- United States

- /

- Insurance

- /

- NasdaqGM:TRUP

Did Trupanion’s (TRUP) Record Margins and New Partnerships Redefine Its Long-Term Investment Story?

Reviewed by Sasha Jovanovic

- Trupanion recently reported record subscription adjusted operating income and margin, driven by accelerated net pet additions and improved retention, alongside new partnerships with Seattle Reign FC and BMO Insurance, and the securing of a new US$120 million, three-year credit facility with PNC Bank to lower interest expense and boost financial flexibility.

- This combination of strong operational performance and expanded distribution is notable for how it may enhance both market presence and long-term business resilience.

- We’ll examine how Trupanion’s record subscription income highlights its potential for sustainable margin improvement and the broader investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Trupanion Investment Narrative Recap

To be a Trupanion shareholder, you need to believe in the long-term expansion of the pet insurance market, supported by rising pet ownership and the growing willingness of pet owners to invest in health coverage for their animals. The recent earnings beat and record subscription margin underscore Trupanion’s potential for sustainable margin improvement, but do not significantly lessen concerns about customer acquisition and retention, the most important short-term catalysts or risks, as core subscriber growth, not just ARPU gains, remains critical for lasting revenue growth.

Among recent announcements, the new US$120 million, three-year credit facility with PNC Bank stands out for its potential to lower interest expense and boost Trupanion’s financial flexibility. Increased liquidity could support investments in marketing and technology that are intended to accelerate subscriber growth, speaking directly to one of the company’s main catalysts: efficient scaling and improved operating leverage as market conditions evolve.

Despite stronger results, it’s important to note that rising customer acquisition costs and stagnant gross new pet additions could present a real challenge for Trupanion if...

Read the full narrative on Trupanion (it's free!)

Trupanion's narrative projects $1.7 billion in revenue and $17.4 million in earnings by 2028. This requires 8.3% yearly revenue growth and a $6.4 million increase in earnings from $11.0 million today.

Uncover how Trupanion's forecasts yield a $56.50 fair value, a 60% upside to its current price.

Exploring Other Perspectives

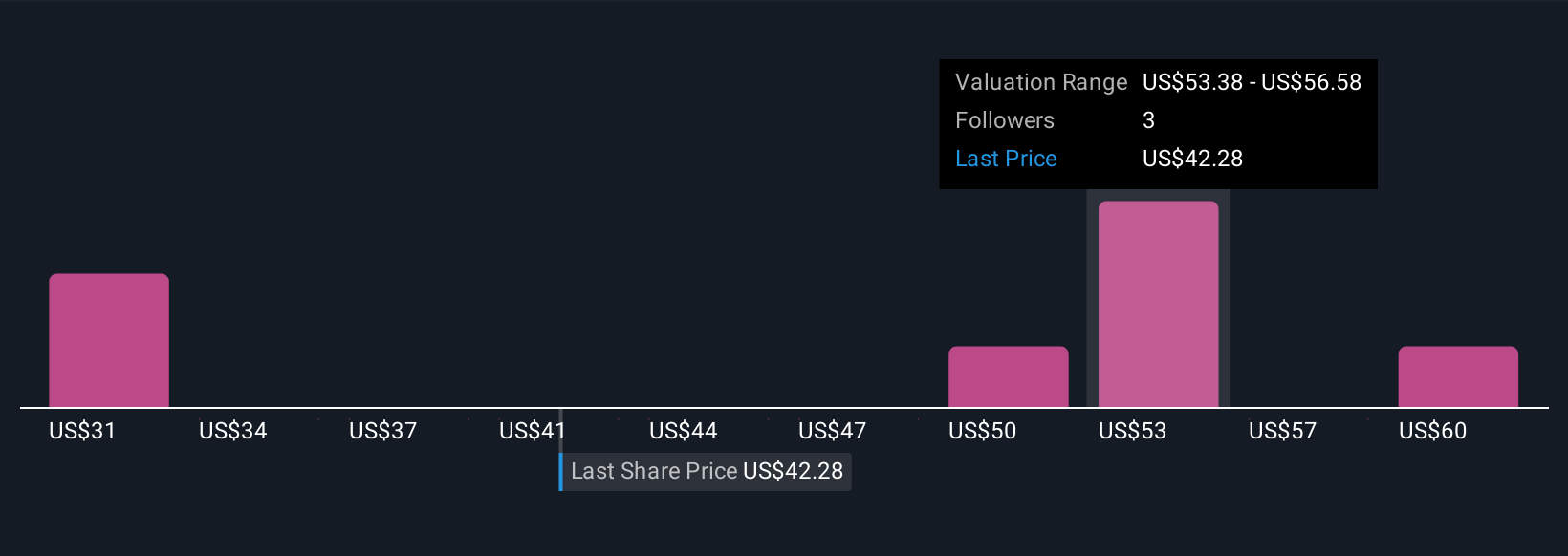

Simply Wall St Community fair value estimates for Trupanion range widely from US$31 to US$62.97, based on five independent views. While opinions diverge, many remain focused on whether Trupanion can translate margin gains into sustained subscriber growth amid shifting consumer spending patterns.

Explore 5 other fair value estimates on Trupanion - why the stock might be worth as much as 78% more than the current price!

Build Your Own Trupanion Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trupanion research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Trupanion research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trupanion's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trupanion might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TRUP

Trupanion

Provides medical insurance for cats and dogs on subscription basis in the United States, Canada, Continental Europe, and Australia.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026