- United States

- /

- Insurance

- /

- NYSE:ALL

How Allstate's (ALL) New Scam Protection Benefit Is Shaping Its Digital Insurance Investment Story

Reviewed by Sasha Jovanovic

- On November 20, 2025, Allstate launched Scam Protection, a new workplace benefit covering losses from digital fraud, ransomware, and cryptocurrency theft, with reimbursement up to US$50,000 and extended coverage for employees' families.

- This offering addresses a rising demand for cybercrime protection during peak digital fraud periods like Black Friday and Cyber Monday, highlighting Allstate's efforts to expand its digital insurance products amid evolving consumer risks.

- We'll examine how Allstate's introduction of a comprehensive cyber protection benefit could influence its investment narrative and market positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Allstate Investment Narrative Recap

To be an Allstate shareholder, one has to believe in the company's ability to grow earnings via digital insurance innovation and strong distribution, even as auto insurance faces headwinds from technology and competition. The launch of Scam Protection highlights Allstate’s push into cyber coverage, a field with rising demand. However, this new product does not materially change the key near-term catalyst, profitable rollout and retention of auto/homeowner policies, or mitigate the biggest risk, which remains profitability pressure from catastrophe losses and climate-driven volatility.

Among recent announcements, Allstate’s guidance of US$83 million in estimated catastrophe losses for October stands out as most relevant. Despite new digital product offerings, frequent and severe catastrophe events continue to pose a substantial threat to Allstate’s underwriting results and earnings consistency, representing a critical near-term and structural risk for shareholders.

On the other hand, investors should be aware of the persistent volatility linked to catastrophe-related claims which can still...

Read the full narrative on Allstate (it's free!)

Allstate's outlook projects $76.3 billion in revenue and $4.3 billion in earnings by 2028. This assumes a 4.9% annual revenue growth and a $1.4 billion decrease in earnings from the current $5.7 billion.

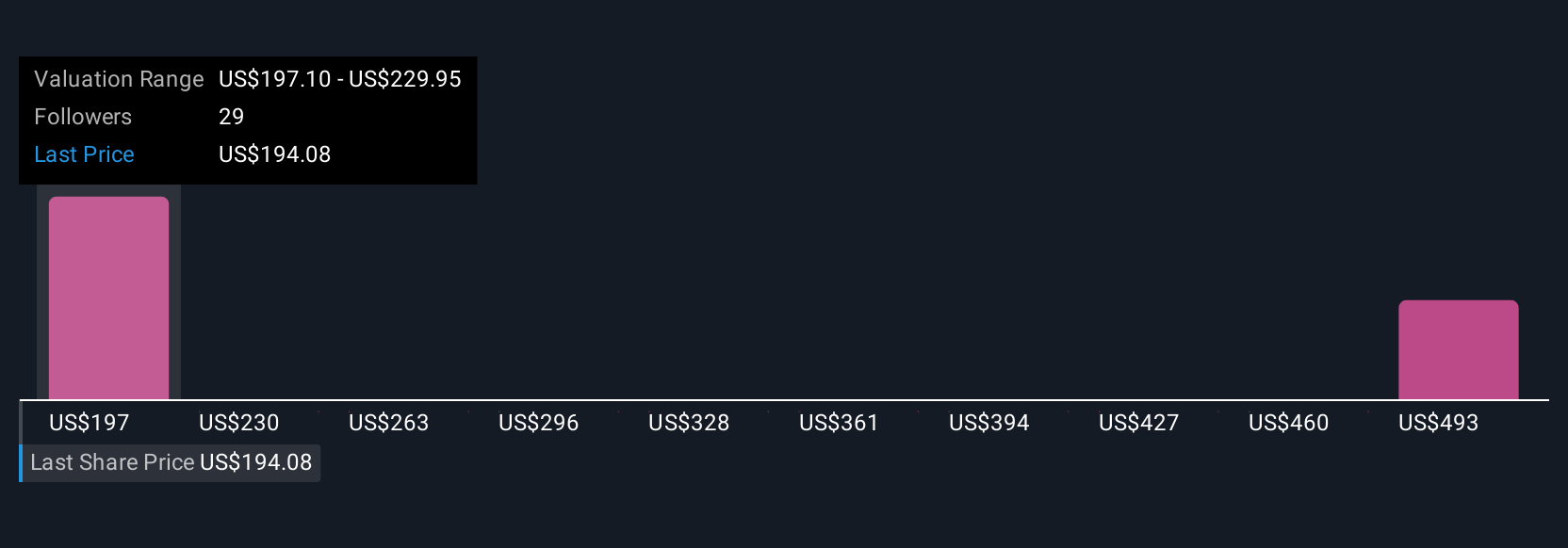

Uncover how Allstate's forecasts yield a $233.45 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Five fair value estimates from the Simply Wall St Community span from US$188 to US$686, highlighting a wide spectrum of independent analysis. With catastrophe risk threatening profit stability, you should consider how sharply opinions differ about Allstate’s future outcomes and explore multiple viewpoints before making decisions.

Explore 5 other fair value estimates on Allstate - why the stock might be worth 12% less than the current price!

Build Your Own Allstate Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allstate research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Allstate research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allstate's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ALL

Allstate

Provides property and casualty, and other insurance products in the United States and Canada.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives