- United States

- /

- Insurance

- /

- NasdaqGS:SKWD

What Skyward Specialty Insurance Group (SKWD)'s Strong Q2 Earnings Reveal About Its Competitive Momentum

Reviewed by Simply Wall St

- Skyward Specialty Insurance Group reported its second-quarter and half-year 2025 earnings, posting revenue of US$319.9 million and US$648.43 million for the periods ended June 30, alongside net income of US$38.84 million and US$80.9 million, respectively, both higher than the prior year.

- Year-over-year growth in both revenue and net income suggests the company's operational and underwriting performance has gained meaningful momentum in a competitive specialty insurance market.

- We'll explore how strong revenue and earnings growth in the latest quarter may influence the company's investment narrative and long-term outlook.

Outshine the giants: these 18 early-stage AI stocks could fund your retirement.

Skyward Specialty Insurance Group Investment Narrative Recap

To be a shareholder in Skyward Specialty Insurance Group, you need conviction in the company's ability to consistently deliver profitable growth through disciplined underwriting, technology-enabled specialty solutions, and expansion into high-retention market niches. The latest quarterly results showed strong revenue and earnings gains, but while this adds near-term confidence to the investment case, it does not materially alter the biggest short-term catalyst: successful execution in its expanding specialty segments. Investors should remain mindful that the key risk remains the transition of its alternative investment portfolio amid market volatility.

Among recent company developments, Skyward Specialty’s acquisition-led launch of its new Aviation underwriting unit in June 2025 closely aligns with ongoing efforts to expand into complex, underserved insurance niches. This move reflects a focus on high-margin product lines, which is central to the growth narrative underpinning recent financial momentum, and ties directly to the management’s efforts to drive recurring, diversified revenue streams.

Yet, in contrast to these strong results, investors should be aware of potential ongoing earnings volatility connected to...

Read the full narrative on Skyward Specialty Insurance Group (it's free!)

Skyward Specialty Insurance Group's outlook anticipates $1.7 billion in revenue and $209.6 million in earnings by 2028. This scenario assumes an annual revenue growth rate of 11.3% and an earnings increase of $77.6 million from the current earnings of $132.0 million.

Uncover how Skyward Specialty Insurance Group's forecasts yield a $60.78 fair value, a 23% upside to its current price.

Exploring Other Perspectives

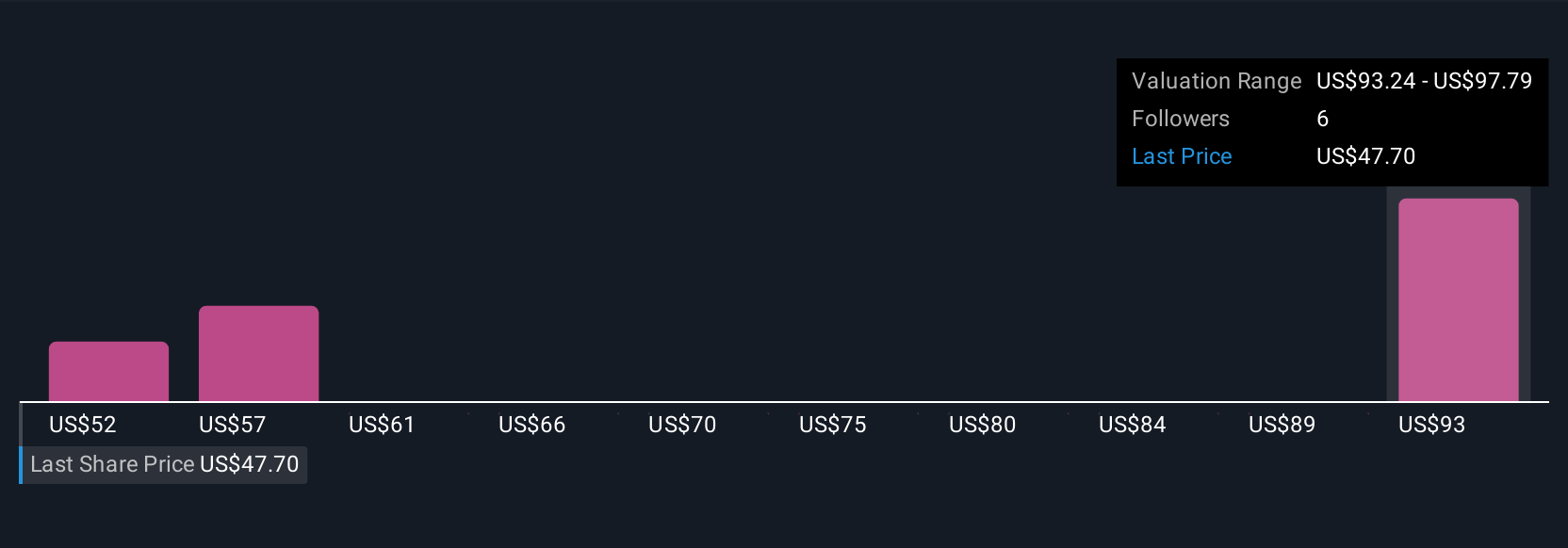

Simply Wall St Community members provided four fair value estimates for Skyward shares, ranging from US$52.26 to US$97.79. While many see upside, market volatility during the company’s ongoing portfolio transition could lead to widely differing future outcomes, so weigh these perspectives carefully.

Explore 4 other fair value estimates on Skyward Specialty Insurance Group - why the stock might be worth as much as 99% more than the current price!

Build Your Own Skyward Specialty Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Skyward Specialty Insurance Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Skyward Specialty Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Skyward Specialty Insurance Group's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SKWD

Skyward Specialty Insurance Group

An insurance holding company, underwrites commercial property and casualty insurance products in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives