- United States

- /

- Insurance

- /

- NasdaqGS:SIGI

How Investors Are Reacting To Selective Insurance Group (SIGI) Leadership Change and Earnings Miss

Reviewed by Sasha Jovanovic

- Selective Insurance Group recently announced the planned retirement of Chief Actuary Vincent Senia, effective January 2026, and the succession of Nathan Rugge, who currently leads Actuarial Reserving, to the executive position.

- This transition comes as the company reported weaker-than-expected third-quarter financial results, with both revenues and earnings per share missing analyst forecasts and lagging sector peers.

- Given Selective Insurance Group's recent earnings miss, we'll examine how this underperformance affects its outlook and the assumptions behind analyst expectations.

The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Selective Insurance Group Investment Narrative Recap

To be a shareholder in Selective Insurance Group, you need to believe that the company's focus on disciplined underwriting, data analytics, and growth in specialty lines will support resilient margins, despite industry volatility. The recent news of Chief Actuary Vincent Senia's planned retirement, with an experienced internal successor, does not materially alter near-term operational catalysts or the main risk, which is continued earnings pressure from elevated casualty claim severity and social inflation trends. The most relevant recent announcement is Selective’s third-quarter earnings miss, which highlighted persistent headwinds in casualty reserves and loss costs. This underperformance, relative to sector peers, underscores how critical accurate reserving and disciplined pricing will remain for protecting profitability as industry pressures intensify. In contrast, the risk from rising casualty claim severity and potential reserve charges is something every investor should watch for, because...

Read the full narrative on Selective Insurance Group (it's free!)

Selective Insurance Group's narrative projects $6.1 billion in revenue and $605.5 million in earnings by 2028. This requires 6.3% annual revenue growth and a $231 million increase in earnings from the current $374.5 million.

Uncover how Selective Insurance Group's forecasts yield a $81.50 fair value, a 4% upside to its current price.

Exploring Other Perspectives

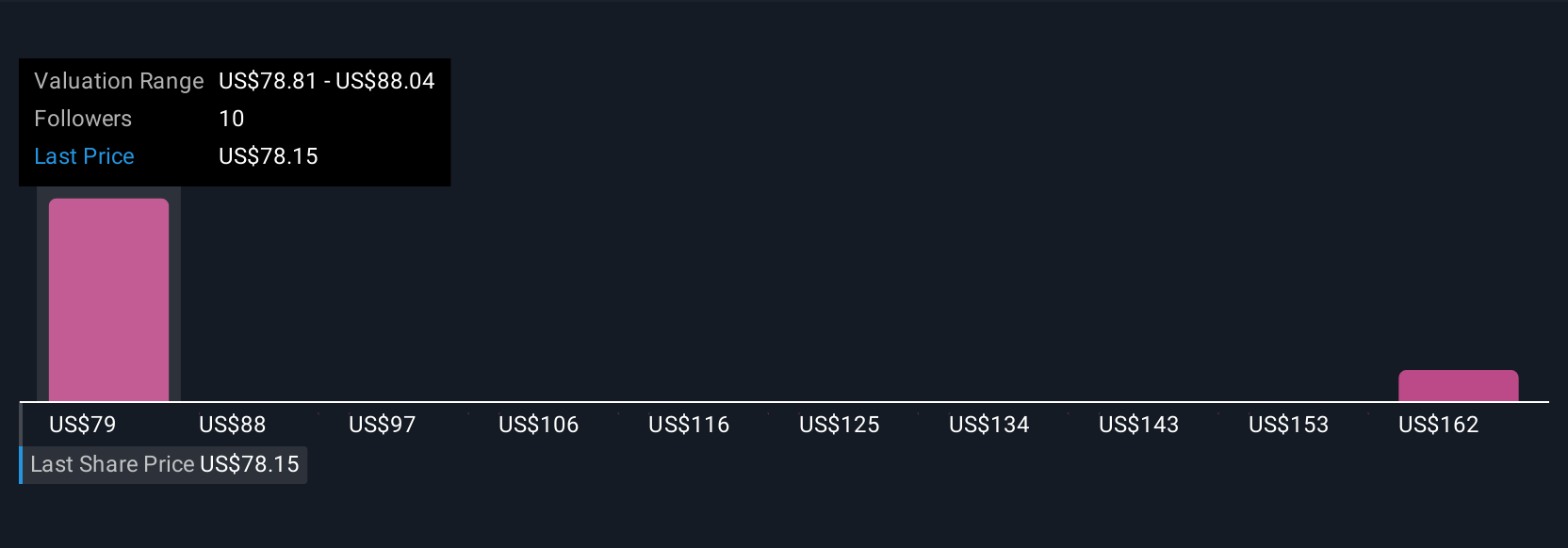

Three fair value estimates from the Simply Wall St Community range widely between US$78.81 and US$173.61 per share. While views differ, many are watching the company’s exposure to casualty lines given recent reserve challenges.

Explore 3 other fair value estimates on Selective Insurance Group - why the stock might be worth just $78.81!

Build Your Own Selective Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Selective Insurance Group research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Selective Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Selective Insurance Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIGI

Selective Insurance Group

Provides insurance products and services in the United States.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives