- United States

- /

- Insurance

- /

- NasdaqGS:PFG

Exploring Principal Financial Group Value After Positive Media Focus and Recent Price Momentum

Reviewed by Bailey Pemberton

- Curious if Principal Financial Group is really offering value for your money? You are not alone, and there is plenty to unpack about what is actually priced in right now.

- The stock has gone up 1.8% in the last week and 6.3% over the past month, signaling renewed investor interest and perhaps changing perceptions of risk or growth ahead.

- One reason for the increased momentum is a wave of positive media coverage focusing on the company’s business diversification and consistent capital returns, which has put Principal Financial Group back in the spotlight for both institutional and retail investors. Updates around strategic partnerships and expanded service offerings have also fed into the narrative and caught the market’s attention in recent weeks.

- For pure numbers people, Principal Financial Group currently scores a 4 out of 6 on our undervaluation checks. This suggests there is some value, though it does not capture the whole story. In the next sections, we will walk through the main valuation approaches, and at the end, introduce a perspective that might reveal even deeper insights into the company’s true worth.

Approach 1: Principal Financial Group Excess Returns Analysis

The Excess Returns valuation model estimates a company's value by focusing on its ability to generate returns above the cost of equity invested by shareholders. In essence, it asks how much profit Principal Financial Group can create for every dollar it retains, after accounting for the returns shareholders expect.

For Principal Financial Group, the model relies on several key figures. The current book value stands at $52.90 per share. The company is estimated to generate stable earnings per share (EPS) of $9.24, according to weighted future Return on Equity estimates from eight analysts. The average return on equity is 15.86%, which exceeds the cost of equity, calculated at $4.05 per share. This results in an excess return of $5.19 per share, highlighting a pattern of efficient capital use. Over time, the stable book value is projected to rise to $58.27 per share, underlining steady growth expectations for the business.

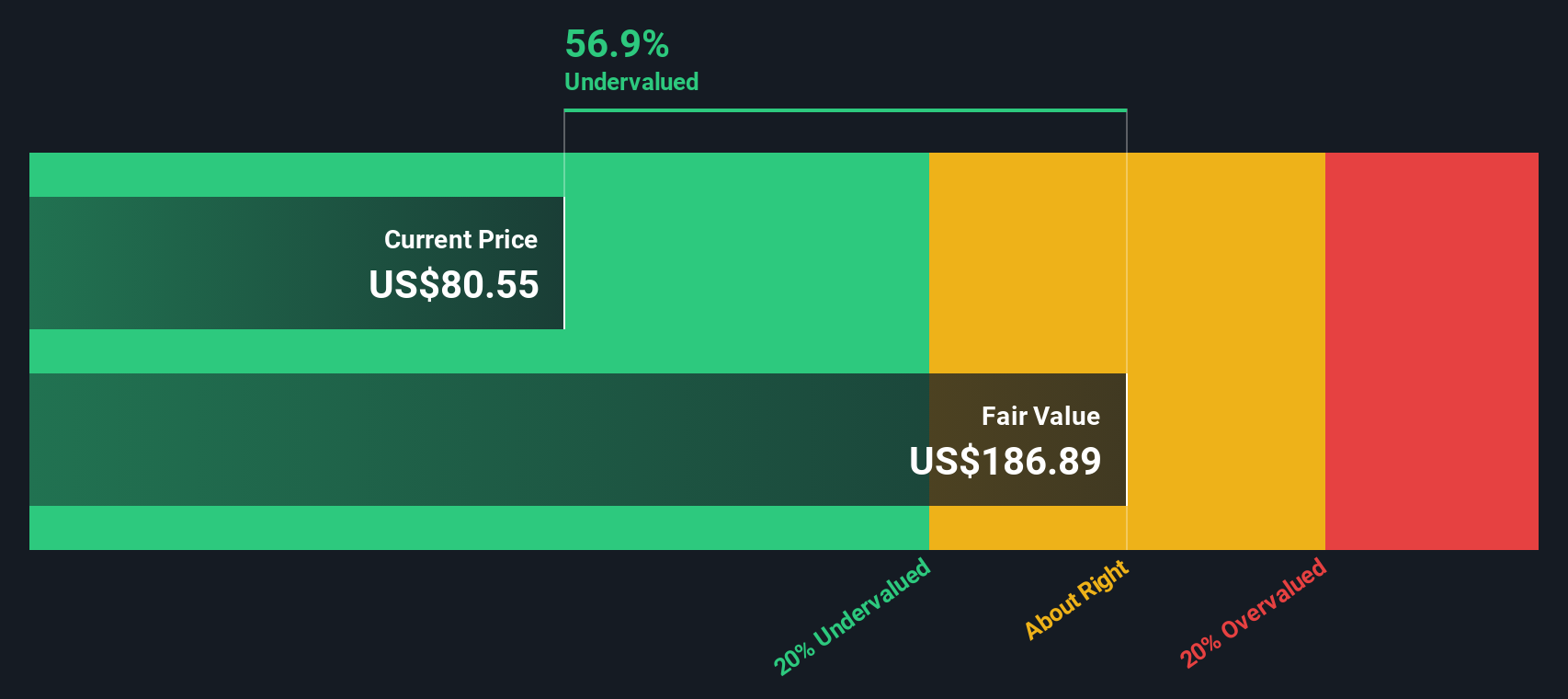

Based on these calculations, the intrinsic value of Principal Financial Group is estimated to be 57.4% higher than its current share price, indicating the stock is significantly undervalued by the market at this time.

Result: UNDERVALUED

Our Excess Returns analysis suggests Principal Financial Group is undervalued by 57.4%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Principal Financial Group Price vs Earnings

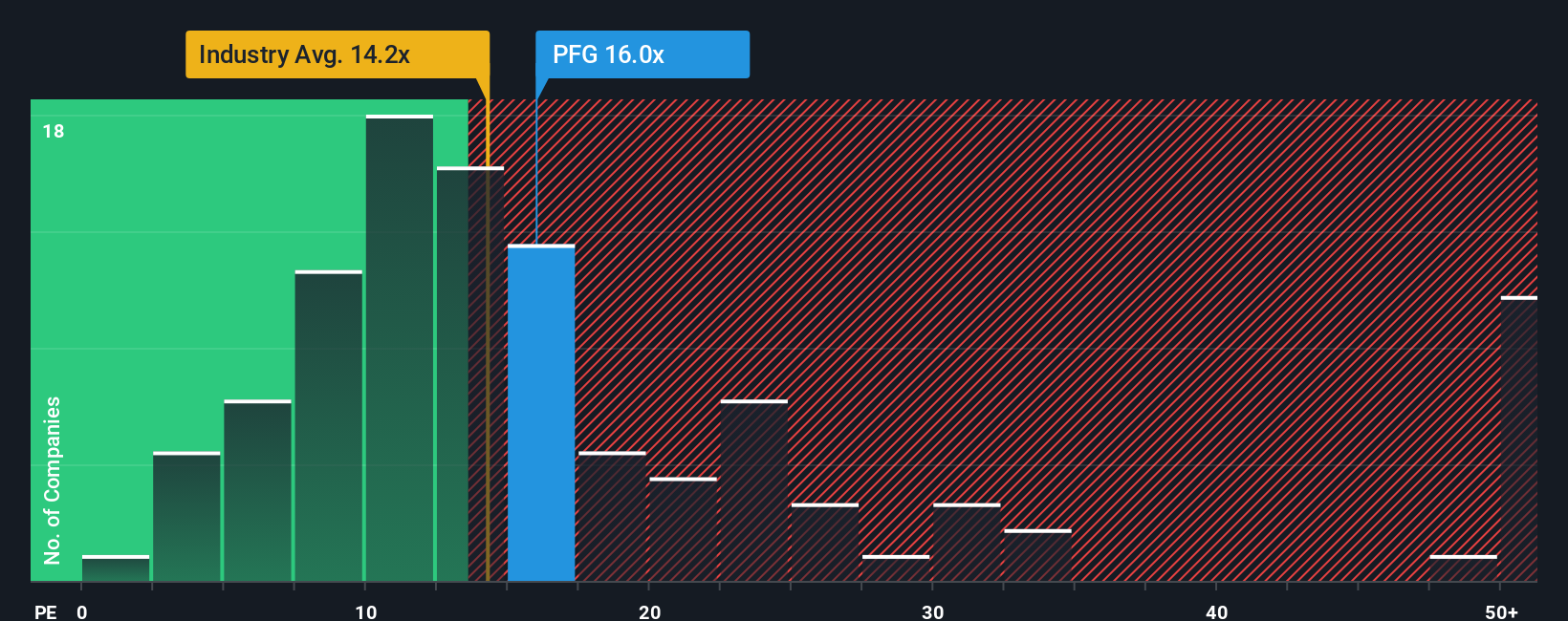

The Price-to-Earnings (PE) ratio is a widely used valuation metric and is particularly relevant for profitable companies like Principal Financial Group. By comparing the market price of a stock to its earnings, PE ratios help investors assess how much they are paying for a company’s profits today and, importantly, what the market expects for future growth.

Growth expectations and risk factors play a major role in determining what a "normal" or "fair" PE ratio should be. Companies expected to grow faster or to produce more stable earnings often command a higher PE, while those seen as riskier or in slow-growth industries generally see lower multiples.

Principal Financial Group is currently trading at a PE ratio of 11.81x. This puts it just below the insurance industry average of 13.20x and above the peer average of 10.46x. To provide even more context, Simply Wall St’s proprietary "Fair Ratio" metric tailors the benchmark by accounting for Principal Financial Group’s specific earnings growth, profit margins, market capitalization, and industry characteristics. This results in a Fair Ratio of 17.60x for PFG. This approach offers a more nuanced benchmark than simply comparing to sector averages or peers, because it adjusts for the unique qualities and outlook of the company itself.

Since Principal Financial Group’s actual PE ratio of 11.81x is well below its Fair Ratio of 17.60x, the stock appears undervalued using this method as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Principal Financial Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful story you build about a company. It is your perspective on where Principal Financial Group is headed, supported by your assumptions about future revenue, earnings, and margins. This approach connects the company's story directly to a financial forecast and, ultimately, a fair value for the stock.

Narratives are available to everyone in the Community page on Simply Wall St's platform, making this advanced approach accessible to millions of investors. By crafting or following a Narrative, you can easily see how updated news or company results affect the outlook, as dynamics and fair values are recalculated with every new data point. Narratives also provide a clear way to compare your estimate of fair value to the current price, helping you decide when to buy, sell, or hold.

For example, when it comes to Principal Financial Group, some investors have an optimistic Narrative, projecting a price target as high as $101 based on robust revenue and margin growth. Others take a more cautious view, seeing fair value closer to $72 by factoring in industry headwinds and volatility. Narratives let you see all these viewpoints and form your own, showing you that the smartest investment decisions start with your story and finish with a number.

Do you think there's more to the story for Principal Financial Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PFG

Principal Financial Group

Provides retirement, asset management, and insurance products and services to businesses, individuals, and institutional clients worldwide.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success