- United States

- /

- Insurance

- /

- NYSE:AFL

Is It Too Late To Consider Aflac After Strong Five Year Share Price Gains?

Reviewed by Bailey Pemberton

- If you are wondering whether Aflac at around $110 a share is still a smart buy, or if the big gains are already behind it, you are not alone. That is exactly what this breakdown will tackle.

- The stock is up 7.8% year to date, 9.8% over the last year, and 182.8% over five years, even though the last month saw a mild dip of 0.6% after a flat 0.3% week.

- Recently, investors have been responding to Aflac's ongoing share repurchase programs and steady dividend increases, which reinforce its image as a disciplined capital allocator. In addition, the market has been digesting updates around its U.S. and Japan insurance operations and regulatory developments, helping shape expectations for future cash flows and risk.

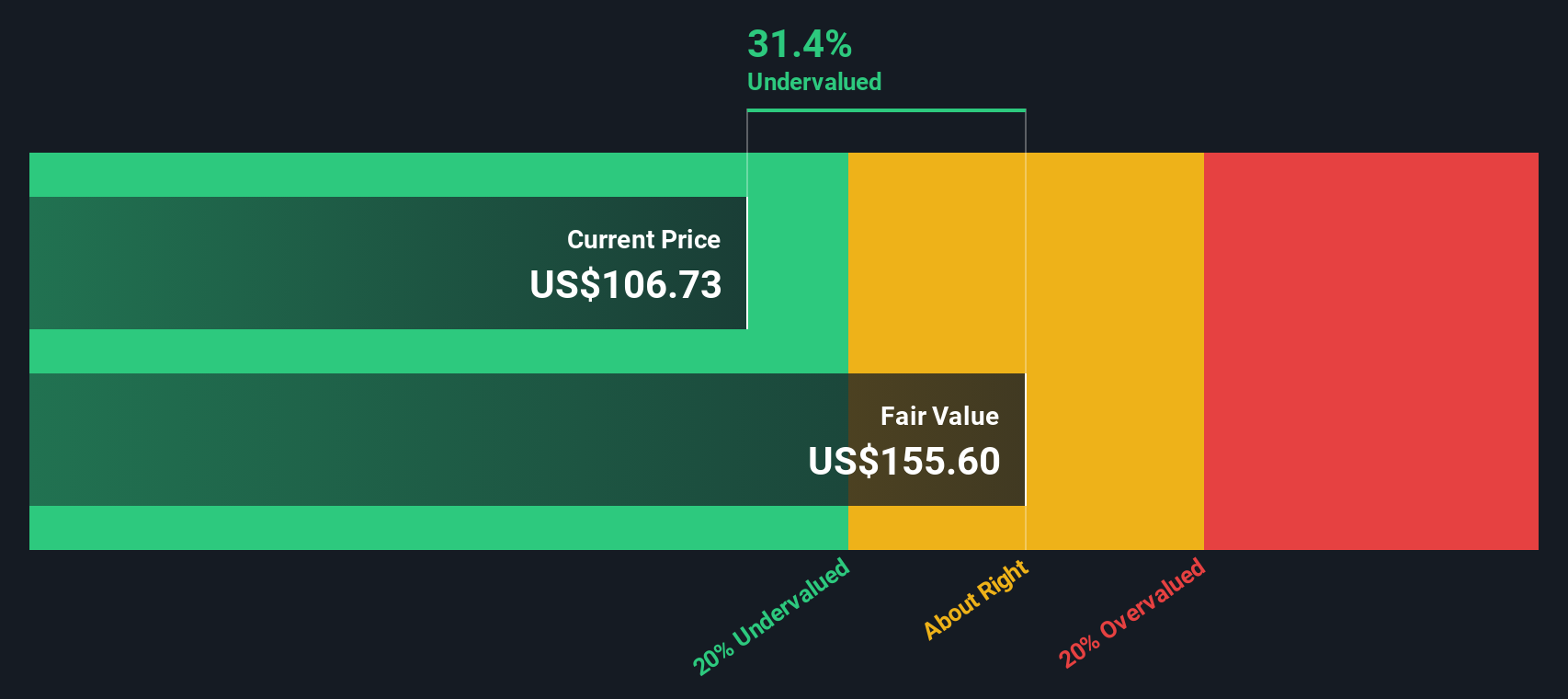

- Right now, Aflac scores a 3/6 valuation check, suggesting it looks undervalued on some metrics but not across the board. We will walk through the main valuation approaches next and finish with a more powerful way to think about what this stock may be worth.

Approach 1: Aflac Excess Returns Analysis

The Excess Returns model looks at how much profit Aflac can earn above the minimum return investors demand on its equity, and then projects how long those extra profits can be sustained.

For Aflac, the starting point is a Book Value of $54.57 per share and a Stable EPS estimate of $7.82 per share, based on weighted future Return on Equity estimates from 4 analysts. With an Average Return on Equity of 13.94% and a Cost of Equity of $3.90 per share, the model calculates an Excess Return of $3.92 per share, indicating Aflac is expected to generate value over and above its funding cost. Analysts also see Stable Book Value edging up to $56.11 per share, based on forecasts from 7 analysts, supporting a steady compounding base.

Rolling these inputs through the Excess Returns framework produces an intrinsic value of about $162 per share. Compared with the current price near $110, this implies the stock is roughly 31.9% undervalued in dollar terms.

Result: UNDERVALUED

Our Excess Returns analysis suggests Aflac is undervalued by 31.9%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: Aflac Price vs Earnings

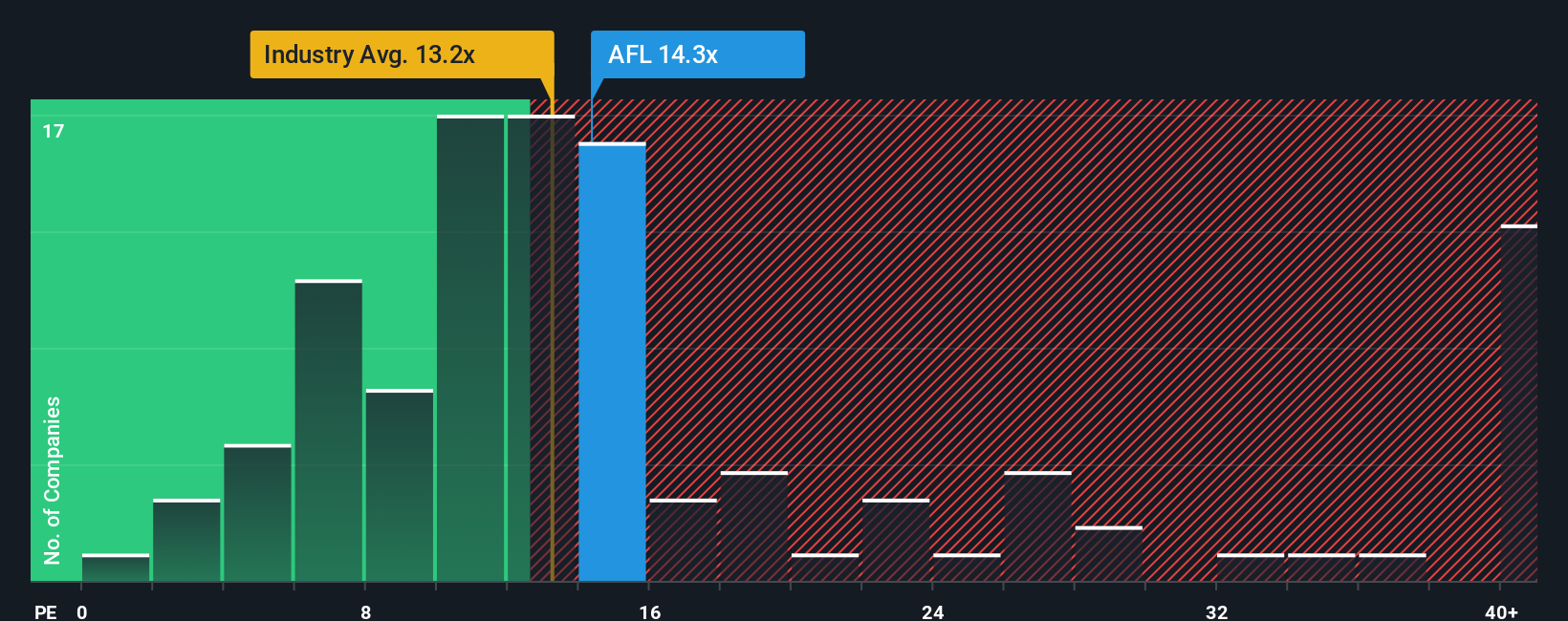

For a mature, consistently profitable insurer like Aflac, the Price to Earnings (PE) ratio is a practical way to gauge value because it links what investors pay today to the profits the business is actually generating.

What counts as a normal or fair PE depends on how fast earnings are expected to grow and how risky those earnings are. Higher growth and lower risk can justify paying a higher multiple, while slower or more volatile earnings usually demand a discount.

Aflac currently trades at about 13.87x earnings, which is slightly above the broader Insurance industry average of roughly 13.38x and just under the 14.33x average for peers. To go deeper than those broad comparisons, Simply Wall St calculates a proprietary Fair Ratio of 12.98x, which reflects Aflac's specific growth outlook, risk profile, margins, industry, and market cap. This Fair Ratio is more tailored than a simple peer or sector comparison because it adjusts for what actually drives sustainable value for Aflac, rather than assuming all insurers deserve the same multiple. With the stock trading modestly above this 12.98x Fair Ratio, the PE view points to Aflac being slightly overvalued.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1464 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Aflac Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce Narratives, a simple framework on Simply Wall St's Community page that lets you connect your view of Aflac's story to your own revenue, earnings, and margin assumptions. You can then turn those into a financial forecast and then into a Fair Value you can compare with the current price to decide whether to buy or sell. All of this then updates dynamically as new news or earnings arrive. For example, one investor might build a bullish Aflac Narrative around strong product innovation, improving margins toward about 21 percent, and a higher future PE closer to 16.3x that supports a Fair Value above the current share price. Another, more cautious investor might emphasize Japan premium pressure, currency risk, and slower U.S. growth to justify using a lower growth path and PE closer to 14x, leading to a Fair Value nearer the low analyst target of $99. Narratives makes both perspectives visible, comparable, and easy to refine over time.

Do you think there's more to the story for Aflac? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:AFL

Aflac

Through its subsidiaries, provides supplemental health and life insurance products.

Established dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion