Stock Analysis

- United States

- /

- Insurance

- /

- NasdaqGS:GLRE

Exploring Three Undiscovered Gems In The US Stock Market July 2024

Reviewed by Simply Wall St

Over the past year, the United States stock market has shown robust growth, rising by 20%, despite a recent dip of 1.6% over the last seven days. In this dynamic environment, identifying stocks with potential for significant earnings growth, projected at an annual rate of 15%, can offer intriguing opportunities for investors looking to uncover less recognized assets in the market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| River Financial | 131.04% | 17.59% | 20.70% | ★★★★★★ |

| Morris State Bancshares | 14.93% | 0.44% | 7.74% | ★★★★★★ |

| Omega Flex | NA | 2.13% | 4.77% | ★★★★★★ |

| First Northern Community Bancorp | NA | 6.68% | 9.08% | ★★★★★★ |

| Teekay | NA | -8.88% | 49.65% | ★★★★★★ |

| Mission Bancorp | 25.37% | 16.23% | 20.16% | ★★★★★★ |

| FirstSun Capital Bancorp | 27.36% | 10.54% | 30.73% | ★★★★★★ |

| Gravity | NA | 15.31% | 24.42% | ★★★★★★ |

| CSP | 2.17% | -5.57% | 73.73% | ★★★★★☆ |

| FRMO | 0.19% | 6.49% | 15.82% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Southern California Bancorp (NasdaqCM:BCAL)

Simply Wall St Value Rating: ★★★★★★

Overview: Southern California Bancorp, serving as the holding company for Bank of Southern California, N.A., has a market capitalization of $272.91 million.

Operations: Southern California Bancorp primarily operates in the commercial banking sector, generating revenue through a variety of financial services. The company has consistently reported a 100% gross profit margin over multiple periods, reflecting its ability to manage operational costs effectively while maximizing revenue streams.

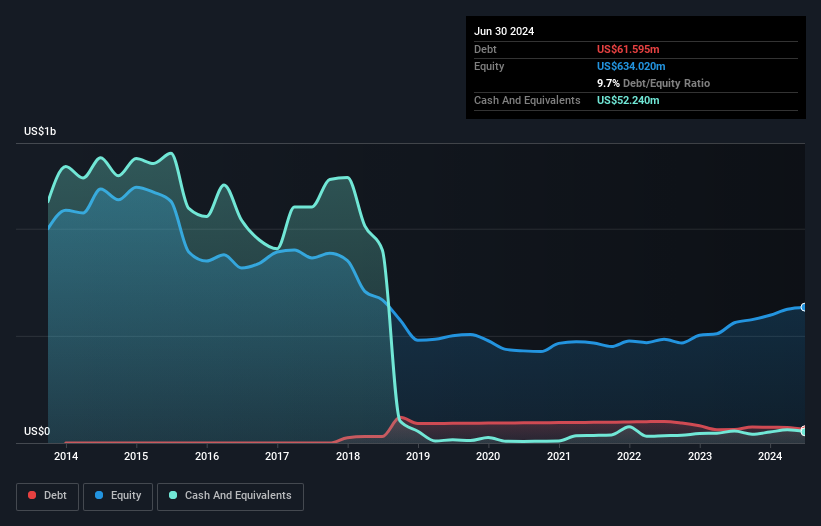

Southern California Bancorp, recently rebranded to California BanCorp, showcases robust financial health with $2.3B in total assets and a strong net interest margin of 4.3%. The bank has a well-maintained bad loan allowance at 0.3% of total loans, ensuring stability. Recently added to multiple Russell indexes, the company also approved significant bylaw amendments enhancing governance flexibility. These strategic moves position it as an attractive prospect within the lesser-tapped sectors of the banking industry.

- Get an in-depth perspective on Southern California Bancorp's performance by reading our health report here.

Understand Southern California Bancorp's track record by examining our Past report.

EZCORP (NasdaqGS:EZPW)

Simply Wall St Value Rating: ★★★★★★

Overview: EZCORP, Inc. operates as a provider of pawn services across the United States and Latin America, with a market capitalization of approximately $554.92 million.

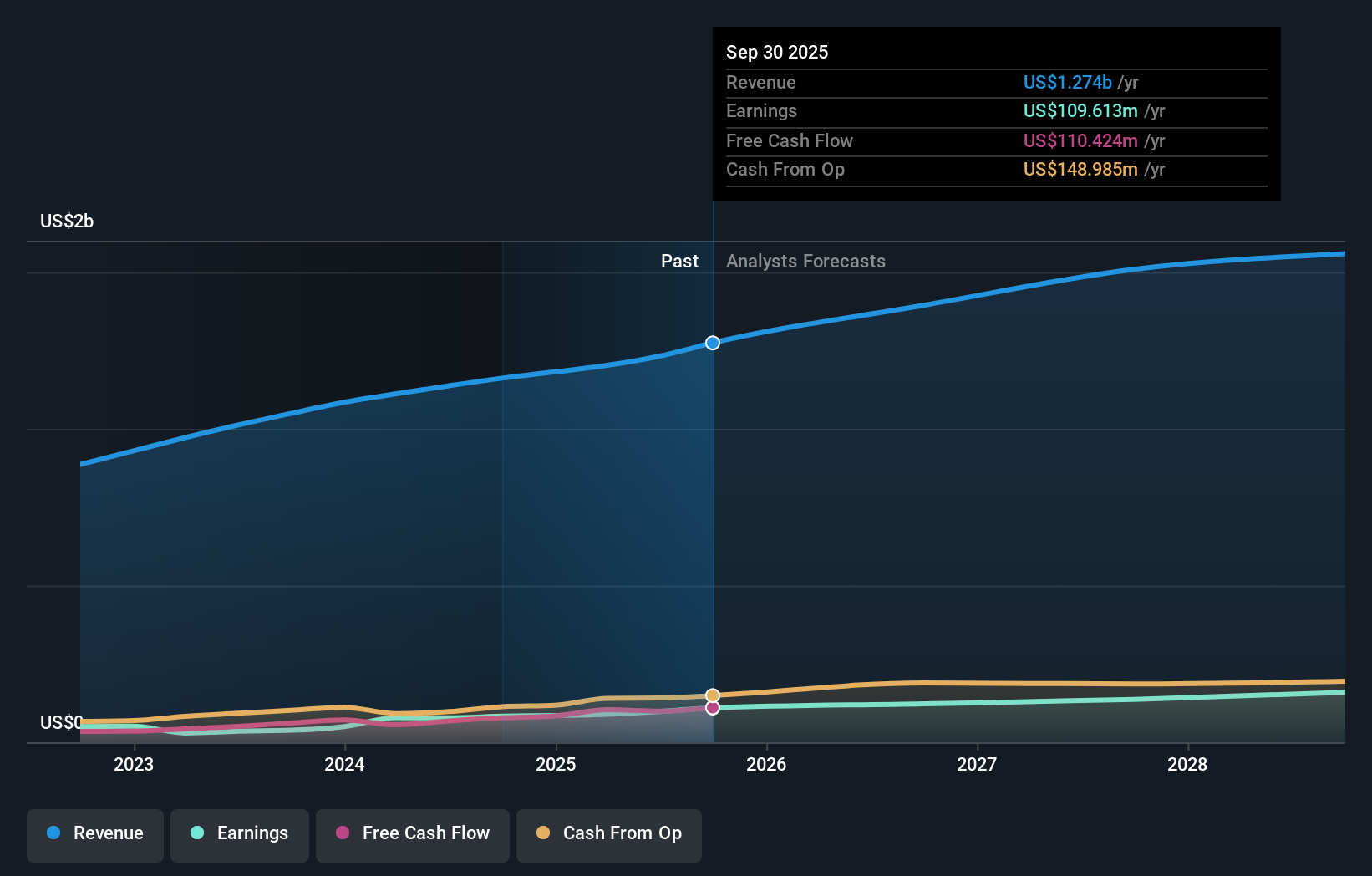

Operations: The company operates primarily in the pawn industry, generating a significant portion of its revenue from U.S. Pawn ($803.58 million) and Latin America Pawn ($308.29 million). Its business model emphasizes lending money secured by pledged personal property and retailing previously owned merchandise, with recent gross profit margins consistently around 58% to 59%.

EZCORP, a lesser-known player in the consumer finance sector, has demonstrated robust financial health with a net debt to equity ratio of 16.5%, reflecting prudent debt management. The company's earnings surged by 165.5% over the past year, outpacing its industry's decline of 11.5%. With an EBIT coverage ratio of 32.2 times, EZCORP comfortably covers its interest expenses, underscoring strong operational efficiency and profitability that could appeal to discerning investors looking for growth opportunities within niche markets.

- Navigate through the intricacies of EZCORP with our comprehensive health report here.

Evaluate EZCORP's historical performance by accessing our past performance report.

Greenlight Capital Re (NasdaqGS:GLRE)

Simply Wall St Value Rating: ★★★★★★

Overview: Greenlight Capital Re, Ltd. is a global property and casualty reinsurance company with a market capitalization of approximately $460.94 million.

Operations: The company operates primarily in the property and casualty reinsurance sector, generating revenue through underwriting activities, evidenced by a consistent increase in gross profit from $80.51 million in Q1 2023 to $156.54 million by mid-2024. This growth is supported by managing operational costs effectively, maintaining operating expenses around $34-$40 million during the same period.

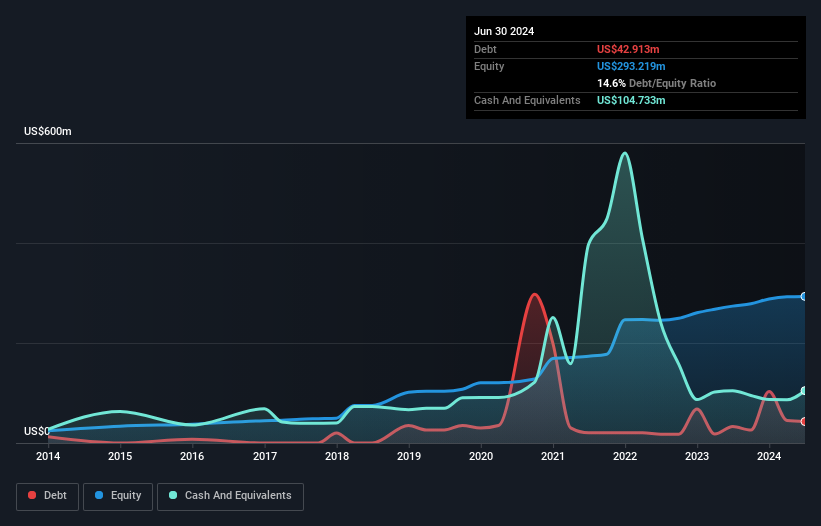

Greenlight Capital Re, a lesser-known insurer, stands out with its robust financial health and market position. The company's earnings soared by 192% over the last year, significantly outpacing the industry's growth of 47%. Its debt-to-equity ratio improved from 19% to 12%, reflecting stronger balance sheet management. Trading at nearly 31% below its estimated fair value, Greenlight offers potential upside. Recent filings indicate strategic moves in capital management, including a shelf registration and maintaining share repurchase plans into 2025.

Next Steps

- Investigate our full lineup of 224 US Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Greenlight Capital Re is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GLRE

Greenlight Capital Re

Through its subsidiaries, operates as a property and casualty reinsurance company worldwide.

Flawless balance sheet with solid track record.