Stock Analysis

- United States

- /

- Insurance

- /

- NasdaqGS:JRVR

We Wouldn't Be Too Quick To Buy James River Group Holdings, Ltd. (NASDAQ:JRVR) Before It Goes Ex-Dividend

Readers hoping to buy James River Group Holdings, Ltd. (NASDAQ:JRVR) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. If you purchase the stock on or after the 13th of March, you won't be eligible to receive this dividend, when it is paid on the 31st of March.

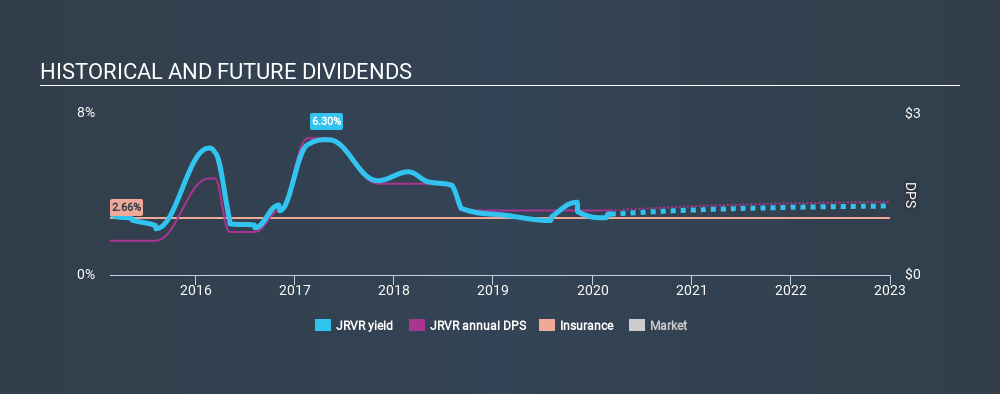

James River Group Holdings's next dividend payment will be US$0.30 per share. Last year, in total, the company distributed US$1.20 to shareholders. Based on the last year's worth of payments, James River Group Holdings stock has a trailing yield of around 2.8% on the current share price of $42.31. If you buy this business for its dividend, you should have an idea of whether James River Group Holdings's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

Check out our latest analysis for James River Group Holdings

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. James River Group Holdings paid out 95% of its earnings, which is more than we're comfortable with, unless there are mitigating circumstances.

When a company pays out a dividend that is not well covered by profits, the dividend is generally seen as more vulnerable to being cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. That's why it's not ideal to see James River Group Holdings's earnings per share have been shrinking at 4.2% a year over the previous five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. James River Group Holdings has delivered an average of 13% per year annual increase in its dividend, based on the past five years of dividend payments. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. James River Group Holdings is already paying out a high percentage of its income, so without earnings growth, we're doubtful of whether this dividend will grow much in the future.

Final Takeaway

Is James River Group Holdings an attractive dividend stock, or better left on the shelf? Earnings per share are in decline and James River Group Holdings is paying out what we feel is an uncomfortably high percentage of its profit as dividends. It's not that we hate the business, but we feel that these characeristics are not desirable for investors seeking a reliable dividend stock to own for the long term. These characteristics don't generally lead to outstanding dividend performance, and investors may not be happy with the results of owning this stock for its dividend.

With that being said, if you're still considering James River Group Holdings as an investment, you'll find it beneficial to know what risks this stock is facing. Case in point: We've spotted 2 warning signs for James River Group Holdings you should be aware of.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:JRVR

James River Group Holdings

Through its subsidiaries, provides specialty insurance services.

Excellent balance sheet with proven track record.