- United States

- /

- Insurance

- /

- NYSE:KNSL

If You Had Bought Kinsale Capital Group (NASDAQ:KNSL) Stock A Year Ago, You Could Pocket A 28% Gain Today

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. For example, the Kinsale Capital Group, Inc. (NASDAQ:KNSL) share price is up 28% in the last year, clearly besting than the market return of around 1.0% (not including dividends). So that should have shareholders smiling. We'll need to follow Kinsale Capital Group for a while to get a better sense of its share price trend, since it hasn't been listed for particularly long.

Check out our latest analysis for Kinsale Capital Group

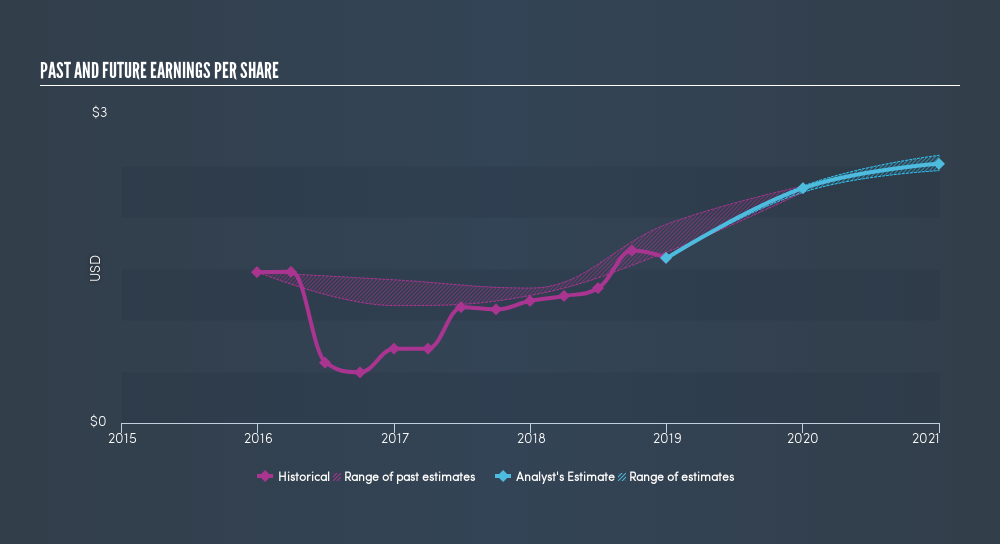

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Kinsale Capital Group was able to grow EPS by 35% in the last twelve months. This EPS growth is significantly higher than the 28% increase in the share price. So it seems like the market has cooled on Kinsale Capital Group, despite the growth. Interesting.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Kinsale Capital Group's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Kinsale Capital Group boasts a total shareholder return of 29% for the last year(that includes the dividends). And the share price momentum remains respectable, with a gain of 19% in the last three months. This suggests the company is continuing to win over new investors. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

We will like Kinsale Capital Group better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:KNSL

Kinsale Capital Group

Engages in the provision of property and casualty insurance products in the United States.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives