- United States

- /

- Insurance

- /

- NYSE:AJG

Arthur J. Gallagher (NYSE:AJG) Q1 2025 Earnings: Revenue Hits US$3,315 Million

Reviewed by Simply Wall St

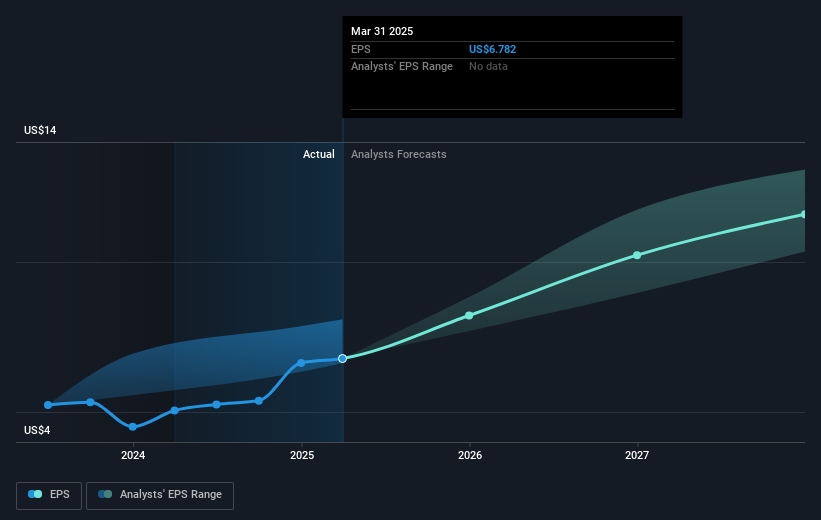

Arthur J. Gallagher (NYSE:AJG) demonstrated notable growth in the last quarter, reporting significant increases in both revenue and net income for Q1 2025, with revenue climbing to USD 3,315 million and net income reaching USD 812 million. Despite the broader market achieving a 1.8% increase, Gallagher's share price rose by a more pronounced 5.24%, potentially buoyed by these stronger-than-expected financial results and an extended credit agreement. These positive developments may have offset any general market concerns related to tariff talks and economic growth, aligning the company's trajectory with ongoing positive market sentiment.

Be aware that Arthur J. Gallagher is showing 3 possible red flags in our investment analysis.

The recent acquisition of AssuredPartners is pivotal for Arthur J. Gallagher and could significantly influence its growth narrative by expanding market reach and enhancing cross-selling capabilities. This strategic move aligns with the company's sustained revenue increase, which rose to US$10.93 billion, and positions AJG to leverage ongoing organic growth and international expansion. Such developments are evident in the notable share price increase by 5.24% in the recent quarter, potentially setting the stage for earnings well beyond the current US$1.46 billion as market penetration deepens.

Over the long term, AJG's total shareholder return, inclusive of share price appreciation and dividends, reached a substantial 294.66% across five years. This extended period demonstrates a very large value generation for investors. In comparison, over the past year, AJG surpassed both the US market and the US Insurance industry returns, underlining its resilience and growth potential within the sector.

Considering the immediate business environment and analyst forecasts, AJG's revenue and earnings outlook may continue to improve, bolstered by a robust M&A pipeline and enhanced operational efficiencies from tech advancements. The current consensus analyst price target of US$332.29 suggests a limited upside of 4.6% from the present share price of US$317.14, indicating that currently, AJG's stock might be closely aligned with market expectations. Investors should continuously evaluate if the predicted growth can justify the valuation of a 41.0x PE ratio against industry averages.

Gain insights into Arthur J. Gallagher's future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives