- United States

- /

- Insurance

- /

- NYSE:AIG

How Investors May Respond To AIG’s Dividend, Leadership Changes, and Buyback Announcement

Reviewed by Sasha Jovanovic

- On November 4, 2025, American International Group’s Board of Directors declared a quarterly cash dividend of US$0.45 per share, payable on December 30, 2025, to shareholders of record as of December 16, 2025, and reported third quarter net income of US$519 million on revenue of US$6.35 billion, alongside announcing buybacks and leadership changes.

- These actions reflect AIG’s focus on returning value to shareholders through consistent dividends, significant share repurchases, and targeted operational improvements, even as the company addresses regulatory scrutiny and catastrophe-related challenges.

- We’ll examine how the robust underwriting-driven earnings and updated buyback program could influence AIG’s investment narrative moving forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

American International Group Investment Narrative Recap

To own American International Group (AIG) stock right now, an investor needs confidence in the company’s ability to drive earnings growth through improved underwriting, disciplined expense management, and strategic buybacks, while accepting the risks from catastrophe-related losses and evolving regulatory pressures. The recent dividend affirmation and share buyback activity reinforce near-term shareholder return, but they do not materially alter the most pressing catalyst: continued outperformance in underwriting; nor do they mitigate the biggest risk, which remains exposure to volatile catastrophe losses and litigation trends. Among the most relevant announcements is AIG’s completion of a US$1.25 billion share buyback in the third quarter, representing 2.86% of shares outstanding. This move increases per-share value for existing shareholders and reflects the company’s ongoing focus on capital management, but its impact on the broader underwriting and catastrophe risk profile is minimal for now. However, investors should be aware that even with improved profitability, the ongoing exposure to major catastrophe events and legal claims could ...

Read the full narrative on American International Group (it's free!)

American International Group's outlook anticipates $31.3 billion in revenue and $3.8 billion in earnings by 2028. This projection is based on a 4.5% annual revenue growth rate and a $0.5 billion earnings increase from current earnings of $3.3 billion.

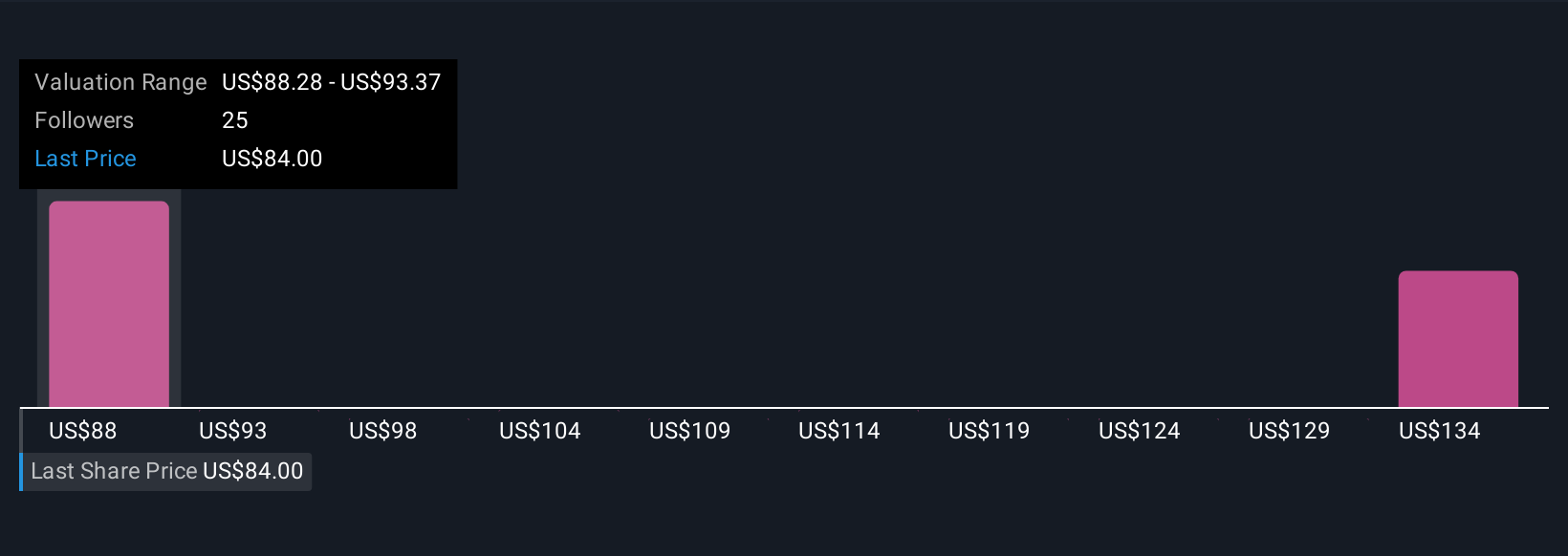

Uncover how American International Group's forecasts yield a $88.28 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Five Simply Wall St Community members estimate AIG’s fair value between US$88.28 and US$140.22 per share. Yet with climate-driven catastrophe losses still posing a key earnings risk, your viewpoint could differ widely from the consensus, consider what matters most for your investment thesis here.

Explore 5 other fair value estimates on American International Group - why the stock might be worth as much as 74% more than the current price!

Build Your Own American International Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American International Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free American International Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American International Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AIG

American International Group

Offers insurance products for commercial, institutional, and individual customers in North America and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives