- United States

- /

- Insurance

- /

- NasdaqGS:GSHD

Goosehead Insurance (GSHD) Margin Expansion Reinforces Bullish Narratives Despite Premium Valuation

Reviewed by Simply Wall St

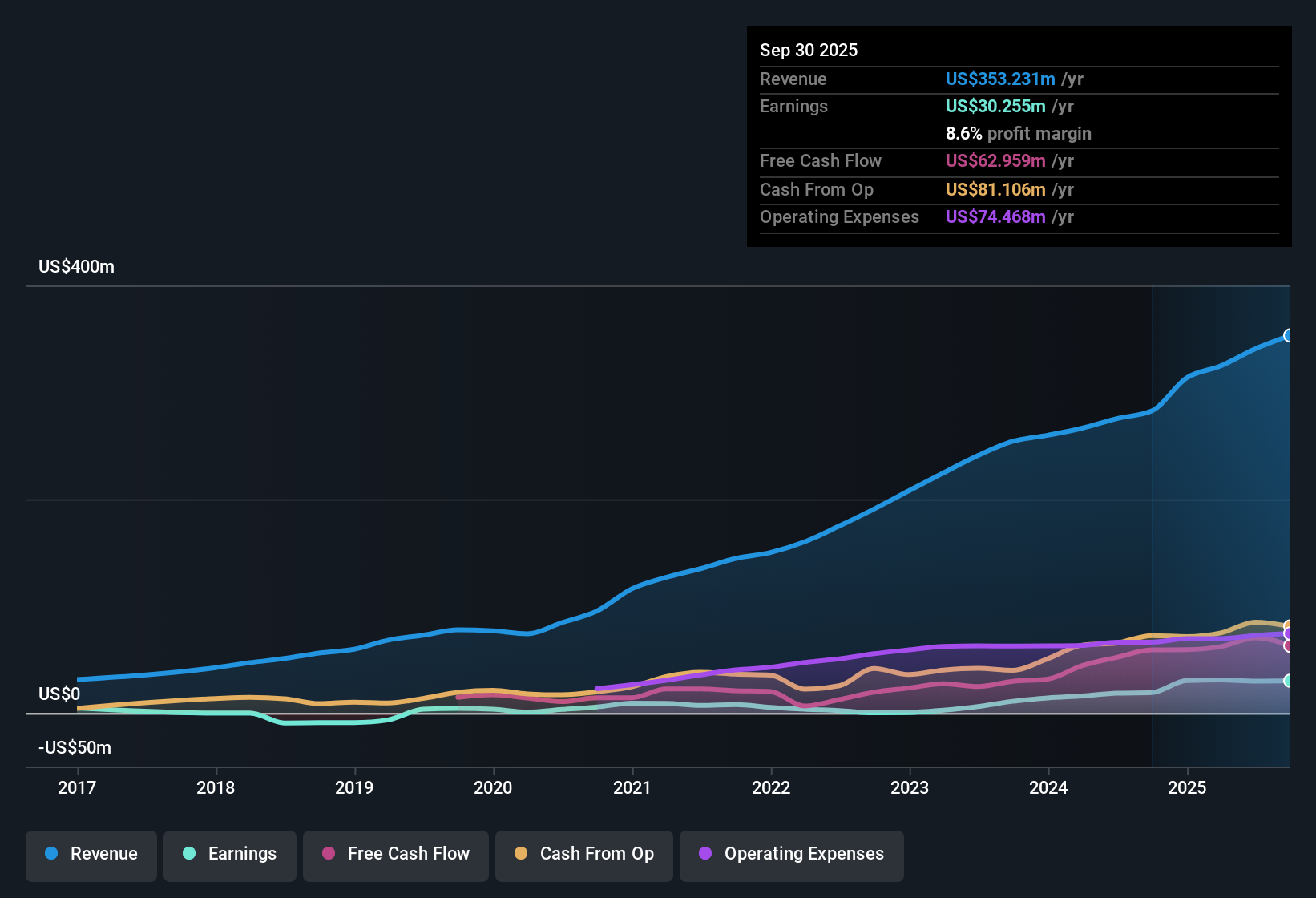

Goosehead Insurance (GSHD) is forecasting annual earnings growth of 34.66%, easily surpassing its historical average and the market’s broader pace. Net profit margin has climbed to 8.6% from last year’s 6.8%, with revenue expected to climb 19.1% per year, both figures outpacing US market trends. With earnings growing at 42.5% per year over the last five years, the company is showing real operational and financial momentum that may draw investor attention, though its premium valuation will keep expectations high.

See our full analysis for Goosehead Insurance.Now let’s see how those headline numbers stack up against the prevailing market narrative. Some will fit the story, while others might shake up expectations.

See what the community is saying about Goosehead Insurance

Margin Expansion Outpaces Industry Peers

- Net profit margin improved to 8.6%, a notable jump from last year’s 6.8%. This signals more earnings brought down to the bottom line, even as the industry average remains well below Goosehead’s level.

- According to the analysts' consensus view, investments in proprietary technology and digital platforms are credited for boosting client retention and lowering servicing costs.

- Consensus narrative notes that enhanced digital tools are increasing operating leverage and are supporting higher net margins than competitors.

- The growing pool of policyholders and successful cross-sell initiatives is expected to expand client lifetime value, further supporting this margin story.

- With tightening regulation and rising climate risks flagged as future headwinds, consensus analysts still expect margin gains to continue as technology and scale offset cost pressures.

To see how analysts size up these margin gains versus the biggest ongoing debates, check out the full consensus breakdown for Goosehead Insurance. 📊 Read the full Goosehead Insurance Consensus Narrative.

Premium Valuation Far Above Industry

- Goosehead trades at a Price-To-Earnings Ratio of 61.2x, significantly higher than the US insurance industry’s 14.3x average and above both its peers and its own DCF fair value of $53.91.

- Analysts' consensus narrative highlights that investors are paying up for the company’s growth trajectory.

- To match the consensus analyst price target of 95.1, Goosehead would need to grow earnings to $71.4 million by 2028 and maintain a PE ratio roughly 4 times the sector’s norm.

- Despite robust operating metrics, these premium multiples require ongoing performance outperformance, which elevates the bar for future upside.

Share Growth and Franchise Expansion

- Analysts expect the company’s outstanding share count to increase by 3.93% annually over the next three years, reflecting continued investment in company-led growth and franchise network scaling.

- Consensus narrative underscores the push into new market verticals through partnerships and aggressive enterprise sales.

- These moves increase revenue streams and are expected to boost recurring, higher-quality earnings as more agents come online and existing ones become more productive.

- However, consensus notes that any slowdown in franchise recruiting could risk this growth engine, so investors will watch the agent pipeline closely in coming years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Goosehead Insurance on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got your own take on Goosehead’s outlook? Add your unique insights and bring your interpretation to life in just a few minutes. Do it your way.

A great starting point for your Goosehead Insurance research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite Goosehead’s rapid earnings and margin growth, its premium valuation means continued outperformance is required to meet high expectations. This leaves little room for error.

If you want to focus on companies trading at more attractive valuations with room to grow, check out these 876 undervalued stocks based on cash flows now to find opportunities missed by the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GSHD

Goosehead Insurance

Operates as a holding company for Goosehead Financial, LLC that engages in the provision of personal lines insurance agency services in the United States.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives