- United States

- /

- Insurance

- /

- NasdaqGS:WTW

Willis Towers Watson (WTW): Assessing Valuation After the Launch of Advanced Radar 5 Insurance Platform

Reviewed by Simply Wall St

Willis Towers Watson (WTW) has just launched Radar 5, an upgraded platform for insurance analytics and pricing that brings Generative AI and streamlined cloud capabilities to insurers. The move highlights WTW's continued push toward digital transformation in insurance.

See our latest analysis for Willis Towers Watson.

WTW shares have shown solid momentum this year, as investors increasingly recognize the company’s technology upgrades and partnerships, such as the recent HealthMAPS® integration with Merit Medicine. While the 1-day and 1-month share price movements were relatively minor, WTW’s 90-day share price return of 6.4% suggests building optimism following its Radar 5 launch. In the broader context, the 1-year total shareholder return of 14.5% and nearly 62.5% over three years signals a strong track record, with recent product innovations suggesting ongoing growth potential.

If these developments have you thinking about the wider insurance and fintech sector, it may be an opportune time to broaden your investing horizons and discover fast growing stocks with high insider ownership

With shares still trading at a discount to analyst targets, and the latest innovations cementing WTW’s leadership in insurance tech, investors face a timely question: Is there upside ahead or is future growth already factored in?

Most Popular Narrative: 11.8% Undervalued

Compared to the most widely followed narrative’s estimated fair value of $374, Willis Towers Watson’s last closing price of $330.42 points to material upside according to key catalysts and consensus forecasts driving the valuation.

“Active portfolio optimization, including cost discipline, segment divestitures, and strategic investments in high-growth markets like the Middle East, are streamlining operations and supporting margin expansion. These efforts are setting the stage for higher net margins and free cash flow.”

The calculation that puts WTW’s fair value higher is anchored in aggressive profit expansion, significant operating leverage, and a future PE assumption that challenges conventional industry norms. Want to know which expectations are fueling this target? The full narrative reveals the projections and decision points that could change your outlook on WTW’s potential.

Result: Fair Value of $374 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent sector competition or a shift toward commoditized digital solutions could compress margins and challenge the optimistic outlook on Willis Towers Watson’s growth.

Find out about the key risks to this Willis Towers Watson narrative.

Another View: What Do Price Multiples Say?

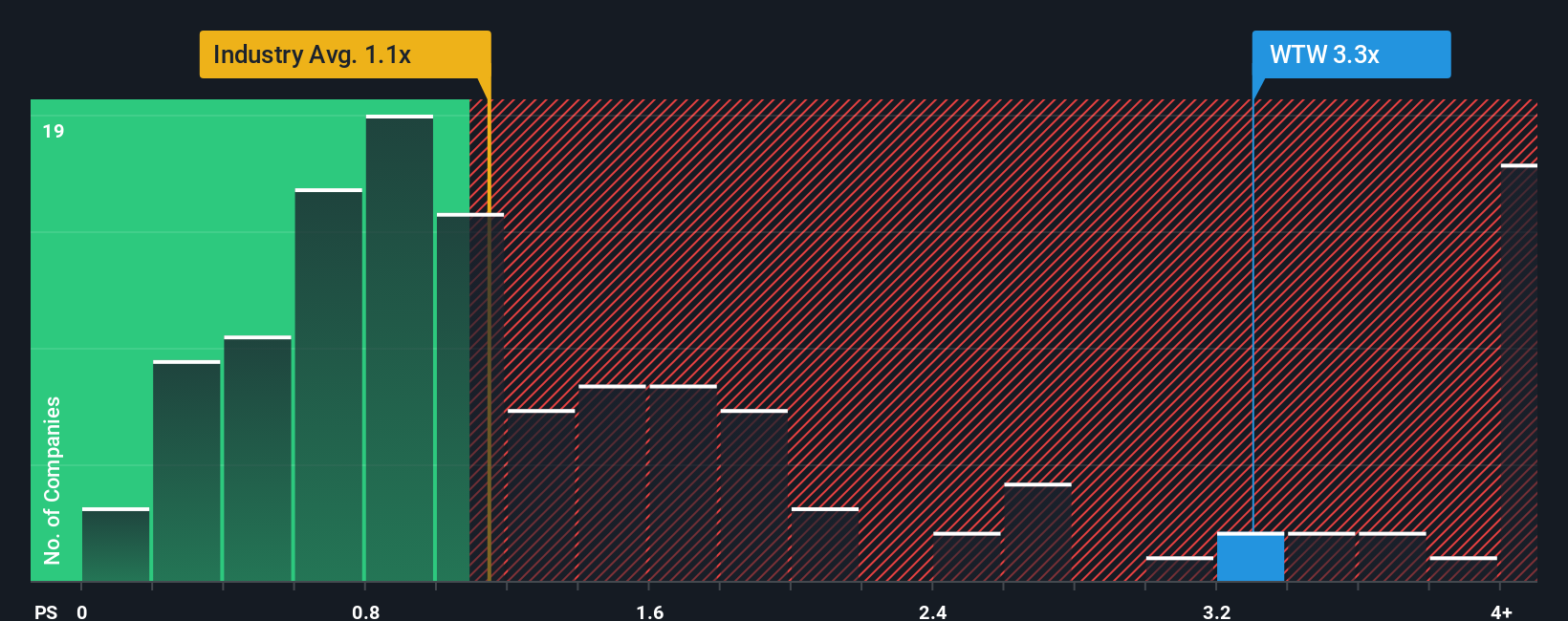

While analyst models see significant upside for Willis Towers Watson, a look at its price-to-sales ratio tells a more cautious story. WTW trades at 3.3x sales, which is well above both the industry average (1.1x) and its fair ratio (2x). This premium suggests the market could be pricing in a lot of optimism already. Is there more risk here than meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Willis Towers Watson Narrative

If you have a different perspective or want to dig deeper on your own, you can shape your own valuation angle in just a few minutes with Do it your way.

A great starting point for your Willis Towers Watson research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Opportunities?

Seize the moment and put your capital to work across exciting sectors that others might overlook. Use these hand-picked screens to get ahead today:

- Tap into future healthcare breakthroughs by analyzing leadership in AI-driven medicine with these 33 healthcare AI stocks.

- Maximize your portfolio potential by targeting steady income from these 17 dividend stocks with yields > 3%, offering high-yield picks with financial strength.

- Stay ahead of the curve and leverage the potential of emerging tech by evaluating these 27 quantum computing stocks, making rapid advances in quantum innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Willis Towers Watson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WTW

Willis Towers Watson

Operates as an advisory, broking, and solutions company worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives