- United States

- /

- Insurance

- /

- NYSE:AJG

Is Arthur J. Gallagher’s Recent Share Price Drop an Opportunity in 2025?

Reviewed by Bailey Pemberton

If you’re standing at the crossroads, wondering whether to buy, hold, or part ways with Arthur J. Gallagher stock, you are not alone. Investors have been watching closely as the company’s share price, which closed at $283.04, has just come off a rough patch, down 4.4% in the past week and 5.7% over the past month. However, when looking at the long-term picture, the stock is up 186.5% over five years and 65.4% over three years. Even with a slight dip of 1.2% over the past year, year-to-date performance still edges up at 2.6%.

What is driving this mixed bag? A handful of recent strategic acquisitions in international insurance brokerage, along with industry buzz about ongoing consolidation, have kept investors’ attention fixed on Arthur J. Gallagher. News cycles suggest optimism about growth, but also hint at shifting risk perceptions as the company expands into new markets. Some analysts point to global macroeconomic uncertainties as factors weighing on the stock in recent months.

Now, let’s talk about value, since that is likely on your mind as you evaluate this stock. Based on our deep-dive into valuation methods, Arthur J. Gallagher earns a value score of 3 out of 6, showing it is undervalued in three key checks. But what does that really mean for your decision-making? Next, we will break down which valuation approaches we used and what they indicate about the company’s current price. If you really want to sharpen your financial toolkit, stay tuned for a discussion of what may be the most insightful way to determine value yet.

Approach 1: Arthur J. Gallagher Excess Returns Analysis

The Excess Returns model evaluates a stock by measuring how much return the company generates above its cost of equity capital. This approach focuses on the efficiency of reinvested profits and sustained long-term growth. For Arthur J. Gallagher, this model calculates whether future returns on invested capital are likely to exceed the required rate of return for shareholders.

According to analyst projections, Arthur J. Gallagher has a Book Value of $89.79 per share and a Stable Earnings Per Share (EPS) of $15.02, derived from estimates by four analysts. The average Return on Equity stands at a robust 14.37%, while the Cost of Equity is calculated at $7.08 per share. The resulting Excess Return comes to $7.94 per share, indicating healthy value creation above the required cost. Looking further ahead, forecasts suggest a Stable Book Value of $104.49 per share based on input from two analysts, which points to ongoing underlying growth.

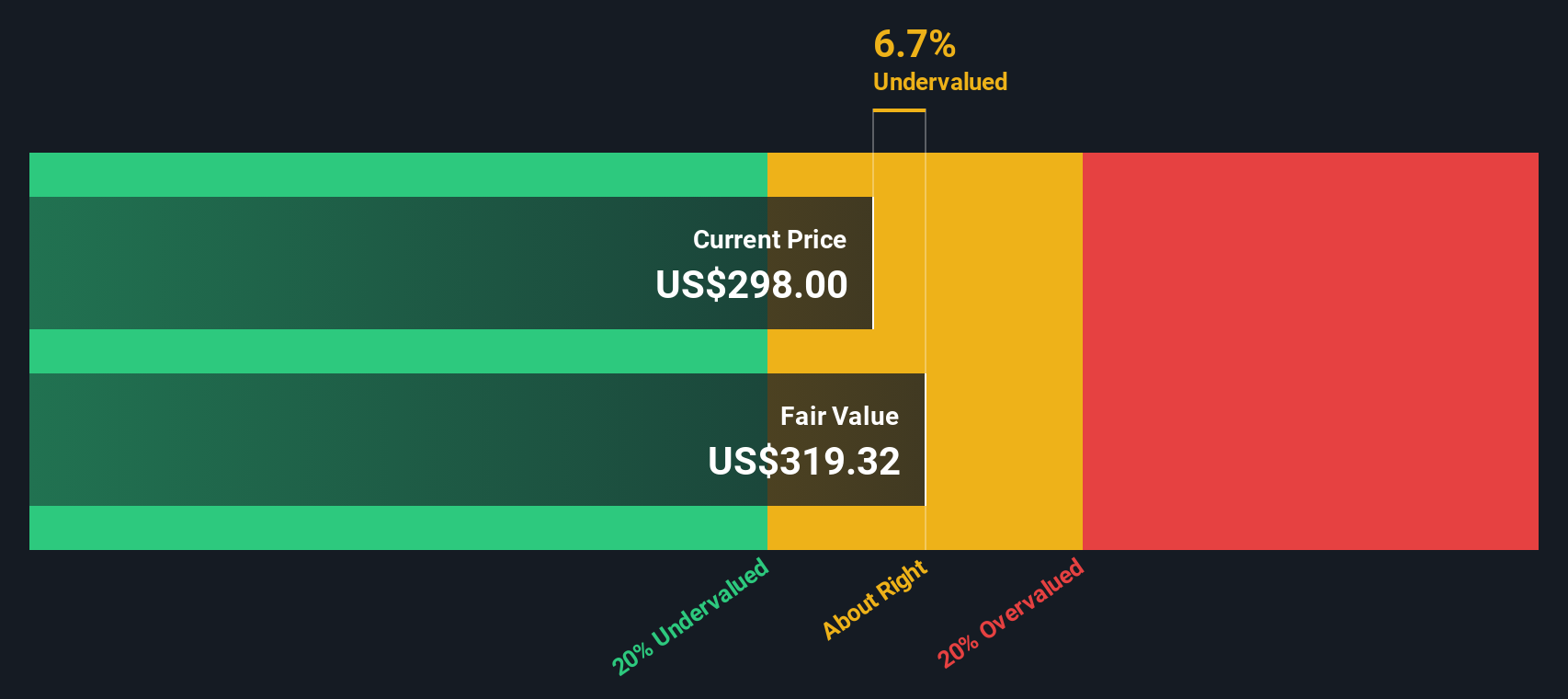

With these inputs, the Excess Returns model estimates the intrinsic value for Arthur J. Gallagher at $319.32 per share. Since the company’s recent share price is $283.04, this suggests the stock is about 11.4% undervalued.

Result: UNDERVALUED

Our Excess Returns analysis suggests Arthur J. Gallagher is undervalued by 11.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Arthur J. Gallagher Price vs Earnings

The Price-to-Earnings (PE) ratio is commonly used to value well-established, profitable companies because it directly links a company's share price with its earnings power. Since Arthur J. Gallagher consistently generates profits, PE is an appropriate metric that provides a clear signal of what investors are willing to pay for each dollar of earnings.

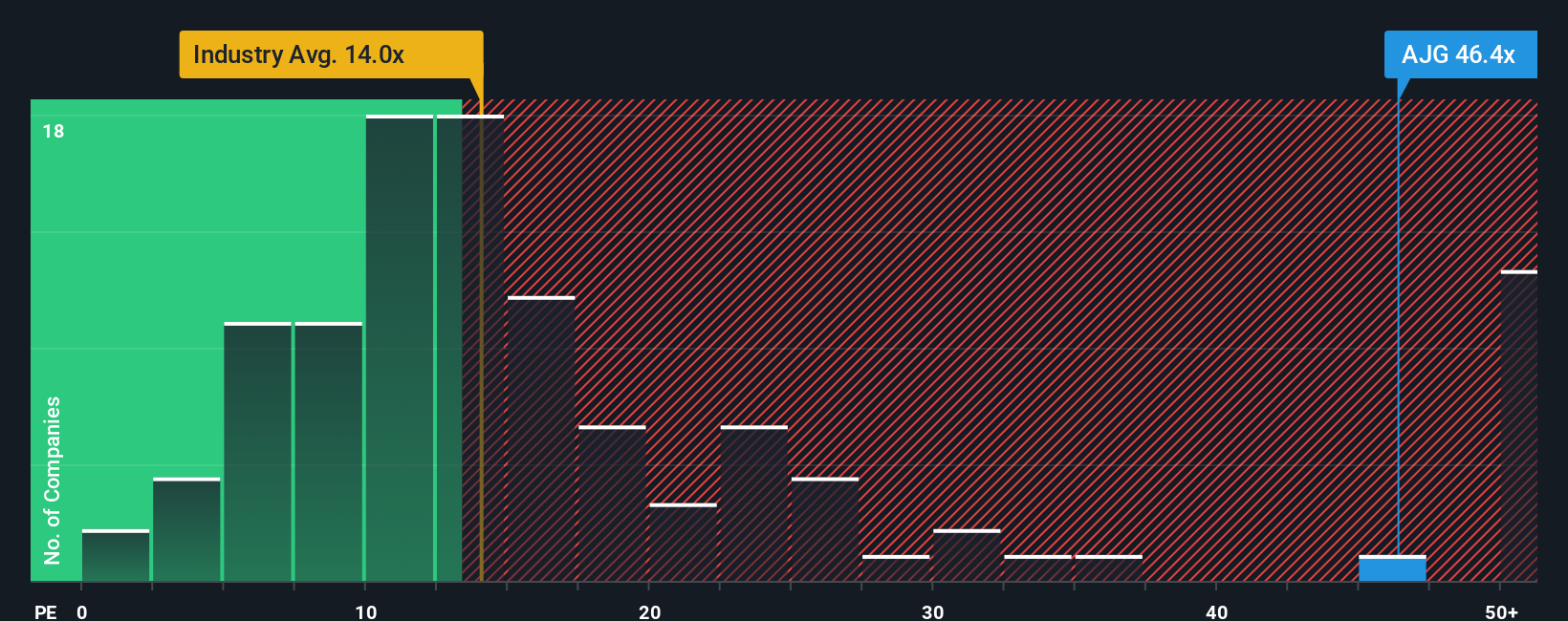

In general, higher growth expectations or lower risk profiles tend to justify higher PE ratios, while slower growth or elevated risk should result in lower ratios. Comparing the company’s current PE to peers and industry standards puts its valuation into better context. Arthur J. Gallagher currently trades at a PE of 44.2x, which is well above the Insurance industry average of 14.0x and the peer group average of 49.5x. At first glance, this suggests an expensive stock, but headline multiples do not always tell the full story.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio is a proprietary metric that factors in the company’s specific outlook, including earnings growth, profit margins, size, risks, and industry benchmarks. Unlike raw comparisons against industry or peers, which may overlook critical nuances, this approach aims to provide a more accurate perspective. For Arthur J. Gallagher, the Fair PE Ratio stands at 20.4x. This means the current multiple is significantly above what would be considered fair based on a comprehensive view of its financial characteristics and future prospects. The gap between the actual PE (44.2x) and the Fair Ratio (20.4x) indicates the stock is overvalued in this context.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Arthur J. Gallagher Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is much more than a collection of numbers or a single price target: it is your unique story or perspective about Arthur J. Gallagher, explaining why you think the company will succeed (or struggle) in the future. Narratives connect the dots between your views on the business, your forecast for things like future revenue, earnings, and margins, and the specific fair value you calculate for the stock. They are easy to use and accessible: millions of investors leverage Narratives right from the Community page on Simply Wall St, where you can quickly build and update your own investment thesis.

With Narratives, you can see at a glance how your calculated Fair Value compares to the current market Price, making it simpler to decide when you might want to buy or sell. Best of all, Narratives update dynamically as new information emerges, whether it is breaking news or quarterly earnings.

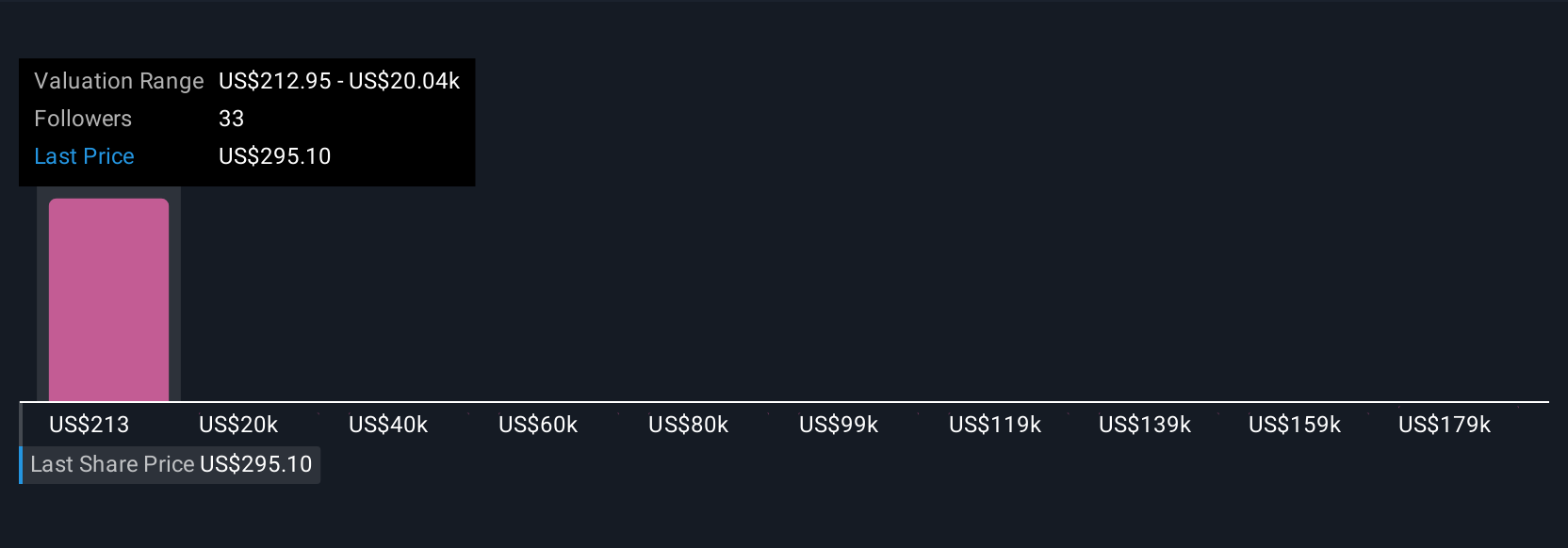

For example, when looking at Arthur J. Gallagher, some investors build bullish Narratives based on expectations for strong digital expansion and a rising global demand for insurance, resulting in a Fair Value as high as $388. Others might be more cautious, highlighting margin pressures and industry risks, and arrive at a Fair Value closer to $267. Narratives empower you to put your own 'story' at the heart of your investment process and adjust it as reality changes.

Do you think there's more to the story for Arthur J. Gallagher? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives