- United States

- /

- Insurance

- /

- NYSE:AON

Aon (AON) Revamps Leadership With Key Global Appointments

Reviewed by Simply Wall St

Aon (AON) recently made significant executive appointments to its Reinsurance division, such as Alfonso Valera and Steve Hofmann taking on pivotal roles to enhance global operations. However, the company's stock remained flat over the last month. This lack of substantial movement aligns with broader market trends characterized by ongoing volatility amidst political tensions surrounding the Federal Reserve. The market was generally flat, with some ups and downs driven by factors such as bank earnings and tariff concerns. These leadership changes, while positive, did not significantly alter Aon's market performance amid these broader economic conditions.

We've spotted 1 possible red flag for Aon you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

Aon's recent executive appointments in its Reinsurance division are aimed at enhancing global operations, potentially influencing future revenue and earnings growth. The focus on strategic acquisitions and the expansion of Aon Business Services may drive long-term operational efficiency, despite recent share price stagnation. These leadership additions align with Aon's commitment to strategic capital allocation and risk solutions, yet the immediate impact on revenue projections remains uncertain amidst broader economic volatility.

Over a five-year period, the company's total return, inclusive of share price movements and dividends, was 77.81%. This long-term performance underscores Aon's resilience and ability to deliver shareholder value, although its one-year return of 11.4% also outpaced the broader US market and the Insurance industry, showing relative strength.

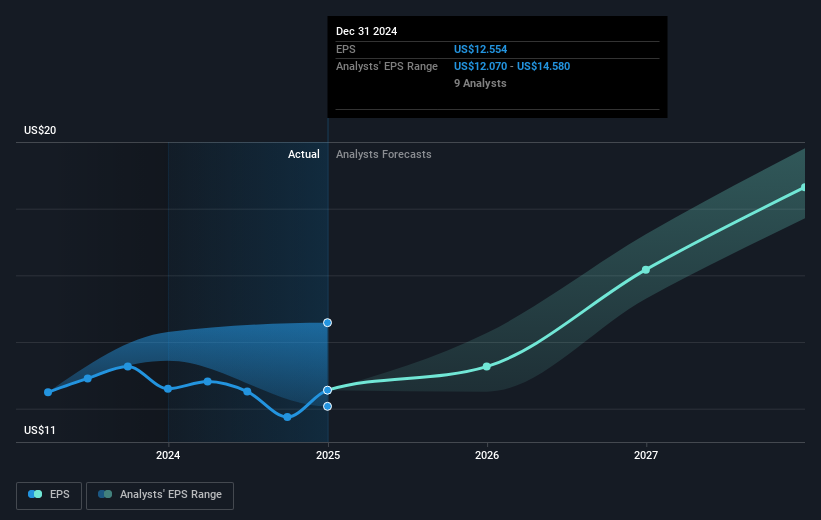

In the short term, the stock's flat movement contrasts with its annual price target of US$397.44, indicating a potential upside of approximately 12.79% from the current share price of US$352.38. This suggests that analysts remain optimistic about Aon's capacity for future earnings growth, expecting revenues to reach US$19.5 billion and earnings to US$3.9 billion by 2028. As investor confidence hinges on Aon's ability to navigate macroeconomic challenges, the reinforced leadership team could be pivotal in achieving these targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives