- United States

- /

- Insurance

- /

- NasdaqGS:SIGI

Can Selective Insurance Group's (SIGI) AI Push and State Expansion Reshape Its Competitive Edge?

Reviewed by Simply Wall St

- Selective Insurance Group, Inc. announced past quarterly earnings for Q2 2025, reporting revenue of US$1.33 billion and net income of US$85.9 million, alongside common and preferred dividend declarations and an update on its share repurchase program.

- The company is expanding into new states and rapidly advancing artificial intelligence initiatives to enhance underwriting and claims management capabilities.

- We’ll examine how strong investment income and disciplined underwriting reported in Q2 2025 shape Selective Insurance Group's investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Selective Insurance Group Investment Narrative Recap

To be a shareholder in Selective Insurance Group, you need to believe in the company’s ability to grow profitably through disciplined underwriting, geographic expansion, and embracing technology, while managing industry headwinds like social inflation. Based on the latest quarterly updates, the most important short-term catalyst, continued underwriting margin improvement, remains mostly unaffected. However, the biggest risk right now continues to be loss cost pressures from social inflation, and the recent results do not eliminate this concern for investors.

Among recent announcements, the Q2 2025 financial results are particularly relevant. Revenue and net income grew robustly compared to the prior period, with management attributing performance to strong investment income and underwriting. Yet, the company also reported some prior year casualty reserve development tied to evolving loss trends, illustrating the ongoing need to balance profitability with appropriate risk management.

In contrast, the ongoing impact of social inflation on commercial auto and liability reserves is a risk investors should be aware of, especially if...

Read the full narrative on Selective Insurance Group (it's free!)

Selective Insurance Group's outlook anticipates $6.3 billion in revenue and $906.0 million in earnings by 2028. This projection is based on an 8.0% annual revenue growth rate and an increase in earnings of $680.8 million from the current $225.2 million.

Uncover how Selective Insurance Group's forecasts yield a $94.67 fair value, a 17% upside to its current price.

Exploring Other Perspectives

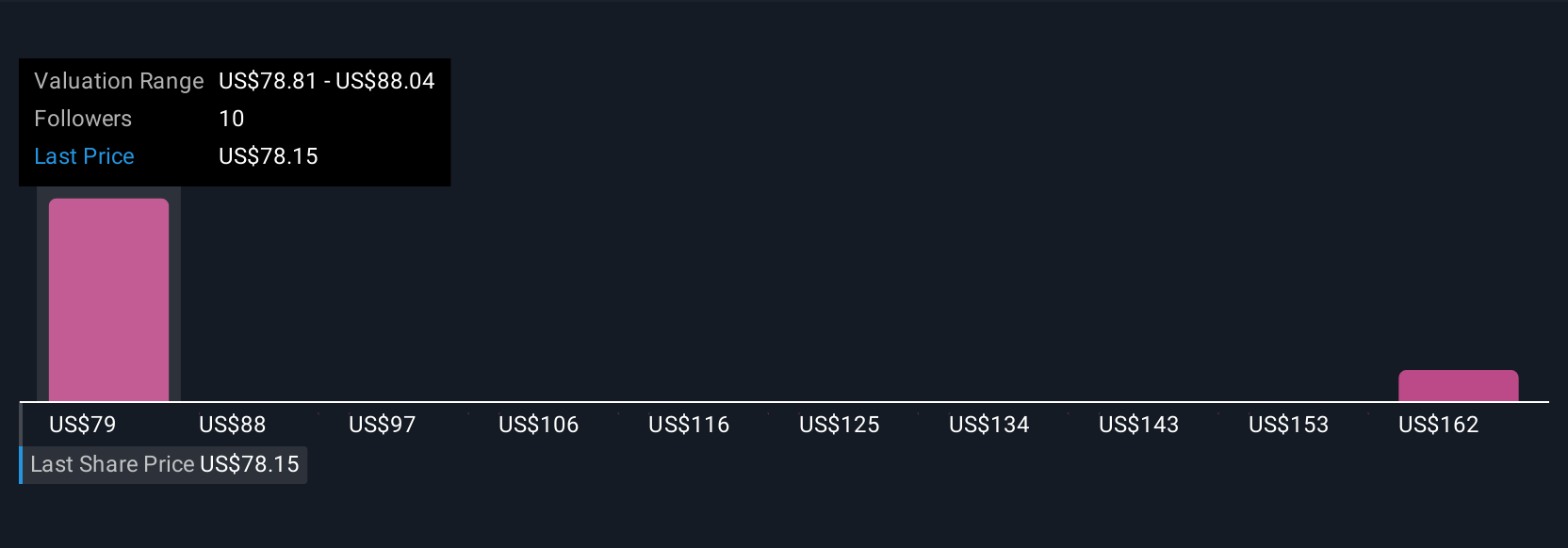

The Simply Wall St Community’s fair value estimates for Selective Insurance Group range widely from US$78.81 to US$186.90, based on three user analyses. While expectations for profitability improvements are a key theme, you’ll find several strongly differing views among individual investors.

Explore 3 other fair value estimates on Selective Insurance Group - why the stock might be worth over 2x more than the current price!

Build Your Own Selective Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Selective Insurance Group research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Selective Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Selective Insurance Group's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIGI

Selective Insurance Group

Provides insurance products and services in the United States.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives