- United States

- /

- Insurance

- /

- NasdaqCM:RELI

A Piece Of The Puzzle Missing From Reliance Global Group, Inc.'s (NASDAQ:RELI) Share Price

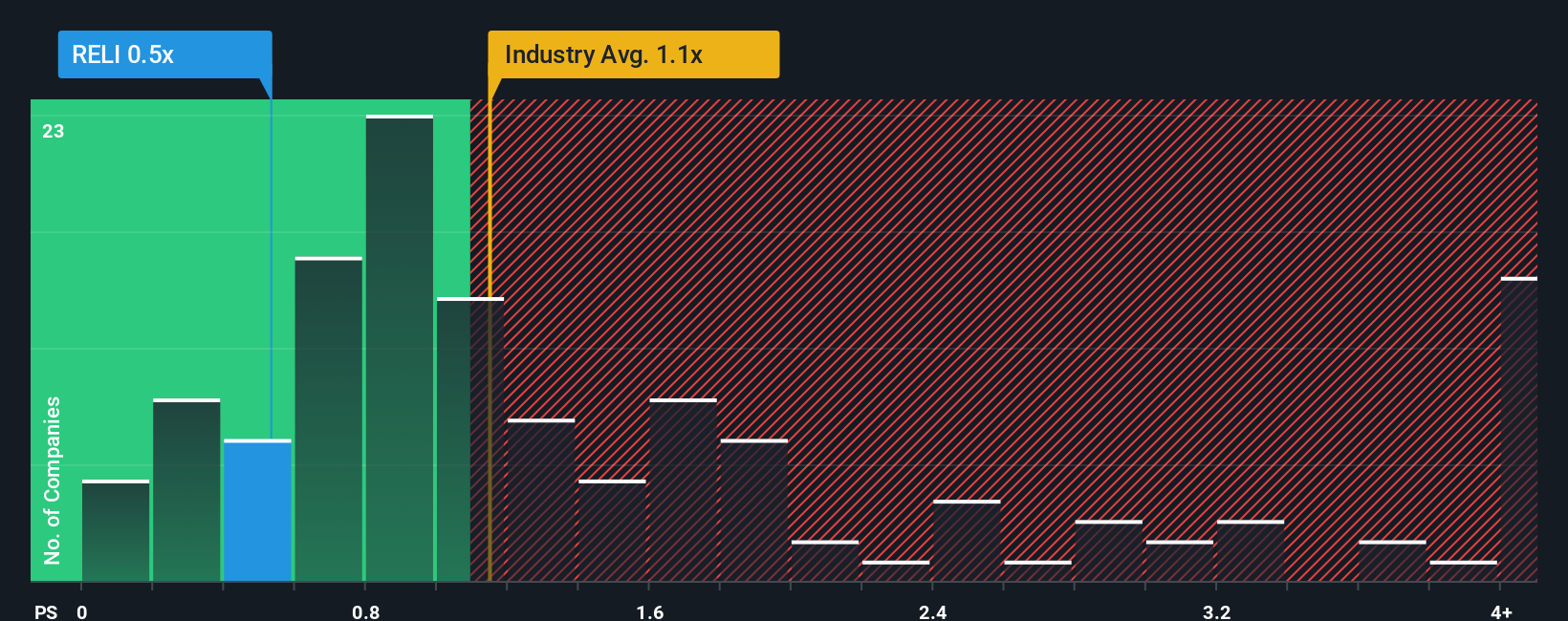

When close to half the companies operating in the Insurance industry in the United States have price-to-sales ratios (or "P/S") above 1.1x, you may consider Reliance Global Group, Inc. (NASDAQ:RELI) as an attractive investment with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Reliance Global Group

How Reliance Global Group Has Been Performing

For example, consider that Reliance Global Group's financial performance has been poor lately as its revenue has been in decline. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Reliance Global Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Reliance Global Group's earnings, revenue and cash flow.How Is Reliance Global Group's Revenue Growth Trending?

In order to justify its P/S ratio, Reliance Global Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 6.8% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 16% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 3.6% shows it's about the same on an annualised basis.

In light of this, it's peculiar that Reliance Global Group's P/S sits below the majority of other companies. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

The Final Word

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Reliance Global Group currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. While recent

Before you take the next step, you should know about the 4 warning signs for Reliance Global Group that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RELI

Reliance Global Group

Focuses on the acquisition and management of wholesale and retail insurance agencies in the United States.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives