- United States

- /

- Insurance

- /

- NYSE:AIZ

Is The Market Rewarding Assurant, Inc. (NYSE:AIZ) With A Negative Sentiment As A Result Of Its Mixed Fundamentals?

It is hard to get excited after looking at Assurant's (NYSE:AIZ) recent performance, when its stock has declined 22% over the past three months. It seems that the market might have completely ignored the positive aspects of the company's fundamentals and decided to weigh-in more on the negative aspects. Stock prices are usually driven by a company’s financial performance over the long term, and therefore we decided to pay more attention to the company's financial performance. Particularly, we will be paying attention to Assurant's ROE today.

Return on equity or ROE is an important factor to be considered by a shareholder because it tells them how effectively their capital is being reinvested. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Assurant

How Is ROE Calculated?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Assurant is:

6.8% = US$387m ÷ US$5.7b (Based on the trailing twelve months to December 2019).

The 'return' refers to a company's earnings over the last year. One way to conceptualize this is that for each $1 of shareholders' capital it has, the company made $0.07 in profit.

What Has ROE Got To Do With Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Assurant's Earnings Growth And 6.8% ROE

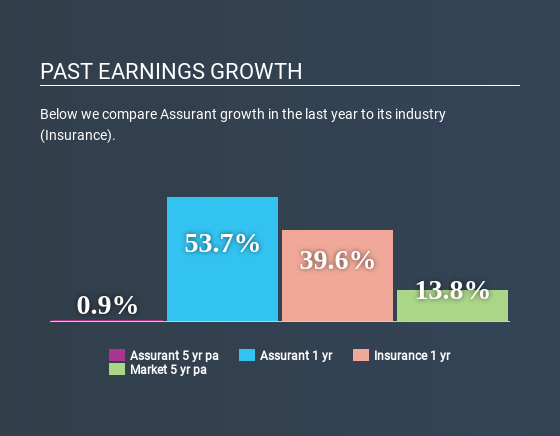

When you first look at it, Assurant's ROE doesn't look that attractive. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 10% either. Therefore, Assurant's flat earnings over the past five years can possibly be explained by the low ROE amongst other factors.

Next, on comparing with the industry net income growth, we found that Assurant's reported growth was lower than the industry growth of 8.0% in the same period, which is not something we like to see.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. This then helps them determine if the stock is placed for a bright or bleak future. Has the market priced in the future outlook for AIZ? You can find out in our latest intrinsic value infographic research report.

Is Assurant Using Its Retained Earnings Effectively?

Assurant has a low three-year median payout ratio of 25% (or a retention ratio of 75%) but the negligible earnings growth number doesn't reflect this as high growth usually follows high profit retention.

Moreover, Assurant has been paying dividends for at least ten years or more suggesting that management must have perceived that the shareholders prefer dividends over earnings growth. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 24% of its profits over the next three years. Regardless, the future ROE for Assurant is predicted to rise to 11% despite there being not much change expected in its payout ratio.

Conclusion

Overall, we have mixed feelings about Assurant. Even though it appears to be retaining most of its profits, given the low ROE, investors may not be benefitting from all that reinvestment after all. The low earnings growth suggests our theory correct.

Up till now, we've only made a short study of the company's growth data. To gain further insights into Assurant's past profit growth, check out this visualization of past earnings, revenue and cash flows.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:AIZ

Assurant

Provides protection services to connected devices, homes, and automobiles in North America, Latin America, Europe, and the Asia Pacific.

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion