it measures what investors are willing to pay for one dollar of current earnings. This makes it especially relevant for stable, consistently profitable firms, as it illustrates both market sentiment and the expectations for future growth and risk.

Growth expectations and company-specific risk play a significant role in what is considered a “normal” or “fair” PE ratio. Higher growth prospects or lower risk often justify a higher PE, while slower growth or elevated uncertainties might lead to a lower valuation multiple.

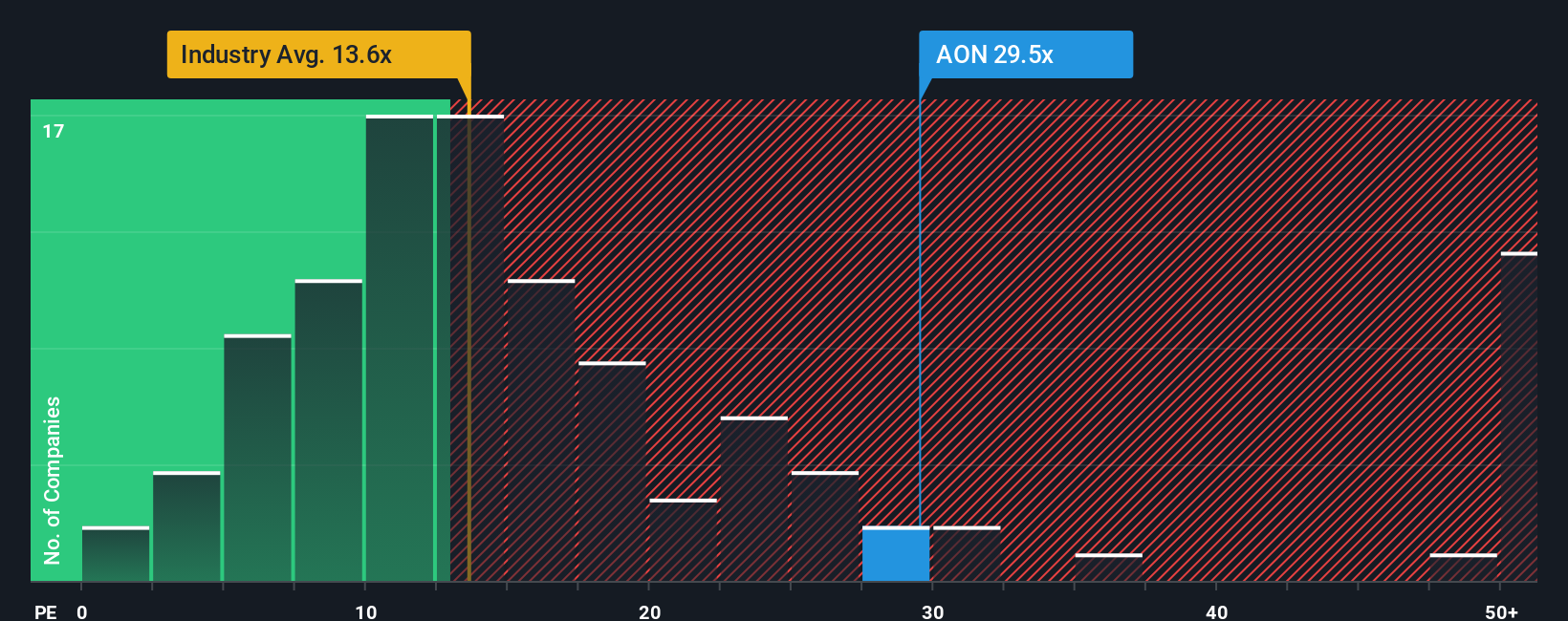

Aon’s current PE ratio sits at 28.28x. When compared to the broader insurance industry average of 13.90x and the peer average of 53.39x, Aon is positioned between the two. However, these benchmarks only capture part of the picture and can overlook the unique characteristics of each business.

This is where Simply Wall St’s Fair Ratio becomes relevant. The Fair Ratio for Aon, calculated to be 17.53x, is designed to reflect a more precise estimate of the multiple the business “should” trade at. Unlike generic comparisons, the Fair Ratio factors in Aon’s growth, profitability, market capitalization, and risk profile. This provides a more accurate and tailored perspective than simply checking the industry or peer average.

Given Aon’s actual PE of 28.28x compared to the Fair Ratio of 17.53x, the stock appears to be valued above its fundamentals on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Aon Narrative

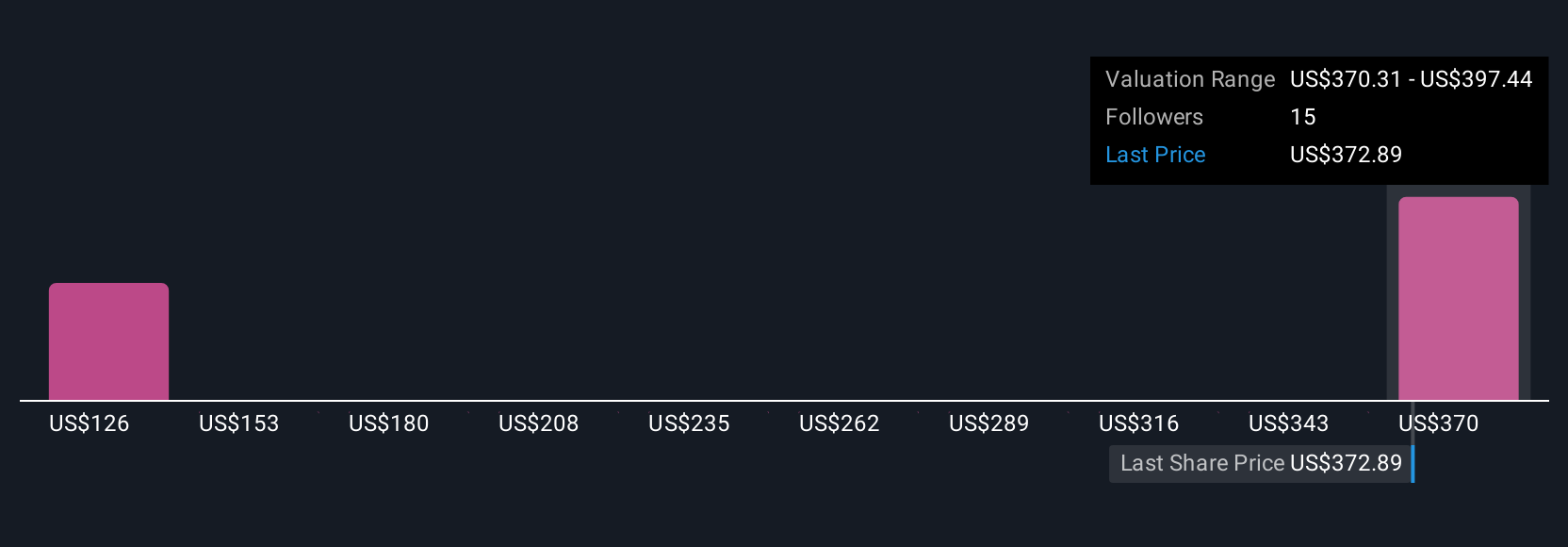

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story for a company, describing how you expect its future to play out and what you think the business is truly worth. On Simply Wall St, Narratives let you bring together your own assumptions about Aon's future revenue, profit margins, growth, and fair value, giving context to your investment viewpoint beyond just ratios or price charts.

What makes Narratives powerful is that they link the company's story directly to a financial forecast, then show you a fair valuation, making it easier for anyone to connect what should happen with what is actually happening. Building or exploring a Narrative is easy and accessible right within the Simply Wall St Community page, where millions of investors share and update their perspectives in real time as new news or earnings information comes in.

This tool helps you decide when to buy or sell by letting you compare your Fair Value to the current price using your own logic and the latest facts. For example, one investor might see Aon as worth $451 per share due to expanding business services and strategic acquisitions, while another could believe it is only worth $349 because of macroeconomic risks and margin pressures. Narratives make both views clear and actionable.

Do you think there's more to the story for Aon? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Good value with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives