- United States

- /

- Insurance

- /

- NYSE:AJG

Arthur J. Gallagher (AJG): Is There Value Opportunity After Recent Share Price Cooling?

Reviewed by Kshitija Bhandaru

See our latest analysis for Arthur J. Gallagher.

Arthur J. Gallagher’s share price has slipped around 4% over the past month and is now up just 1.7% year to date, suggesting the recent momentum has cooled a bit despite earlier resilience. Looking at the longer term, the company’s three-year total shareholder return of 64% and five-year total return of 174% remind investors that steady gains can still come from the insurance sector, even after short-term pullbacks.

If you’re keeping an eye on sector trends or want to spot the next breakout, this is a great time to broaden your watchlist and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets and solid long-term growth in place, the key question now is whether Arthur J. Gallagher is undervalued or if the market has already factored in its future prospects. Is there a genuine buying opportunity here?

Most Popular Narrative: 17.3% Undervalued

Arthur J. Gallagher’s last close of $280.47 sits well below the fair value projected in the most widely followed narrative, hinting at notable upside. The substantial valuation gap stems from expectations of industry-beating growth and key catalysts not yet reflected in the stock price.

Broader adoption of digital tools, enhanced data analytics, and early-stage AI projects within the company's operations are producing measurable efficiency improvements and margin expansion. This is positioning net margins and overall profitability for continued long-term growth.

Want to know the secret to this valuation? The growth projection behind this fair value is fueled by bold operational bets and future profitability margins that get tongues wagging on Wall Street. Curious to learn which game-changing moves tip the scales? Dive into the full narrative and see the assumptions other investors are watching closely.

Result: Fair Value of $339.2 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sharper declines in property insurance rates or overreliance on acquisitions could disrupt Arthur J. Gallagher’s growth story and challenge current bullish expectations.

Find out about the key risks to this Arthur J. Gallagher narrative.

Another View: What Do Multiples Say?

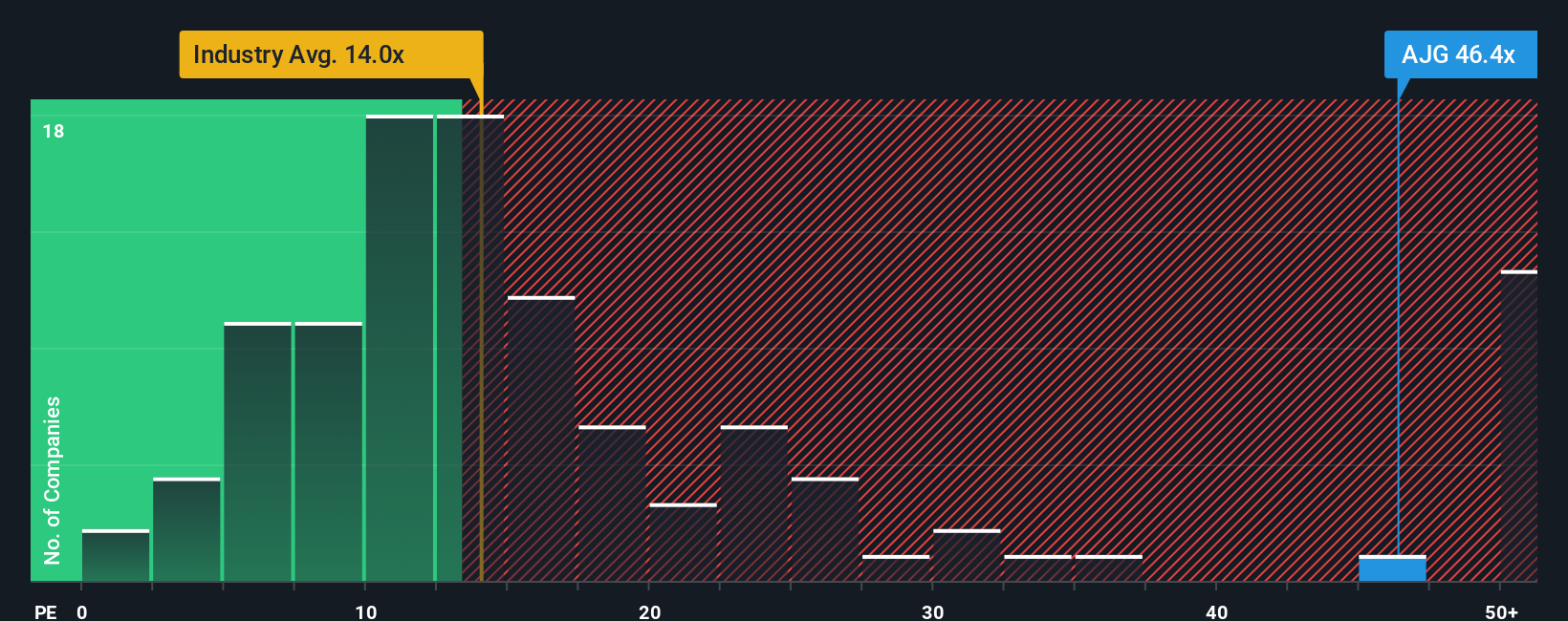

Looking at Arthur J. Gallagher from a price-to-earnings angle, the stock trades at 43.8x, which is much higher than the US insurance industry average of 13.2x and also exceeds its fair ratio of 20.4x. This indicates that investors are paying a steep premium that may create valuation risk, especially if growth slows. Does the market really support this gap, or could sentiment shift?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Arthur J. Gallagher Narrative

If you’d rather dig into the numbers yourself or approach the story from a fresh angle, you’re free to craft your own take in minutes with Do it your way.

A great starting point for your Arthur J. Gallagher research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Plenty of other opportunities are waiting. Don't let the next big winner slip through your fingers when Simply Wall Street makes it easy to find your edge.

- Lock in upfront value by targeting these 878 undervalued stocks based on cash flows that the market hasn't fully appreciated yet. Catch potential upside before the crowd reacts.

- Earn while you wait by checking out these 18 dividend stocks with yields > 3%, where strong yields put steady income at the heart of your portfolio.

- Seize the momentum in tomorrow’s tech by acting early on these 24 AI penny stocks pioneering advances in artificial intelligence and reshaping entire sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AJG

Arthur J. Gallagher

Provides insurance and reinsurance brokerage, consulting, and third-party property/casualty claims settlement and administration services to entities and individuals worldwide.

Excellent balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives