- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Willis Towers Watson (WTW): Reassessing Valuation After Expanded Buyback and Fresh Analyst Upgrades

Reviewed by Kshitija Bhandaru

Willis Towers Watson (WTW) has drawn investor attention this week after expanding its share repurchase program by $1.5 billion and receiving multiple analyst upgrades. This reflects growing confidence in its operational strategy and shareholder focus.

See our latest analysis for Willis Towers Watson.

WTW hit a record high of $346.27 recently as momentum picked up following the expanded buyback and senior leadership additions. While short-term share price returns have been modest, the 1-year total shareholder return of 20.3% signals investors are rewarding consistent execution and capital return commitments.

If industry confidence in Willis Towers Watson has you thinking bigger, this may be an ideal moment to look for opportunity and discover fast growing stocks with high insider ownership

With analyst optimism reaching new highs and the stock trading near its record high, investors must consider whether Willis Towers Watson is still attractively priced or if the market has already accounted for all of its growth potential.

Most Popular Narrative: 6% Undervalued

Willis Towers Watson’s most widely followed narrative sees the fair value at $368.78, a step above its last close of $345.78. This signals that forward-looking expectations remain elevated despite recent gains.

Persistent healthcare cost inflation and aging populations are driving sustained demand for pension and health benefits consulting, leading to robust growth in recurring revenue streams within Health, Wealth & Career, and supporting both revenue expansion and margin stability.

What powers this premium? There are bold assumptions about future margins, recurring growth, and expanding operating leverage. Intrigued by which figures analysts believe will shape WTW’s next chapter? The full narrative reveals the financial engine behind the price target.

Result: Fair Value of $368.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, accelerating AI adoption in insurance could compress fees, while ongoing integration challenges from acquisitions may threaten future profit margins for Willis Towers Watson.

Find out about the key risks to this Willis Towers Watson narrative.

Another View: Risks Behind the Ratios

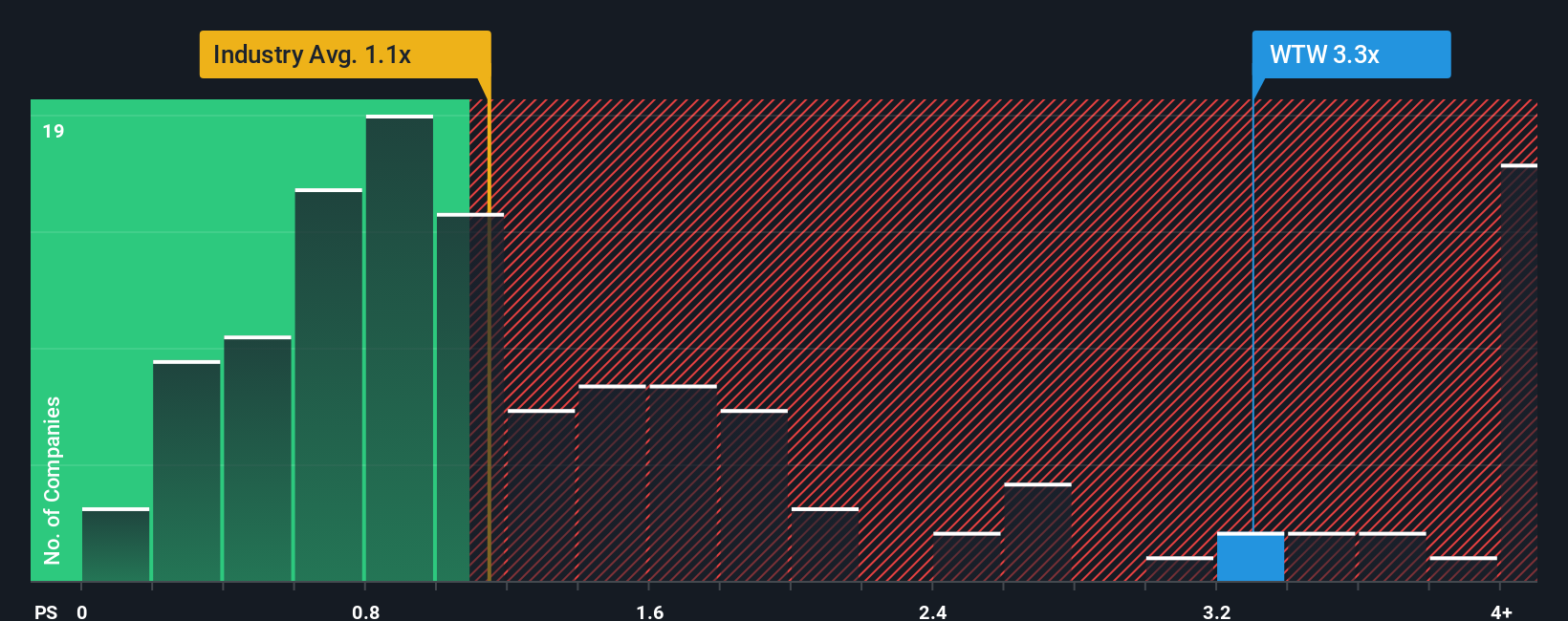

While fair value models indicate Willis Towers Watson is trading about 10% below its estimated worth, its price-to-sales ratio of 3.4x commands a significant premium to both the US Insurance industry average of 1.2x and the fair ratio of 2x. This could mean investors are assuming more growth than the market typically rewards. Does this signal opportunity or raise the risk of disappointment?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Willis Towers Watson Narrative

If you want a more hands-on approach or have a unique perspective on Willis Towers Watson, it's simple to build your own view using our platform in just a few minutes. Do it your way

A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your edge with fresh stock insights you won’t want to miss. Handpick opportunities that suit your goals before the rest of the market catches on.

- Amplify your income by seeking out higher-yield opportunities through these 19 dividend stocks with yields > 3% and build a portfolio with solid earnings potential.

- Jump ahead of trends by tapping into breakthrough advancements in tomorrow’s AI sector using these 24 AI penny stocks and see who is poised to lead the charge.

- Secure bargains and enhance your returns by uncovering hidden value with these 904 undervalued stocks based on cash flows so you do not miss out on the next big mover.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives