Last Update 29 Oct 25

Fair value Decreased 2.20%Analysts have lowered their price target for Selective Insurance Group from approximately $83.33 to $81.50. They cite concerns about weaker revenue growth, softer profit margins, and increased reserve risks in the commercial auto segment.

Analyst Commentary

Recent analyst reports reveal a range of perspectives on Selective Insurance Group's outlook. While some see areas of resilience, most express caution, citing industry and company-specific challenges.

Bullish Takeaways

- Bullish analysts note that price targets, while adjusted, still imply some potential upside from current levels. This reflects steadier elements of the business.

- Despite sector headwinds, commercial property and casualty markets are showing signs of stabilization according to some researchers.

- Recent analyst actions suggest some improvements in the firm's underlying valuation, particularly through minor upward adjustments in price estimates.

Bearish Takeaways

- Bearish analysts express concern over persistent weakness in revenue growth and ongoing pressure on profit margins.

- There is heightened caution regarding reserve risks, with particular focus on the commercial auto segment. Future reserve "potholes" are perceived as significantly higher than in the past.

- Following recent quarterly results, multiple analysts have reduced estimates due to deterioration in core loss ratios and slower growth in premiums and net interest income.

- The stock is anticipated to stay in a valuation "penalty box" given continued reserve additions and broader industry headwinds.

What's in the News

- Selective's Board of Directors declared a quarterly cash dividend of $0.43 per common share, payable December 1, 2025, to holders of record on November 14, 2025 (Key Developments).

- Between July 1, 2025 and October 22, 2025, the company repurchased 464,701 shares for $36.2 million. This completed the repurchase of 1,019,252 shares for $80.94 million under the existing buyback plan (Key Developments).

- Selective Insurance Group announced a new share repurchase program authorizing up to $200 million in buybacks with no expiration date (Key Developments).

- The Board of Directors authorized a new buyback plan on October 22, 2025 (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has decreased from $83.33 to $81.50, reflecting a modest reduction in overall valuation expectations.

- Discount Rate remains unchanged at 6.78 percent. This indicates no shift in perceived risk or expected return.

- Revenue Growth projection has fallen from 6.32 percent to 5.89 percent. This shows a slight downward revision in expected top-line expansion.

- Net Profit Margin is slightly lower, moving from 9.86 percent to 9.79 percent. This signals a minor contraction in anticipated profitability.

- Future P/E ratio has declined from 10.22x to 9.63x. This suggests decreased investor optimism about future earnings multiples.

Key Takeaways

- Investments in digital tools and underwriting strategies are expected to boost efficiency, margins, and earnings while moderating volatility.

- Business diversification and expansion into specialty and underserved markets should support resilient revenue growth and reduced underwriting risk.

- Heavy exposure to rising casualty claim severities and outdated business practices poses ongoing risks to earnings stability, growth, and long-term competitive positioning.

Catalysts

About Selective Insurance Group- Provides insurance products and services in the United States.

- The company's ongoing focus and investments in operational efficiency-including data analytics, digital claims management, and underwriting tools-are expected to drive improved combined ratios and support margin expansion, leading to long-term net margin and earnings growth.

- Expansion of Selective's Excess & Surplus (E&S) segment, along with plans to offer these products to retail agents, positions the company to capture growth opportunities from emerging specialty risks, supporting both revenue diversification and premium growth.

- The broader societal shift toward automation and digitalization across industries is increasing demand for technology risk and cyber liability insurance, representing a significant, durable premium growth opportunity that should positively impact future revenue.

- The company's deliberate strategy to diversify its business mix and geographic footprint, including growth in the mass affluent personal lines and underserved regional markets, is likely to generate a more resilient and balanced revenue stream, while moderating catastrophe and underwriting volatility.

- Selective's consistent application of granular underwriting and pricing-demonstrated by targeted rate actions greater than loss trends in key casualty lines-positions the company to weather industry-wide loss cost inflation, supporting stable underwriting profits and long-term ROE.

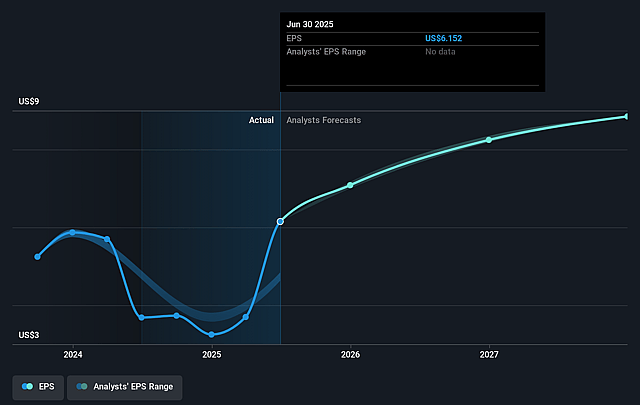

Selective Insurance Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Selective Insurance Group's revenue will grow by 6.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.3% today to 9.9% in 3 years time.

- Analysts expect earnings to reach $605.5 million (and earnings per share of $8.85) by about September 2028, up from $374.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.2x on those 2028 earnings, down from 12.8x today. This future PE is lower than the current PE for the US Insurance industry at 14.3x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Selective Insurance Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistently high and increasing trend in casualty claim severities-primarily due to social inflation (increased litigation and higher jury awards)-continues to drive unfavorable prior year reserve developments, especially in general liability and commercial auto, which together represent over 50% of Selective's total premium; this increases the risk of ongoing earnings volatility and unpredictability in future net margins.

- The company's business mix is more heavily weighted to casualty lines relative to peers, particularly in the contractors segment, making Selective especially vulnerable to industry-wide issues such as social inflation and claim severity trends, which could result in higher claims costs and pressure on underwriting profit.

- Selective's need to constantly boost loss trend assumptions and the recurring pattern of reserve increases in immature accident years highlight the uncertainty and difficulty in accurately forecasting loss trends, raising the risk of future reserve charges that could further impair net earnings and undermine investor confidence in financial guidance.

- Management's response to adverse loss emergence by implementing aggressive price increases and stricter underwriting is leading to declining retention rates and slower premium growth, particularly in core Commercial Lines, which could inhibit topline revenue growth as competition intensifies and peers may underprice risk.

- Broader industry trends-such as the growing adoption of direct-to-consumer insurtech models and increased regulatory scrutiny over pricing, data usage, and climate risk-may expose Selective's reliance on traditional agency distribution and legacy risk models, potentially compressing margins due to increased compliance/technology costs and weakening revenue and customer acquisition over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $83.333 for Selective Insurance Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $90.0, and the most bearish reporting a price target of just $72.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $6.1 billion, earnings will come to $605.5 million, and it would be trading on a PE ratio of 10.2x, assuming you use a discount rate of 6.8%.

- Given the current share price of $78.67, the analyst price target of $83.33 is 5.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.