- United States

- /

- Insurance

- /

- NasdaqCM:TIPT

Here's What You Should Know About Tiptree Inc.'s (NASDAQ:TIPT) 2.5% Dividend Yield

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Today we'll take a closer look at Tiptree Inc. (NASDAQ:TIPT) from a dividend investor's perspective. Owning a strong business and reinvesting the dividends is widely seen as an attractive way of growing your wealth. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

A 2.5% yield is nothing to get excited about, but investors probably think the long payment history suggests Tiptree has some staying power. The company also bought back stock equivalent to around 10% of market capitalisation this year. Some simple analysis can offer a lot of insights when buying a company for its dividend, and we'll go through this below.

Explore this interactive chart for our latest analysis on Tiptree!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. Although Tiptree pays a dividend, it was loss-making during the past year. When a loss-making financial company pays a dividend, the dividend is not being paid out of profit, which is a concern if the company can't return to operating profitably.

Dividend Volatility

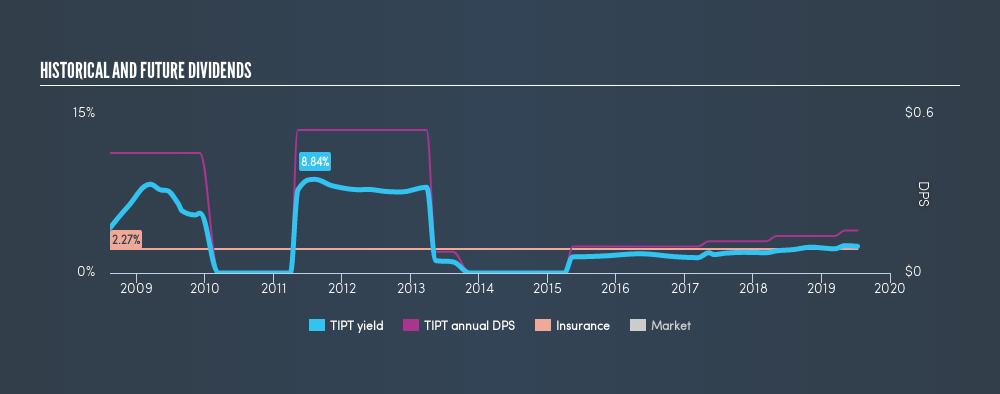

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. Tiptree has been paying dividends for a long time, but for the purpose of this analysis, we only examine the past 10 years of payments. This dividend has been unstable, which we define as having fallen by at least 20% one or more times over this time. During the past ten-year period, the first annual payment was US$0.45 in 2009, compared to US$0.16 last year. The dividend has shrunk at around 9.9% a year during that period. Tiptree's dividend has been cut sharply at least once, so it hasn't fallen by 9.9% every year, but this is a decent approximation of the long term change.

When a company's per-share dividend falls we question if this reflects poorly on either the business or management. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS are growing. It's good to see Tiptree has been growing its earnings per share at 36% a year over the past 5 years.

Conclusion

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Tiptree is paying out a dividend despite reporting a loss; clearly a concern. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. In summary, we're unenthused by Tiptree as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

Are management backing themselves to deliver performance? Check their shareholdings in Tiptree in our latest insider ownership analysis.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqCM:TIPT

Tiptree

Through its subsidiaries, provides specialty insurance products and related services in the United States and Europe.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives