- United States

- /

- Insurance

- /

- NYSE:AON

A Closer Look at Aon's Valuation as Wins, Acquisitions, and AI Drive Growth Prospects

Reviewed by Kshitija Bhandaru

Aon (NYSE:AON) is attracting attention after a series of business wins, strategic acquisitions, and the rollout of new analytics tools. Growing demand in Health Solutions, along with fresh leadership appointments, is also helping to drive the company’s positive momentum.

See our latest analysis for Aon.

Momentum around Aon is building, thanks to a fresh mix of business wins, product innovation, and leadership appointments. These factors are showing up in investor sentiment. While the most recent share price return may look muted, Aon's 1-year total shareholder return of 4.6% and a robust 80% total return over the past five years reveal steady long-term wealth creation supported by its ongoing transformation and expansion efforts.

If you’re looking for your next opportunity, now’s an ideal moment to expand your search and discover fast growing stocks with high insider ownership

But given this recent momentum and Aon's upward trajectory, is the market underestimating the stock's potential, or has the company’s future growth already been fully priced in?

Most Popular Narrative: 12.9% Undervalued

The narrative consensus sets Aon's fair value at $414, which is notably higher than the last close of $360.73. Behind this gap, a bullish scenario is being constructed on strong operational drivers and management actions.

Investment in priority hires and expanding Aon Business Services (ABS) capabilities are creating capacity to fund growth initiatives and drive operational efficiencies, benefiting net margins and earnings. Despite macroeconomic uncertainties, Aon sees increased demand from clients for their risk solutions, as they navigate complex trade and economic environments, supporting sustainable revenue growth.

Want to know what makes this valuation tick? It rests on a set of aggressive assumptions about how quickly Aon can expand its margins and grow earnings. The future targets pushing this price—are they realistic or a stretch? The answer is in the narrative, and the numbers might surprise you.

Result: Fair Value of $414 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unpredictable macroeconomic swings and higher post-acquisition debt could weigh on Aon's revenue growth and put pressure on profit margins if conditions deteriorate further.

Find out about the key risks to this Aon narrative.

Another View: Valuation by Multiples

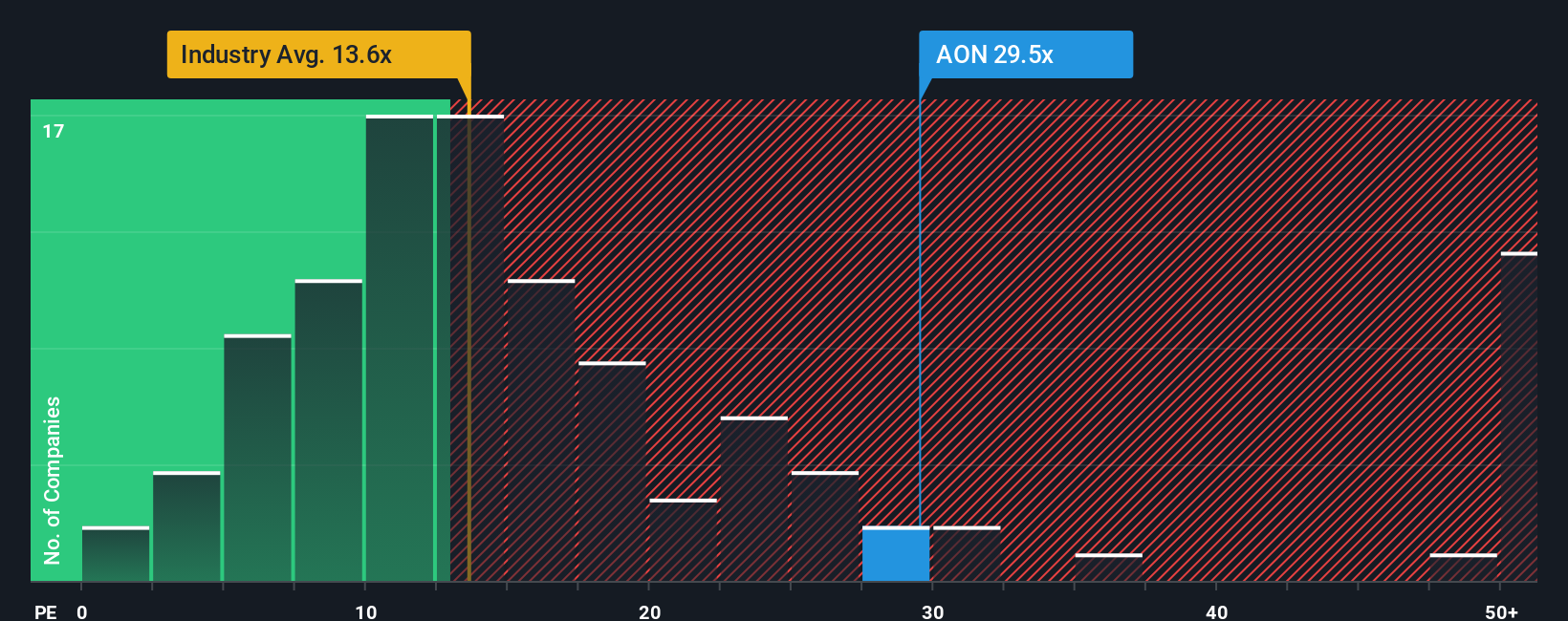

Shifting gears from fair value estimates, the market’s key reference point is Aon's current price-to-earnings ratio of 29.9x. This is more than twice the US Insurance industry’s 13.7x average, and even higher than its peer average of 17.6x. Compared to the fair ratio of 17.6x, Aon appears expensive on this measure. This raises questions about whether investors are already paying up for future optimism or overlooking hidden risks. Could valuation multiples move back toward industry norms?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aon Narrative

If you’re keen to challenge this perspective or want to test your own assumptions using the data, you can shape your own narrative in just a few minutes. Do it your way.

A great starting point for your Aon research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself. These unique stock opportunities could be the edge you’re missing. Find strategies targeting sectors or advantages others might overlook, right on Simply Wall Street.

- Spot fresh tech disruptors and momentum players among these 23 AI penny stocks making waves in artificial intelligence breakthroughs.

- Unlock high-potential finds with these 914 undervalued stocks based on cash flows that the market hasn’t caught onto yet for real upside.

- Zero in on income strength and market resilience with these 19 dividend stocks with yields > 3% offering robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AON

Aon

A professional services firm, provides a range of risk and human capital solutions worldwide.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives