- United States

- /

- Insurance

- /

- NasdaqGS:GSHD

How Will Rising Costs Shape Goosehead Insurance's (GSHD) Growth Story Amid Strong Revenue Gains?

Reviewed by Sasha Jovanovic

- In the past week, Goosehead Insurance reported its third quarter 2025 results, highlighting a 16% year-over-year revenue increase to US$90.44 million and announcing completion of a 691,000 share buyback program for US$59.19 million.

- While revenue and franchise expansion showed momentum, the company faced higher operating and interest expenses, resulting in flat earnings per share versus the prior year, prompting analyst caution despite management's ongoing optimism about technology investments and market growth.

- We'll examine how Goosehead's significant revenue growth alongside rising expenses impacts its evolving investment narrative and long-term outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Goosehead Insurance Investment Narrative Recap

To be a Goosehead Insurance shareholder, you need confidence in the firm's ability to grow its technology-driven franchise model while driving consistent agent productivity and expanding its policy base. The latest Q3 results reinforce strong revenue growth, but higher costs have neutralized earnings gains. This news does not materially change the key short-term catalyst, continued expansion of the franchise and sales team, or the biggest current risk: whether Goosehead’s investments in technology and agents can sustainably boost margins despite rising expenses.

Among recent announcements, Goosehead’s completed US$59.19 million share repurchase, totaling 691,000 shares, stands out. While this signals some confidence in the company’s value proposition, it does not fundamentally shift the focus away from the company's pressing need to translate topline momentum into consistently improving bottom-line results given the continued rise in operating and interest costs.

However, it is important for investors to be aware that even with robust revenue growth, Goosehead faces mounting pressure to control expenses if it hopes to...

Read the full narrative on Goosehead Insurance (it's free!)

Goosehead Insurance's narrative projects $588.5 million in revenue and $71.4 million in earnings by 2028. This requires 20.0% yearly revenue growth and a $41.5 million earnings increase from current earnings of $29.9 million.

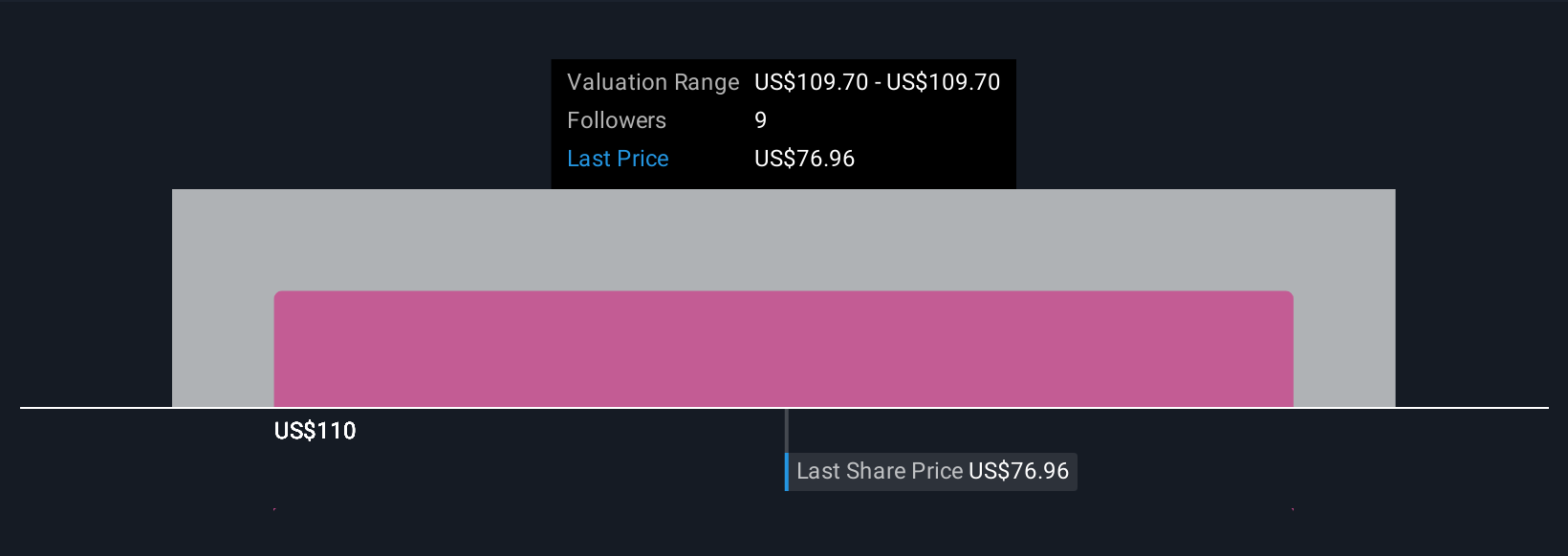

Uncover how Goosehead Insurance's forecasts yield a $98.10 fair value, a 33% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimated Goosehead’s fair value between US$53.75 and US$98.10, showing a wide spectrum across just two unique viewpoints. With expense pressure now undermining margin improvements, such variety in opinions highlights how expectations for future profitability can sharply diverge.

Explore 2 other fair value estimates on Goosehead Insurance - why the stock might be worth 27% less than the current price!

Build Your Own Goosehead Insurance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Goosehead Insurance research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Goosehead Insurance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Goosehead Insurance's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSHD

Goosehead Insurance

Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives